Let’s be real, nobody jumps for joy at the thought of tax season. It’s like that annual check-up you know you need, but really don’t look forward to. And if you’re staring at the phrase “cara bayaran cukai pendapatan” feeling a bit lost, you’re definitely not alone. Don’t worry, we’ve all been there. It’s just a fancy way of saying "how to pay income tax" in Malay, and it’s way less scary than it sounds. This isn’t about boring you with jargon; it’s about arming you with the knowledge to tackle your Malaysian income tax like a pro.

Think about it – ‘cara bayaran cukai pendapatan’ is more than just a mouthful; it’s your ticket to peace of mind. No more last-minute scrambles, no more wondering if you did it right. By getting a handle on this, you’re basically leveling up your adulting game. And who doesn’t want that?

In Malaysia, the 'cara bayaran cukai pendapatan', or income tax payment system, is a cornerstone of the nation's revenue generation. It's how the government funds essential public services, infrastructure projects, and social welfare programs. We’re talking healthcare, education, roads – all the things that make a difference in our daily lives. So, yeah, understanding 'cara bayaran cukai pendapatan' isn't just about avoiding penalties (although that's definitely a bonus), it's about being a responsible citizen and contributing to a better Malaysia.

Now, you might be thinking, "Okay, this sounds important, but where do I even begin?" Well, the good news is that the Malaysian government has made significant strides in making 'cara bayaran cukai pendapatan' more accessible and user-friendly. From online platforms to straightforward guidelines, they've really stepped up their game to make the process smoother.

This isn't about bombarding you with technicalities; it's about breaking down 'cara bayaran cukai pendapatan' into bite-sized, digestible pieces. We'll explore the ins and outs, the dos and don'ts, and empower you to tackle your income tax obligations with confidence. So, buckle up and get ready to demystify the world of 'cara bayaran cukai pendapatan'. Trust us, it's not as daunting as it seems.

Advantages and Disadvantages of Different Cara Bayaran Cukai Pendapatan Methods

When it comes to navigating the world of 'cara bayaran cukai pendapatan,' understanding the different payment methods is key. Each option comes with its own set of advantages and disadvantages, catering to various preferences and circumstances. Let's dive into a comparative analysis to help you choose the most suitable method for a seamless tax payment experience:

