In today's fast-paced financial landscape, understanding the intricacies of banking services is crucial. One such service that often requires clarification is the cashier's check. This article delves deep into the world of Bank of America cashier's check fees, providing a comprehensive guide to navigate the costs and benefits.

Cashier's checks, guaranteed by the issuing bank, offer a secure payment method for various transactions. They differ from personal checks, as the bank draws funds directly from its own account, assuring the recipient that the funds are available. But this assurance comes at a price, and understanding the fee structure is paramount.

Bank of America, a prominent financial institution, offers cashier's checks to its customers. The cost of obtaining a cashier's check from Bank of America is a key consideration for account holders. This fee can vary, and it's essential to be aware of the current charges. This article aims to shed light on the specifics of these charges.

Why are cashier's checks important? In situations where guaranteed funds are required, such as real estate transactions or large purchases, a cashier's check offers a level of security and trust. This distinguishes them from personal checks, which are susceptible to insufficient funds. Therefore, understanding the cost associated with obtaining a cashier's check is a critical aspect of financial planning.

Knowing the Bank of America cashier's check fee allows for accurate budgeting and informed financial decisions. Whether you're a seasoned investor or simply managing personal finances, understanding the cost of banking services is vital for maximizing your resources. This article will provide clarity and guidance on this important topic.

The historical context of cashier's checks dates back centuries. Originally, they served as a safer alternative to carrying large sums of cash. The modern form, with banks guaranteeing the funds, has evolved over time to become a widely accepted payment method.

A cashier's check represents a pre-paid instrument, meaning the funds are deducted from the payer's account upon issuance. This contrasts with personal checks, where funds are withdrawn upon the recipient's deposit. This pre-funding mechanism is what provides the guarantee and security associated with cashier's checks.

Benefits of using a cashier's check from Bank of America include guaranteed payment, increased security, and wider acceptance by recipients, particularly in large transactions.

To obtain a cashier's check from Bank of America, one would typically visit a branch, provide the required information and payment, and receive the check. It is recommended to confirm the current fee with Bank of America directly.

Advantages and Disadvantages of Bank of America Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed Payment | Fee Associated |

| Increased Security | Requires a Bank Visit |

| Wide Acceptance |

Best practices for using cashier's checks include keeping a record of the check number, verifying the recipient's information, and storing the check securely until it is needed.

Real examples of cashier's check usage include purchasing a vehicle, making a down payment on a house, and paying for auction items.

Challenges associated with cashier's checks might include lost or stolen checks, which require a process for replacement. The solution usually involves contacting the issuing bank and initiating a stop payment and reissue process.

Frequently Asked Questions:

1. What is the Bank of America cashier's check fee? (Check with Bank of America for the most current fee)

2. Where can I get a cashier's check from Bank of America? (At a Bank of America branch)

3. What information do I need to get a cashier's check? (Valid identification and payment)

4. How long is a cashier's check valid? (Typically, cashier's checks do not expire, but it's best to use them within a reasonable timeframe)

5. Can I cancel a cashier's check? (Yes, but it involves a process with the bank.)

6. What happens if I lose a cashier's check? (Contact the bank to report a lost check and request a replacement.)

7. Are cashier's checks safer than personal checks? (Yes, due to the guaranteed funds.)

8. Can I get a cashier's check online? (While some banks offer online requests, Bank of America typically requires a branch visit.)

Tips for managing cashier's checks include keeping records and ensuring accurate recipient information.

In conclusion, understanding the cost and utilization of cashier's checks, specifically the Bank of America cashier's check fee, is crucial for sound financial management. The advantages of guaranteed payment, heightened security, and wide acceptance make cashier's checks a valuable tool for various financial transactions. By weighing the benefits against the fees, individuals can make informed decisions about utilizing this payment method effectively. Being aware of the process for obtaining a cashier's check, understanding the associated fees, and following best practices for their use will empower individuals to navigate their financial needs with confidence. Always confirm the most up-to-date fee information with Bank of America directly before initiating a transaction.

