We live in a digital age, a whirlwind of instant transfers and online payments. But sometimes, you just need a good old-fashioned check. Maybe you're sending a gift, paying a contractor, or dealing with a business that hasn't quite embraced the 21st century. Whatever the reason, that little rectangular slip of paper still holds its own in a world dominated by pixels and screens.

So, you're staring into your wallet, and reality hits – you're fresh out of checks. Panic sets in for a moment, but then you remember your trusty bank, Chase. Can I get checks at the bank Chase? you wonder. You've got bills to pay and time is ticking.

The answer is a resounding yes! Chase, like most major banks, absolutely provides check-ordering services for its customers. But it's not just about getting *any* checks. It's about understanding the process, the options available to you, and even exploring some intriguing alternatives that might just make your financial life a little bit smoother.

Ordering checks might seem like stepping back in time, a quaint ritual in our fast-paced digital world. But there's a certain satisfaction in the tangible, the feeling of signing your name on a freshly printed check, knowing it will reach its destination and fulfill its purpose. Plus, sometimes, it's just easier, more reliable, or the only option available.

Let's dive deeper into the world of checks with Chase, exploring the different avenues for ordering, the potential fees involved, and how to navigate the process with ease. We'll even unveil some modern alternatives that might just make you reconsider your reliance on those paper rectangles.

Advantages and Disadvantages of Getting Checks

| Advantages | Disadvantages |

|---|---|

| Widely accepted payment method | Can be slower than electronic payments |

| Tangible record of payment | Risk of loss or theft |

| Useful for specific situations (e.g., gifts, vendors who don't accept cards) | Need to reorder periodically |

Best Practices for Ordering Checks

1. Order in Advance: Don't wait until you're completely out of checks to reorder. Allow ample time for processing and delivery.

2. Verify Your Information: Double-check your name, address, and account details before submitting your order to prevent errors and delays.

3. Explore Design Options: While standard checks are readily available, consider personalizing with different designs, images, or even your own photos.

4. Understand Fees: Inquire about potential fees associated with ordering checks, as these can vary based on quantity, design, and delivery options.

5. Consider Security Features: Opt for checks with enhanced security features, such as watermarks or microprinting, to minimize the risk of fraud.

Common Questions and Answers

1. Can I order checks online with Chase?

Yes, you can conveniently order checks online through the Chase website or mobile app.

2. How long does it take to get checks from Chase?

Delivery times vary depending on the chosen shipping method, but it typically takes 5-7 business days for standard delivery.

3. Is there a fee to order checks from Chase?

Fees for ordering checks can vary based on your account type and the specific check options you select. It's best to check with Chase for the most up-to-date pricing information.

4. Can I get checks the same day from Chase?

While same-day check printing is not typically offered by Chase, you can inquire about expedited shipping options for faster delivery.

5. What if I need checks immediately?

If you require checks urgently, consider visiting your local Chase branch to explore options for obtaining temporary checks.

6. Can I use my old checkbook if I still have checks left?

Yes, you can continue using checks from your old checkbook as long as the account details remain current.

7. What alternatives are there to using checks?

Consider exploring digital options like online bill pay, mobile check deposits, and peer-to-peer payment apps like Zelle for more convenient and faster transactions.

8. What should I do if I lose my new checks?

Report lost or stolen checks to Chase immediately to prevent unauthorized use. They can help you initiate a stop payment and order a new set.

Conclusion

In the age of instant digital transactions, the humble check persists, proving its relevance in various financial scenarios. While technology offers convenient alternatives, there's a certain reliability and tangibility associated with checks that digital methods can't quite replicate. Knowing that you can easily obtain checks from your bank, even one as digitally focused as Chase, provides a sense of security and flexibility in managing your finances. Whether you're mailing a birthday check to your niece, paying your rent to a landlord who prefers traditional methods, or simply like the feeling of a handwritten check, Chase has you covered. They offer a seamless process for ordering checks, ensuring you have access to this essential financial tool whenever the need arises. So, the next time you find yourself wondering, "Can I get checks at the bank Chase?" rest assured that the answer is a resounding yes. Just remember to explore all your options, weigh the advantages and disadvantages, and choose the method that aligns best with your financial needs and preferences.