| Method | Advantages | Disadvantages |

|---|---|---|

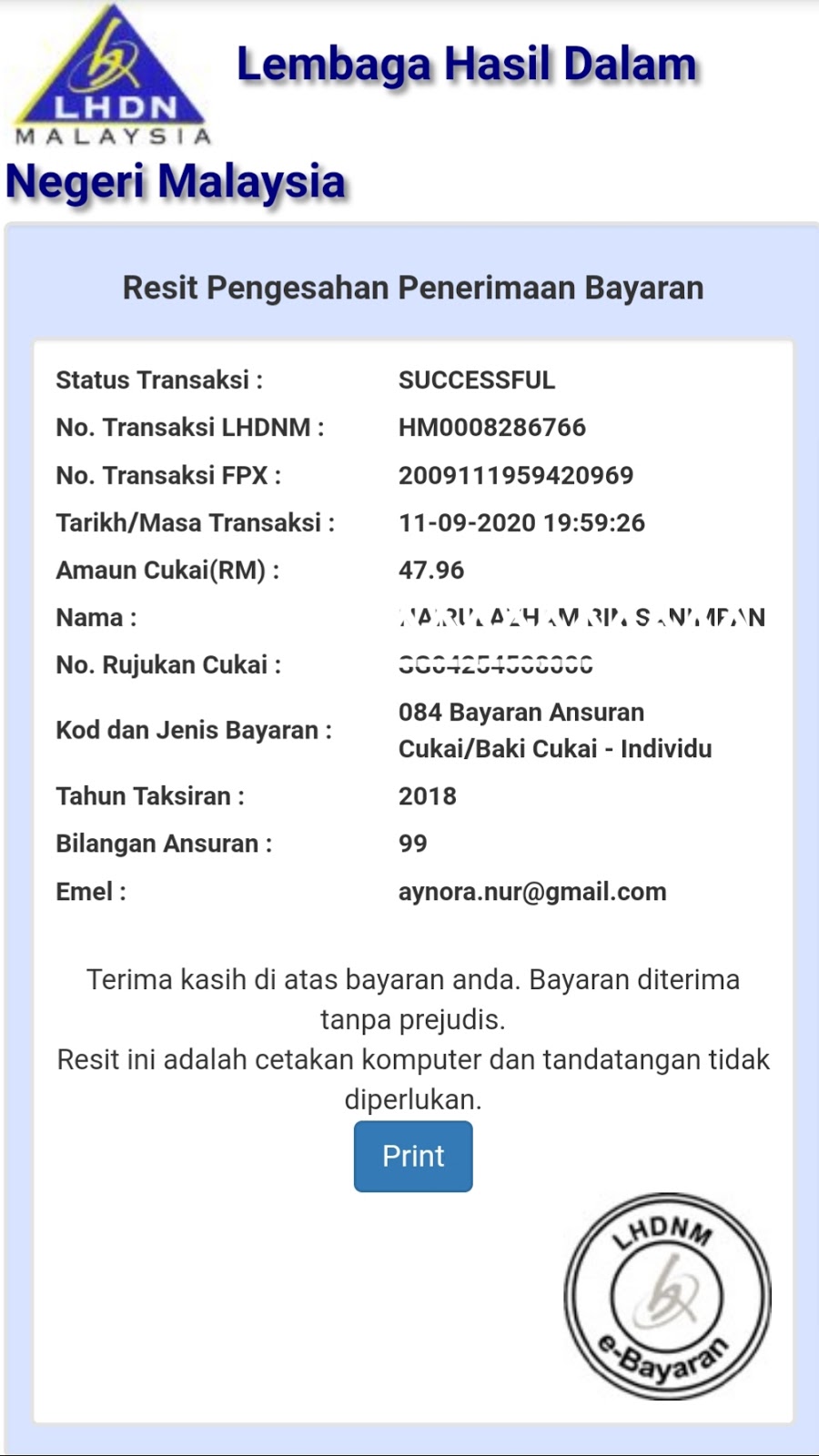

| Online Payment (e-Filing, LHDN Portal) | Convenient, accessible 24/7, instant payment confirmation | Requires internet access, potential technical glitches |

| Credit Card | Ease of use, potential reward points, deferred payment option | Possible transaction fees, interest charges if not paid on time |

| Bank Transfer/Cash Deposit (at authorized banks) | Widely accessible, familiar process | Potential queues at banks, requires physical visit |

| Telegraphic Transfer (for overseas payments) | Secure option for international payments | Higher transaction fees, longer processing time |

| Salary Deduction (PCB) | Automatic deduction, spreads tax liability throughout the year | Not suitable for those with fluctuating income |

By carefully weighing the pros and cons of each 'cara bayaran cukai pendapatan' method, you can streamline your tax payment process and ensure timely compliance.

Navigating the world of 'cara bayaran cukai pendapatan' might seem like a daunting task, but it doesn't have to be. By understanding the various aspects of income tax payment in Malaysia – from the different methods available to the importance of timely filing – you're taking a proactive step towards financial responsibility. Remember, 'cara bayaran cukai pendapatan' is more than just a civic duty; it's an investment in the future of Malaysia. So, take the time to educate yourself, seek assistance if needed, and embrace the opportunity to contribute to the nation's progress.

SEMAK NO CUKAI PENDAPATAN : CARA DAPATKAN NOMBOR INCOME TAX INDIVIDU - Trees By Bike

Cukai Pendapatan: Cara Mengira Bayaran Balik LHDN Untuk Lebihan Bayaran - Trees By Bike

Jimat Bayar Cukai Untuk Taksiran Berasingan - Trees By Bike

cara bayaran cukai pendapatan - Trees By Bike

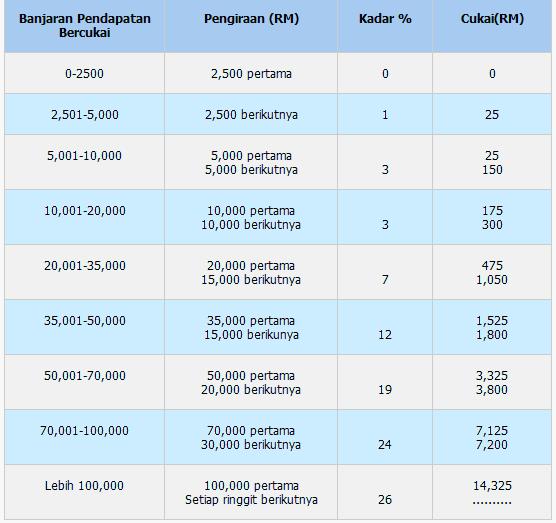

Kadar cukai individu pemastautin - Trees By Bike

Cara Daftar Cukai LHDN Untuk e - Trees By Bike

JADUAL POTONGAN CUKAI BULANAN 2014 PDF - Trees By Bike

Contoh Surat Rayuan Pengurangan Bayaran - Trees By Bike

ezHASiL: Panduan Isi e - Trees By Bike

Hanya Pendapatan Bercukai Tahunan lebih RM230,000 alami kenaikan cukai - Trees By Bike

Surat Rayuan Pengurangan Cukai Taksiran Pintu - Trees By Bike

Wow! Panduan E Filing Lhdn 2023 Wajib Kamu Ketahui - Trees By Bike

Cara Bayar Baki Cukai Pendapatan Secara Online Yang Mudah - Trees By Bike

cara bayaran cukai pendapatan - Trees By Bike

Cara Mudah Pengiraan Cukai Pendapatan Tips Bijak Menguruskan Wang Sah - Trees By Bike