We’ve all been there. You’re about to make a transfer, pay a bill, or maybe even treat yourself online, and BAM—it hits you. You need your CIMB account number, and you can’t, for the life of you, remember where you wrote it down. Don’t worry; this happens more often than you think.

Whether you're a seasoned CIMB customer or just starting, knowing where to find your account number is crucial for smooth banking. It's not just a random string of digits; it's your financial address, the key to accessing your funds and managing your finances.

Back in the day, tracking down your account number often meant a trip to the bank or a long wait on a customer service line. Thankfully, we’re living in the digital age! CIMB, like most modern banks, has evolved to offer various convenient methods for retrieving this vital piece of information.

In this article, we'll break down those methods, providing step-by-step instructions and helpful tips to make finding your CIMB account number as painless as possible. So, grab your detective hat (metaphorically, of course), and let's crack the case of the missing CIMB account number!

Remember, while finding your account number is generally a straightforward process, protecting your account information is paramount. Always be cautious about where you share sensitive financial data and be wary of any suspicious requests for this information.

Advantages and Disadvantages of Various Methods

| Method | Advantages | Disadvantages |

|---|---|---|

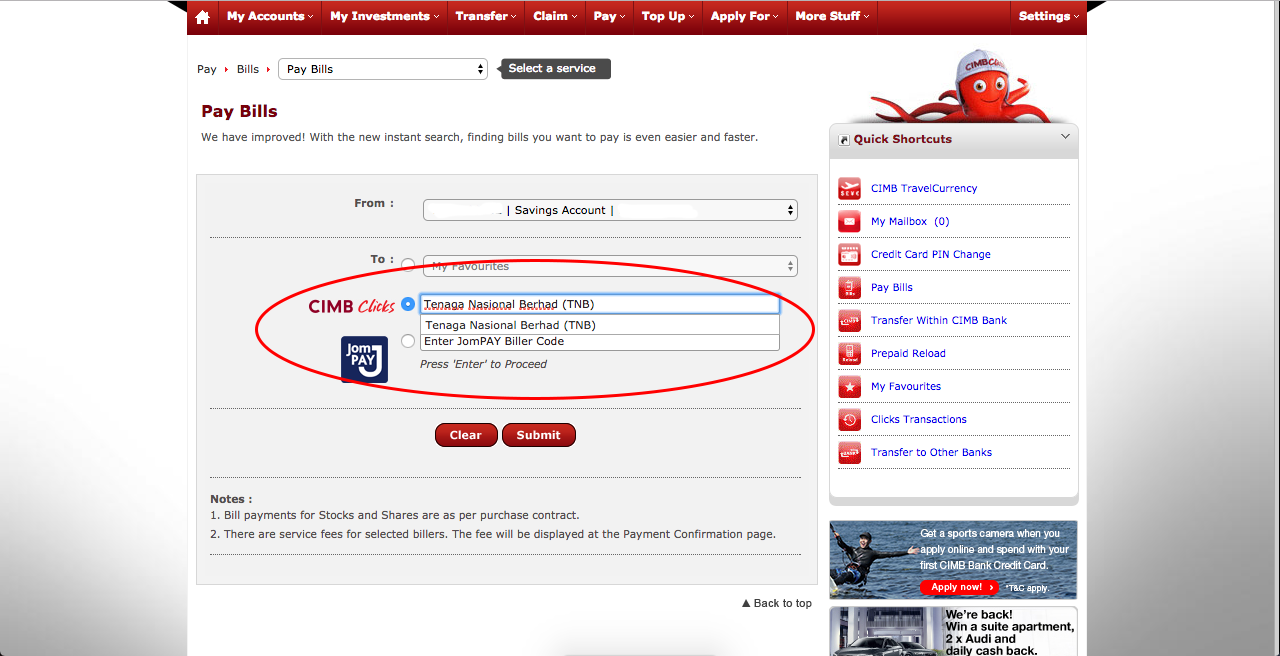

| CIMB Clicks (Online Banking) | Convenient, accessible 24/7 | Requires prior online banking setup |

| CIMB Mobile App | Quick, accessible on-the-go | Requires smartphone and internet access |

| Checkbook | Readily available if you have one | Not everyone uses checkbooks anymore |

| Bank Statement | Clearly stated on the document | Requires having a recent statement on hand |

| Customer Service | Direct assistance from bank staff | May involve wait times and verification steps |

Best Practices for Keeping Your Account Number Secure

While locating your CIMB account number isn’t overly complicated, protecting this crucial piece of information should always be a top priority. Here are some best practices to keep in mind:

- Never share your account number publicly: Avoid posting it on social media or sharing it in unsecured emails.

- Be wary of phishing attempts: CIMB will never ask for sensitive information via email or SMS.

- Use strong passwords: Protect your online banking accounts with unique and complex passwords.

- Enable two-factor authentication: Add an extra layer of security to your online accounts whenever possible.

- Regularly monitor your accounts: Review your statements frequently for any suspicious activity.

Frequently Asked Questions (FAQs)

Q: What should I do if I’ve lost my CIMB ATM card and need my account number?

A: Don’t panic! You can still retrieve your account number through other means like CIMB Clicks, the CIMB mobile app, a bank statement, or by contacting CIMB customer service. However, it’s crucial to block your lost ATM card immediately by contacting CIMB or using their online banking services.

Q: Can I find my CIMB account number if I only have my debit card?

A: Unfortunately, your debit card number is different from your bank account number. To locate your account number, you'll need to utilize one of the other methods mentioned earlier.

Q: I’m opening a new CIMB account online. When will I receive my account number?

A: Once you’ve successfully opened your new CIMB account online, you’ll typically receive your account number instantly via email or SMS. This information should also be readily available through your online banking portal.

Q: I’ve forgotten my CIMB Clicks (online banking) password. Can I still access my account number?

A: Yes! You can easily reset your CIMB Clicks password online by following the “Forgot Password” instructions on the login page. Once you’ve regained access to your account, you can readily view your CIMB account number.

Q: What is the format of a CIMB account number?

A: CIMB account numbers typically follow a specific format, which may vary depending on your account type and branch. However, they are generally a string of 10-14 digits.

Q: Can I use my old CIMB account number if I’ve closed my account and opened a new one?

A: No, you cannot use an old account number associated with a closed account. Each new account you open will be assigned a unique account number.

Q: I think there’s been unauthorized activity on my CIMB account. What should I do?

A: Immediately contact CIMB’s customer service hotline to report any suspected unauthorized transactions. They will guide you through the necessary steps to secure your account and investigate the matter.

Knowing how to locate your CIMB account number is an essential aspect of managing your finances. Whether you need to make a transfer, set up online bill payments, or simply keep track of your funds, having this information at your fingertips empowers you to stay in control of your money. Remember to keep your account details secure and utilize the various resources CIMB provides to make your banking experience as seamless as possible.

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

Maybank acc pink cute template in 2021 - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike

how to know my cimb account number - Trees By Bike