Imagine this: It's tax season, and everyone around you is drowning in receipts, forms, and a sense of impending doom. But not you. You're calm, collected, and sipping your coffee with a subtle smile. Why? Because you've been one step ahead, managing your tax obligations throughout the year with a strategic approach to "bayaran ansuran cukai pendapatan" – installment payments for your income tax.

For many, the thought of dealing with taxes evokes a sense of dread. The lump-sum payment can feel overwhelming, and the fear of penalties for underpayment adds to the stress. But what if there was a way to spread out your tax liability throughout the year, making the process smoother and financially manageable? This is where "bayaran ansuran cukai pendapatan," or income tax installment payments, come into play.

Instead of scrambling to gather funds during tax season, imagine a scenario where you consistently set aside a portion of your income specifically for taxes. This proactive approach not only alleviates the financial strain but also provides peace of mind knowing that you're staying ahead of your tax obligations.

In a world where financial planning is paramount, understanding the nuances of "bayaran ansuran cukai pendapatan" becomes crucial. Whether you're a salaried employee, a freelancer, or a business owner, grasping this concept can significantly impact your financial well-being.

This comprehensive guide will delve into the intricacies of "bayaran ansuran cukai pendapatan," exploring its benefits, providing practical tips for implementation, and addressing common questions to empower you with the knowledge to navigate the world of taxes with confidence.

Advantages and Disadvantages of "Bayaran Ansuran Cukai Pendapatan"

Let's weigh the pros and cons of embracing installment payments for your income tax:

| Advantages | Disadvantages |

|---|---|

| Enhanced Financial Planning: Predictable payments allow for better budgeting and financial control. | Potential for Overpayment: If your income fluctuates, you might end up overpaying, requiring a refund later. |

| Reduced Tax Season Stress: No last-minute scrambles to gather funds, promoting peace of mind. | Disciplined Approach Required: It demands consistent financial discipline to make payments on time. |

| Avoidance of Penalties: Timely installments prevent late payment penalties and potential interest charges. |

While the concept of "bayaran ansuran cukai pendapatan" offers numerous advantages, it's essential to approach it strategically. Let's explore some best practices to ensure a smooth and efficient experience.

Best Practices for Implementing "Bayaran Ansuran Cukai Pendapatan"

Here are some practical tips to make the most of installment payments for your income tax:

- Understand Your Tax Liability: Before you begin, estimate your annual tax liability accurately. This will determine the amount you need to set aside for each installment. Consulting a tax professional can be beneficial in this regard.

- Set Up a Dedicated Account: Open a separate bank account specifically for your tax payments. This fosters financial discipline and prevents the temptation to spend funds earmarked for taxes.

- Automate Your Payments: Most financial institutions offer automated payment options. Schedule regular transfers to your tax account to ensure timely payments without the hassle of manual transactions.

- Review and Adjust Regularly: Life is dynamic, and so are our financial situations. Periodically review your income, expenses, and tax liability to make necessary adjustments to your installment amounts.

- Seek Professional Guidance: If you're unsure about any aspect of "bayaran ansuran cukai pendapatan" or require personalized advice, don't hesitate to consult a qualified tax professional. Their expertise can prove invaluable in optimizing your tax strategy.

By incorporating these best practices, you can seamlessly integrate "bayaran ansuran cukai pendapatan" into your financial routine, transforming tax season from a period of stress into a manageable and even empowering experience.

Remember, knowledge is power. Understanding and utilizing the concept of "bayaran ansuran cukai pendapatan" can significantly contribute to your financial well-being, allowing you to face tax season with confidence and peace of mind. Take control of your financial future – one installment at a time.