Bank Of America Printable Checks - Trees By Bike

Citizens Bank Wire Information - Trees By Bike

Do Diamonds Go Up in Value Like Gold - Trees By Bike

Pin by Evan Michael on Quick Saves - Trees By Bike

cashier's check fee bank of america - Trees By Bike

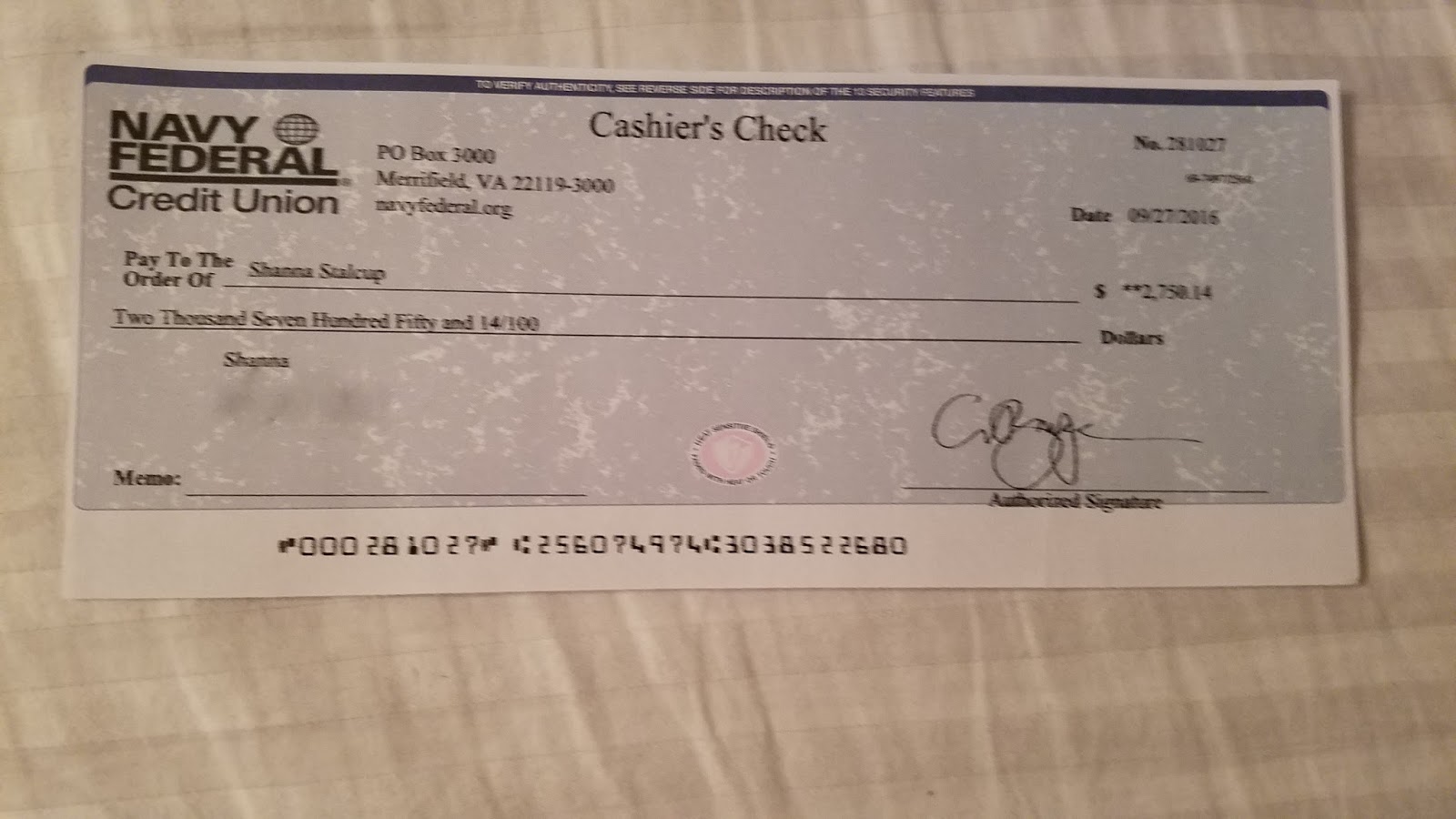

Navy Federal Credit Union Cashier S Check - Trees By Bike

Chase Bank Check Template Fresh 12 Cashier Check Template In 2020 - Trees By Bike

Wire Transfer Navy Federal Credit Union Limit - Trees By Bike

What Is Cashiers Check - Trees By Bike

Navy Federal Cashier S Check Fee - Trees By Bike

cashier's check fee bank of america - Trees By Bike

Third Federal customer balks at cashier - Trees By Bike

Navy Federal Cashier S Check Fee - Trees By Bike

Comment gérer un Chèque de caisse perdu - Trees By Bike

cashier's check fee bank of america - Trees By Bike

/cdn.vox-cdn.com/uploads/chorus_asset/file/18995632/Cashier3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/6QQCDG2MWFACLOVC4SBER633SI.jpg)