Blank Check To Practice Writing - Trees By Bike

Route Number And Account Number - Trees By Bike

The Top 5 Most Common Check - Trees By Bike

can i get checks at the bank chase - Trees By Bike

Chase Cashier's Check Template - Trees By Bike

can i get checks at the bank chase - Trees By Bike

can i get checks at the bank chase - Trees By Bike

can i get checks at the bank chase - Trees By Bike

can i get checks at the bank chase - Trees By Bike

Can You Get One Check From The Bank at Joe Carr blog - Trees By Bike

Chase Bank Check Template - Trees By Bike

Beware of These Mystery Shopping Fake Check Scams - Trees By Bike

Printable Blank Cashiers Check - Trees By Bike

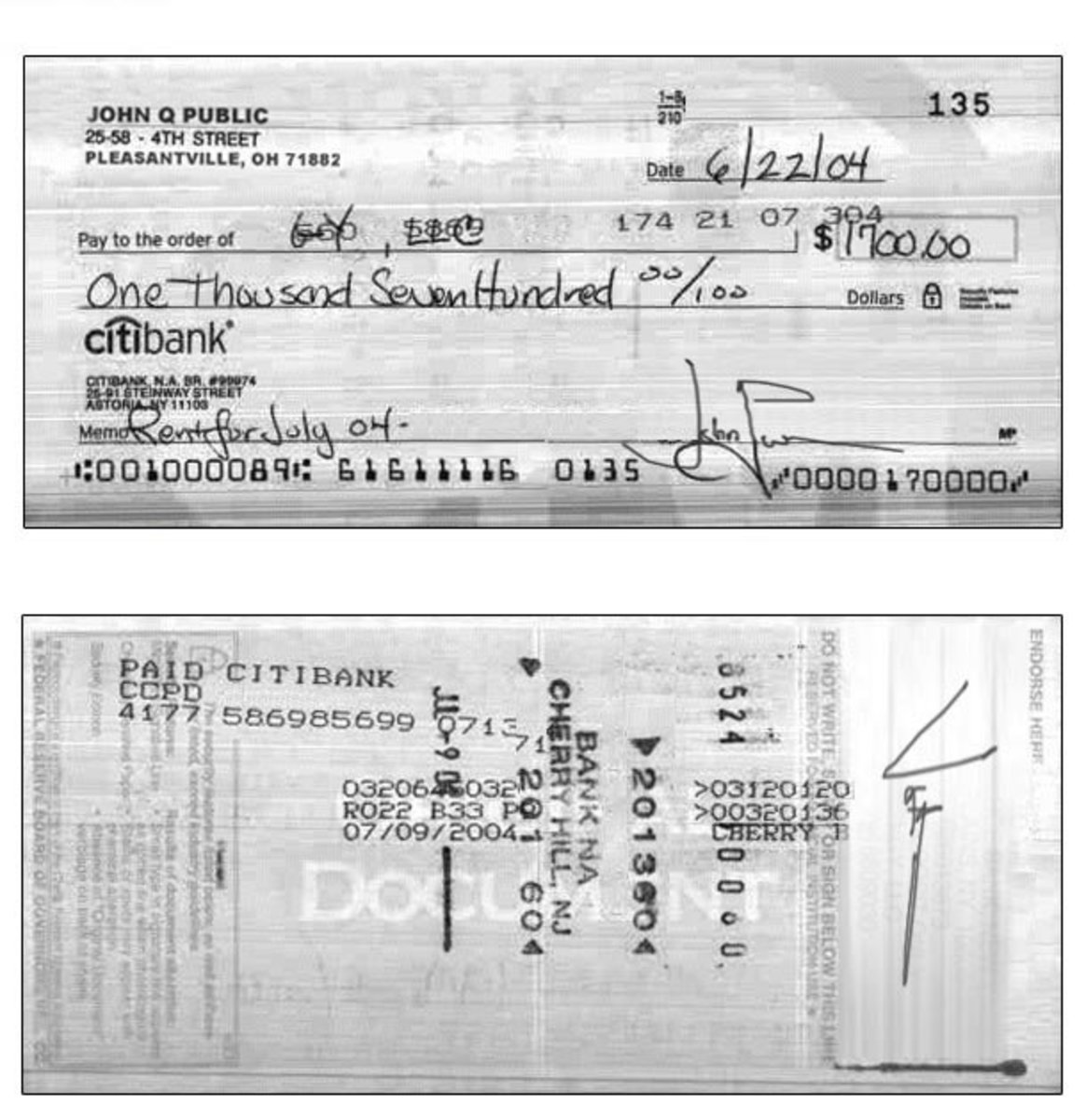

How to Write a Chase Check (with Example) - Trees By Bike

can i get checks at the bank chase - Trees By Bike