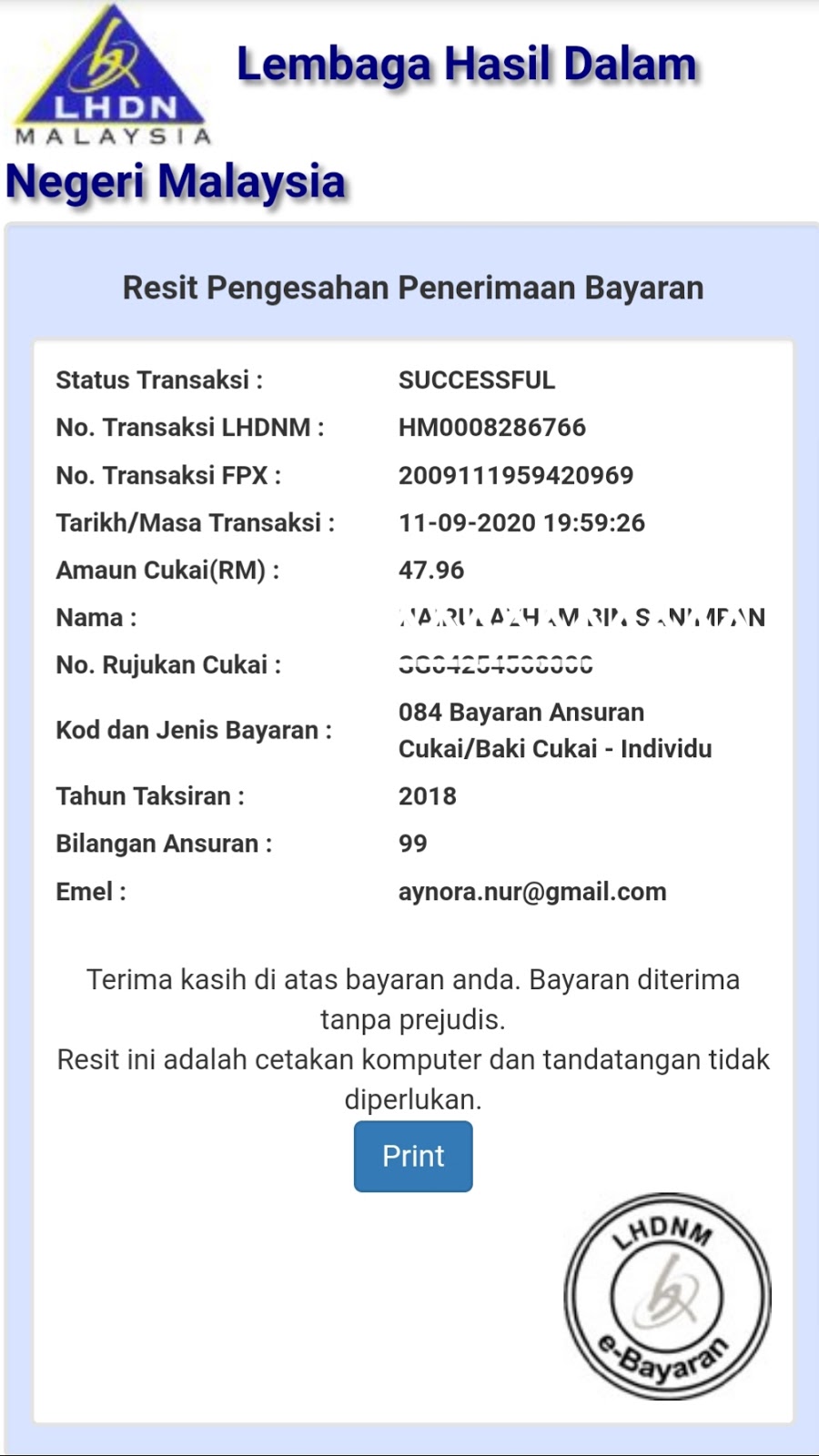

Cara Bayar Baki Cukai Pendapatan Secara Online Yang Mudah - Trees By Bike

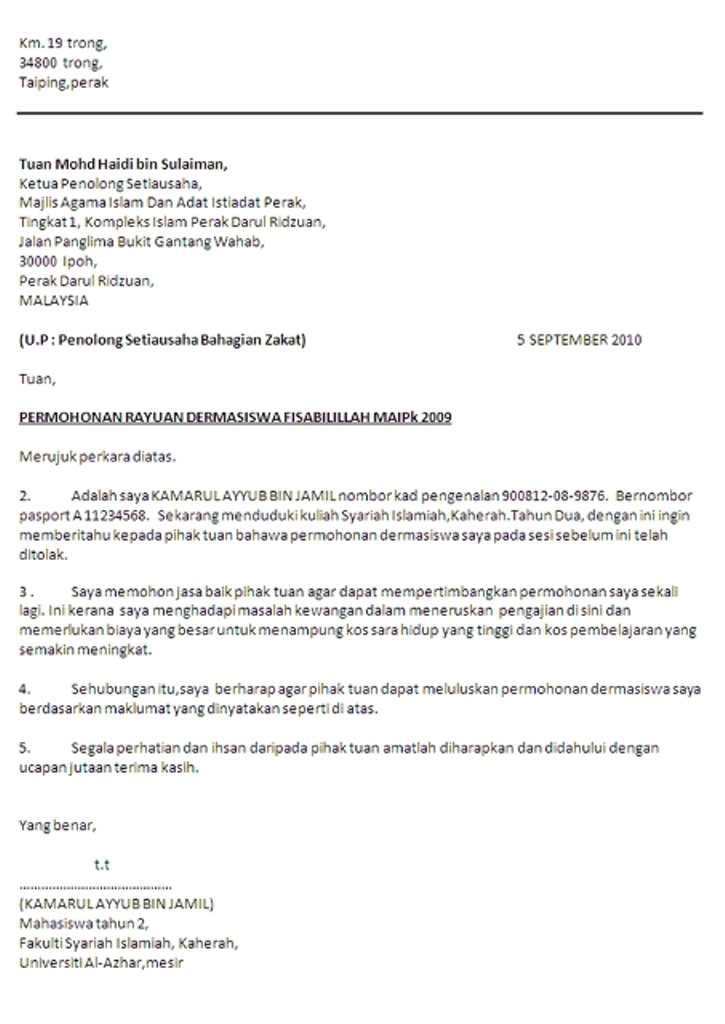

Contoh Surat Rayuan Bayaran Balik Pinjaman Mara - Trees By Bike

Contoh Surat Rayuan Bayaran Ansuran Cukai Pendapatan - Trees By Bike

bayaran ansuran cukai pendapatan - Trees By Bike

Contoh Surat Rayuan Pengurangan Bayaran Kereta - Trees By Bike

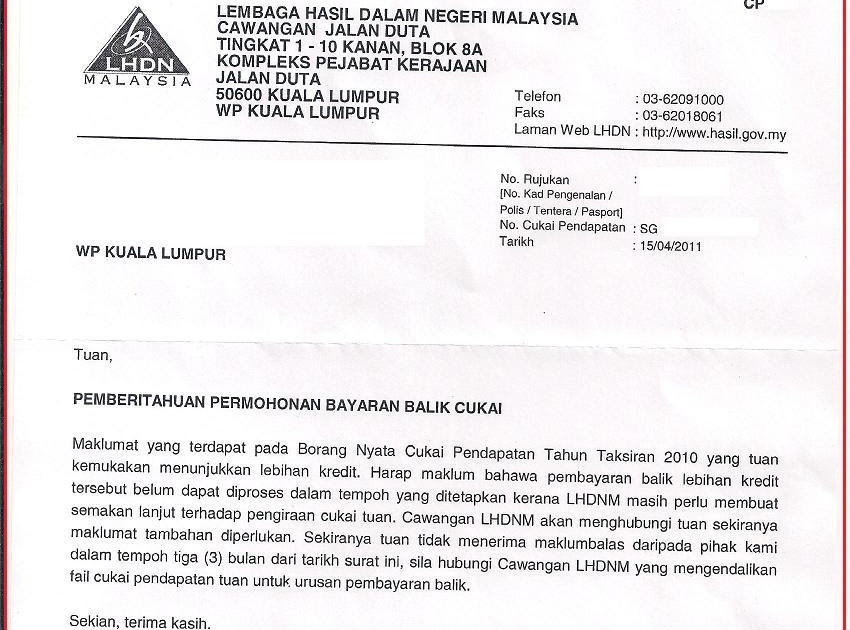

Contoh Surat Rayuan Taksiran Lhdn - Trees By Bike

Contoh Surat Rayuan Bayaran Ansuran Cukai Pendapatan - Trees By Bike

Contoh Surat Rayuan Bayaran Ansuran Cukai Pendapatan - Trees By Bike

LHDN tawar bayaran ansuran tunggakan cukai pendapatan, CKHT - Trees By Bike

Contoh Surat Rayuan Bayaran Ansuran Cukai Pendapatan - Trees By Bike

Contoh Surat Rayuan Taksiran Lhdn - Trees By Bike

Lembaga Hasil Contoh Surat Rayuan Bayaran Ansuran Cukai Pendapatan - Trees By Bike

LHDN tawar bayaran ansuran tunggakan cukai pendapatan, keuntungan - Trees By Bike

Contoh Surat Rayuan Taksiran Lhdn - Trees By Bike

LHDN tawar bayaran ansuran tunggakan cukai pendapatan, CKHT - Trees By Bike