Let's be real, the phrase "annual profit" has a certain ring to it, doesn't it? It conjures up images of financial freedom, luxurious vacations, and maybe even that yacht you've been eyeing. But how do you get from dreaming about those profits to actually seeing them reflected in your bank account? The answer, my friend, lies in understanding the art of calculating and maximizing your earning potential.

We're not talking about some mystical, Wall Street sorcery here. This is about empowering yourself with the knowledge and tools to take control of your financial destiny. Whether you're a seasoned entrepreneur or just starting out on your business venture, understanding the fundamentals of profit calculation is non-negotiable. It's the compass that guides your decisions, the yardstick that measures your success, and the key to unlocking a world of financial possibilities.

Now, you might be thinking, "This all sounds great, but isn't calculating annual profit a job for the accountants with their fancy degrees and even fancier calculators?" While it's true that accountants are wizards with numbers, you don't need a CPA license to grasp the basics. In fact, demystifying this process is the first step to taking charge of your financial future.

Think of it like this: you wouldn't drive a car without understanding the basic functions of the gas pedal, brakes, and steering wheel, right? The same principle applies to your finances. Knowing how to calculate your annual profit is like mastering the controls of your financial vehicle. It allows you to navigate the road to success, avoid costly mistakes, and accelerate towards your financial goals.

So, buckle up, because we're about to embark on a journey into the heart of annual profit calculation. We'll break down complex concepts into digestible bites, equip you with practical tools and strategies, and empower you to make informed decisions that drive profitability. By the end of this ride, you'll be well on your way to not just understanding, but mastering the art of turning a profit, year after year.

Advantages and Disadvantages of Calculating Annual Profit

While understanding and calculating annual profit is crucial for any business, it's not without its nuances. Let's weigh the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Provides a clear picture of your financial health | Only a snapshot in time, doesn't reflect future fluctuations |

| Enables informed decision-making for future investments and growth strategies | Can be influenced by external factors like market trends or economic downturns |

| Helps identify areas for improvement and cost optimization | Doesn't account for intangible assets like brand value or customer loyalty |

Best Practices for Effective Profit Management

Let's dive into some actionable strategies to not only calculate but also maximize your annual profits:

