Starting a business with your spouse can be an exciting adventure. It allows you to combine your skills, passions, and resources to build something together. However, before you dive in, it's crucial to establish a solid legal foundation for your venture. In California, many couples consider forming a limited liability company (LLC). But what if you want the simplicity of a single-member structure while still acknowledging both spouses as owners? This is where understanding the nuances of a "husband and wife single member LLC" in California comes in.

Let's be clear: the term "husband and wife single member LLC" is a bit of a misnomer in the eyes of the law. California, like most states, recognizes two primary LLC ownership structures: single-member and multi-member. A single-member LLC, as the name suggests, has one owner. This means that legally, only one spouse can be the sole owner of the LLC.

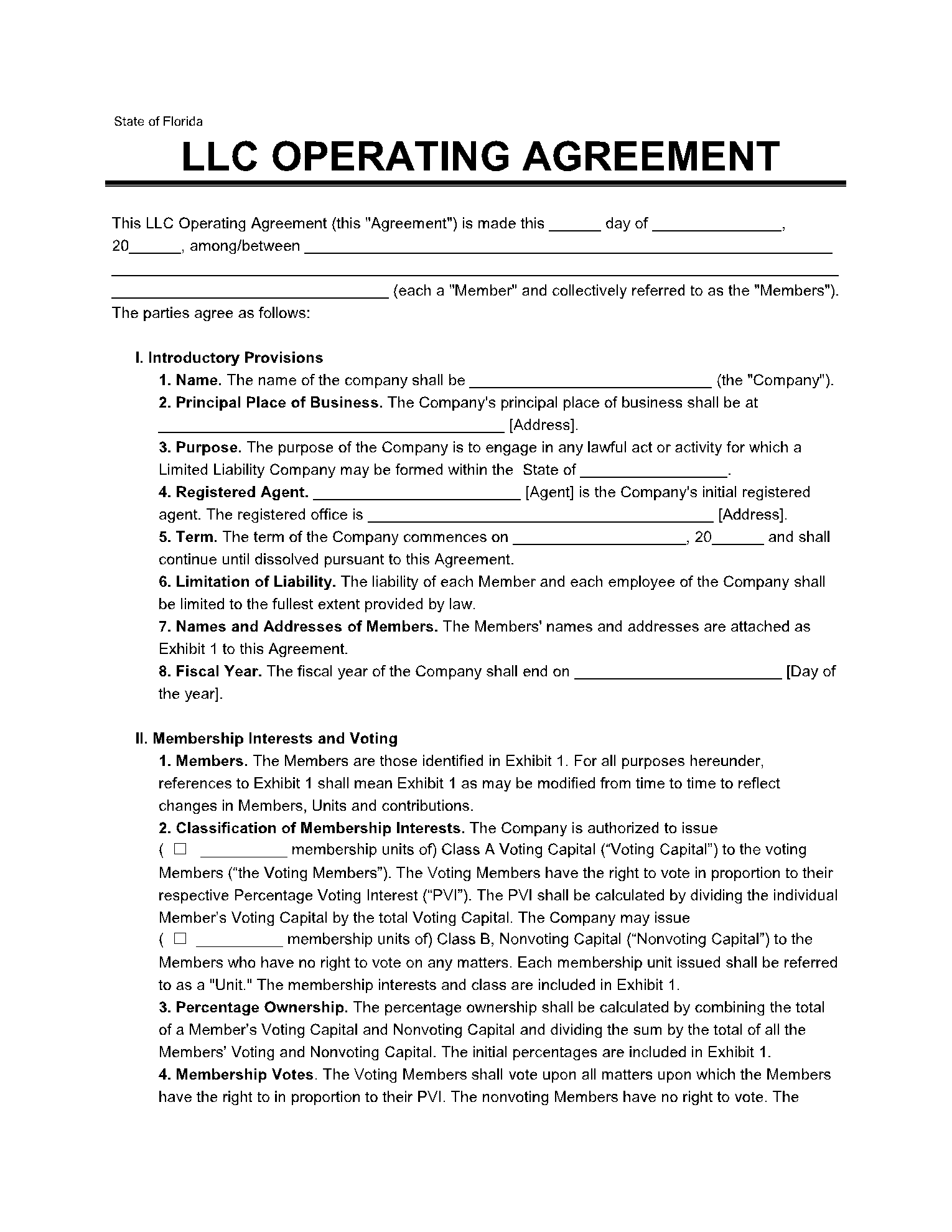

You might be thinking, "Wait, so my spouse and I can't run a business together as a single-member LLC?" Not quite. While only one spouse can be the official "member," there are ways to structure the LLC and its operating agreement to reflect the joint nature of the business. This typically involves designating the non-member spouse as a co-manager or granting them significant decision-making authority.

Understanding the implications of this structure is crucial. If your goal is to protect both spouses' personal assets from business liabilities, a single-member LLC might still be a viable option. However, it's essential to draft a comprehensive operating agreement that clearly outlines the roles, responsibilities, and ownership interests of both spouses. This helps prevent misunderstandings and potential disputes down the line.

Before making any decisions, consulting with a qualified attorney or CPA experienced in California business law is essential. They can guide you through the specific legal requirements, help you choose the right LLC structure for your situation, and ensure your operating agreement adequately protects both you and your spouse's interests.

Advantages and Disadvantages of a Husband and Wife Single Member LLC in California

| Advantages | Disadvantages |

|---|---|

| Simplified Tax Filing (as a disregarded entity on personal tax returns) | Potential for disputes without a clear operating agreement |

| Potential liability protection for the non-member spouse's assets | May not offer the same level of asset protection as a multi-member LLC |

| Flexibility in management and profit-sharing arrangements | Can create complexity if the business relationship changes (e.g., divorce) |

Navigating the world of business structures with your spouse requires careful consideration. While a "husband and wife single member LLC" in California isn't a formal legal entity, understanding how to structure a single-member LLC to accommodate both spouses' involvement is key. By seeking expert advice and crafting a clear operating agreement, you can set your business up for success while protecting your shared interests.

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike

husband and wife single member llc california - Trees By Bike