Navigating the world of taxes can feel like traversing a complex maze. Forms, deadlines, and a multitude of regulations can make the process feel overwhelming. Among these complexities lies a beacon of potential savings – tax deductions. Understanding how to effectively utilize these deductions, often referred to as "cara kiraan potongan cukai pendapatan" in Malay, can significantly impact your financial well-being.

Imagine this: you've worked diligently all year, earning your income. Now, imagine being able to reduce the amount of that hard-earned money that goes towards taxes – legally and ethically. This is the power of understanding tax deductions. These deductions allow you to subtract certain expenses from your total income, effectively lowering the amount of income subject to taxation.

But where do you begin? How do you know which deductions you qualify for and how to claim them? This is where a clear and concise guide becomes invaluable. By breaking down the process into manageable steps, we aim to empower you to navigate the world of tax deductions with confidence.

Before diving into the specifics, it's important to grasp the fundamental concept of why tax deductions exist. Governments implement tax systems not only to generate revenue but also as a tool to encourage certain behaviors within society. Tax deductions often reflect these policy goals. For instance, deductions related to education expenses might be introduced to incentivize individuals to invest in their skills and knowledge, thereby contributing to a more skilled workforce.

Similarly, deductions for charitable donations can be seen as a way to promote philanthropy and support non-profit organizations. By providing these deductions, governments aim to create a win-win situation: individuals receive tax benefits, and society benefits from the positive outcomes associated with the deductible expenses. Therefore, understanding the rationale behind these deductions can provide valuable context as you explore your own tax-saving opportunities.

Advantages and Disadvantages of Understanding Tax Deductions

| Advantages | Disadvantages |

|---|---|

| Reduced Tax Liability | Time and Effort in Record-Keeping |

| Increased Financial Resources | Potential for Errors if Not Done Correctly |

| Support for Specific Life Goals (e.g., homeownership, education) | Complexity of Tax Laws Can Be Daunting |

While the concept of tax deductions might seem straightforward, the actual process of identifying, calculating, and claiming these deductions can be intricate. Factors such as your employment status, types of income, and eligible expenses all come into play. However, by arming yourself with the right knowledge and resources, you can confidently approach your tax obligations and potentially unlock significant savings.

cara kiraan potongan cukai pendapatan - Trees By Bike

Jangan Lupa Bayar Zakat Pendapatan Tahun 2020. Ini Cara Kiraannya Yang - Trees By Bike

cara kiraan potongan cukai pendapatan - Trees By Bike

Cara Daftar LHDN Pertama Kali Untuk Declare Income Tax (e - Trees By Bike

Bajet 2023: Potongan cukai pendapatan, diskaun PTPTN, pengecualian duti - Trees By Bike

Cara Kira Cukai Pendapatan Sewa & Pelepasan Cukai Lain 2024 Bagi - Trees By Bike

cara kiraan potongan cukai pendapatan - Trees By Bike

cara kiraan potongan cukai pendapatan - Trees By Bike

Derma / Hadiah: Syarat & Cara Dapatkan Insentif Potongan Cukai - Trees By Bike

Hanya Pendapatan Bercukai Tahunan lebih RM230,000 alami kenaikan cukai - Trees By Bike

Berapa Gaji Yang Layak Kena Potongan Cukai Bulanan (PCB)? Ini Cara - Trees By Bike

Senarai Pelepasan Cukai 2021 dan Cara Isi E - Trees By Bike

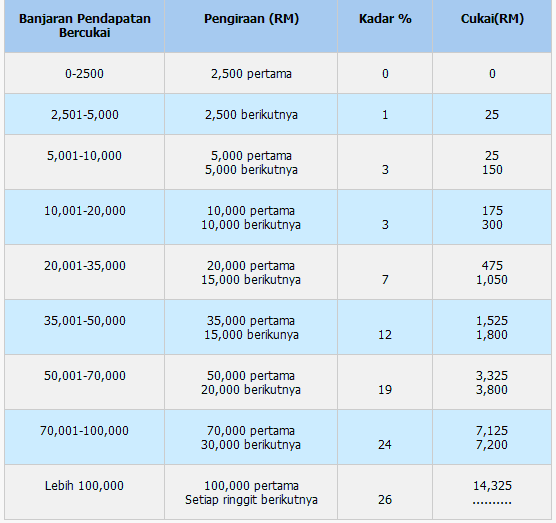

Kadar cukai individu pemastautin - Trees By Bike

Panduan Lengkap Cukai Pendapatan 2023 (Taksiran 2022) - Trees By Bike

JADUAL POTONGAN PCB 2012 PDF - Trees By Bike