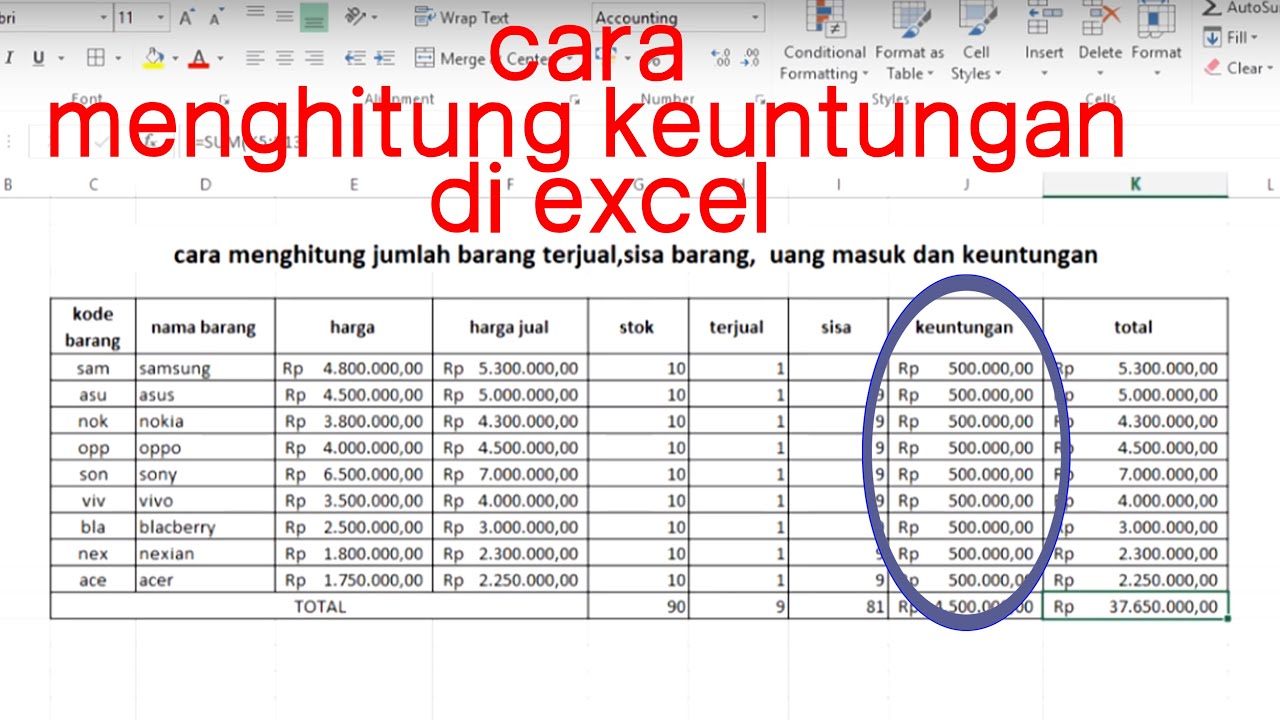

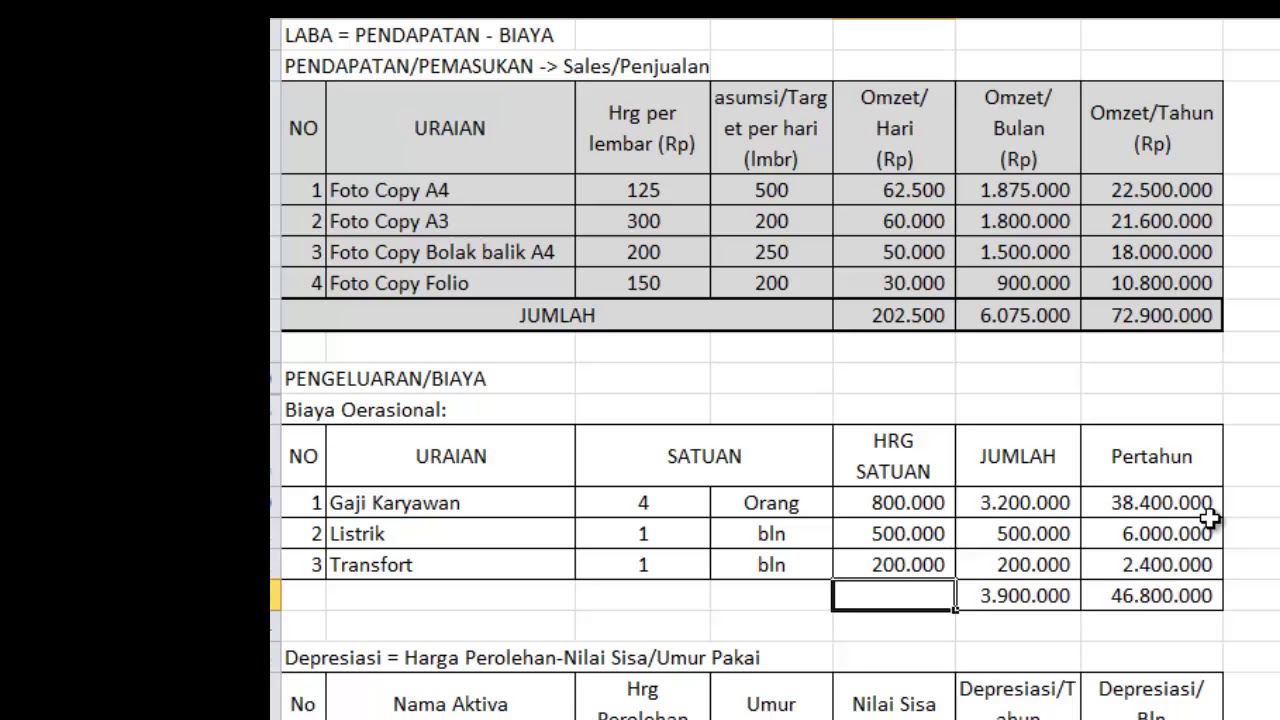

- Track Every Penny: Implement robust accounting software or spreadsheets to meticulously monitor income and expenses.

- Pricing Power: Regularly review and adjust your pricing strategies to ensure they align with market value and profitability goals.

- Cost Control: Identify and minimize unnecessary expenses without compromising quality or customer satisfaction.

- Boost Sales Smartly: Explore cost-effective marketing and sales strategies to attract new customers and encourage repeat business.

- Invest in Growth: Strategically reinvest profits into areas like product development, marketing, or employee training to fuel long-term success.

FAQs about Annual Profit

Let's tackle some burning questions you might have:

1. What's the difference between gross and net profit?

Gross profit is your total revenue minus the direct costs of goods sold. Net profit factors in all operating expenses, taxes, and interest payments, giving you the actual bottom line.

2. When's the best time to calculate annual profit?

While technically calculated at the end of your fiscal year, regularly monitoring your profit and loss throughout the year is crucial for timely adjustments and informed decision-making.

3. Can I increase profitability even with stable sales?

Absolutely! Focus on optimizing operational efficiency, reducing expenses, and exploring avenues to enhance profit margins on existing products or services.

4. What role does inventory management play in profitability?

Efficient inventory management minimizes waste, storage costs, and ensures you have the right products available at the right time to meet customer demand, directly impacting your bottom line.

5. How can I use profit data to secure funding?

Demonstrating consistent profitability and a clear growth plan supported by solid financial data significantly increases your chances of securing loans or investments.

6. Is breaking even in the first year good enough?

While breaking even indicates you're covering your costs, aiming for profitability from the outset is crucial for long-term sustainability and growth.

7. What are some common mistakes to avoid when calculating profit?

Overlooking expenses, misclassifying transactions, and neglecting to factor in taxes are common pitfalls that can lead to inaccurate profit calculations.

8. Where can I find reliable resources to improve financial literacy for my business?

Numerous online courses, books, and workshops are available to enhance your understanding of financial management principles and empower you to make informed decisions for your business.

The Bottom Line: Your Path to Profitability Starts Now

Mastering the art of calculating and maximizing your annual profit isn't just a financial exercise; it's about embracing a mindset of growth, strategic thinking, and proactive financial management. By understanding the key drivers of profitability, implementing effective strategies, and constantly seeking opportunities for improvement, you equip yourself with the tools to navigate the ever-evolving business landscape and achieve lasting financial success. Remember, your financial journey is a marathon, not a sprint. Embrace the learning process, seek expert guidance when needed, and never underestimate the power of consistent effort in building a profitable and sustainable future for your business.

Formula Kos Jualan Untuk Tingkatkan Pendapatan Perniagaan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

Contoh Perhitungan Modal Usaha - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike

cara kira keuntungan tahunan - Trees By Bike