Navigating the Malaysian employment landscape can feel like traversing a complex maze of regulations. One crucial aspect that often raises questions is the contribution towards Social Security Organisation (SOCSO) and Employment Insurance System (EIS) on bonus payments. Understanding these obligations is essential for both employers and employees to ensure compliance and maximize benefits.

This deep dive explores the intricacies of whether bonuses are considered wages for SOCSO and EIS contributions. We'll dissect the definitions, examine the legal framework, and uncover the implications for all parties involved. Understanding these contributions is not just about compliance; it's about ensuring a safety net for employees and a stable employment ecosystem.

The question of whether a bonus counts towards SOCSO and EIS contributions isn't a simple yes or no. It depends on the type of bonus and how it's defined within the legal framework. Certain bonuses are considered part of wages and are therefore subject to contributions, while others are excluded. This nuanced approach requires careful consideration to ensure accurate calculations and avoid potential penalties.

The importance of understanding these regulations cannot be overstated. For employees, it ensures they receive the full benefits they are entitled to in times of need. For employers, it means adhering to the law and fostering a transparent and compliant workplace. Ultimately, accurate SOCSO and EIS contributions contribute to a stronger social security system and a more robust economy.

Let's delve into the historical context of SOCSO and EIS. SOCSO, established in 1971, provides social security protection for employees against various contingencies such as invalidity, sickness, and death. EIS, introduced later, provides financial assistance to employees who have lost their jobs. Over time, the regulations surrounding these schemes have evolved, reflecting changes in the labor market and economic landscape.

SOCSO contributions are calculated based on an employee's monthly wages, including certain allowances and bonuses. EIS contributions are also based on wages, but the calculation differs slightly. Generally, contractual bonuses that are consistently paid are considered part of wages, while discretionary bonuses, such as performance bonuses, may not be.

Benefits of understanding and correctly implementing SOCSO and EIS contributions include financial security for employees during times of hardship, legal compliance for employers, and a contribution to a stronger social safety net. For instance, an employee who loses their job due to retrenchment can receive financial aid from EIS, while SOCSO provides benefits in case of work-related accidents or illnesses.

Employers should maintain accurate records of employee wages and bonuses, categorize bonuses correctly, and utilize the official SOCSO and EIS contribution calculators to ensure accurate calculations. Regularly reviewing and updating internal policies to reflect changes in regulations is crucial for maintaining compliance.

Advantages and Disadvantages of Clear SOCSO & EIS Bonus Contribution Guidelines

| Advantages | Disadvantages |

|---|---|

| Clearer understanding for employers and employees | Potential for increased administrative burden |

| Reduced risk of non-compliance and penalties | Need for constant updates to reflect regulatory changes |

| Enhanced trust and transparency in the workplace | Possible disagreements over bonus classifications |

Best practices include consulting with HR professionals or legal experts for complex scenarios, utilizing online resources provided by SOCSO and PERKESO (EIS), and conducting regular internal audits to ensure compliance. Staying updated on regulatory changes is vital.

Frequently asked questions include: What types of bonuses are subject to SOCSO and EIS? How are contributions calculated? What are the penalties for non-compliance? Where can I find more information? What are the benefits for employees? What are the responsibilities of employers? How can I appeal a decision? How do I file a claim?

Tips include using payroll software that automatically calculates SOCSO and EIS contributions, maintaining detailed records of all bonus payments, and proactively communicating with employees about their contributions.

In conclusion, understanding the complexities of SOCSO and EIS contributions on bonuses is paramount for both employers and employees in Malaysia. It not only ensures legal compliance but also contributes to a more robust social security system. By staying informed, implementing best practices, and seeking professional advice when needed, businesses can navigate this intricate landscape effectively and contribute to a fairer and more secure future for all. Take the time to review your current practices, educate your employees, and ensure you're aligned with the latest regulations. The benefits of a well-managed and compliant system far outweigh the potential challenges. Invest in understanding today for a more secure tomorrow.

EIS SOCSO Contribution A Guide For Employers In Malaysia - Trees By Bike

SOCSO EIS submission and payment methods - Trees By Bike

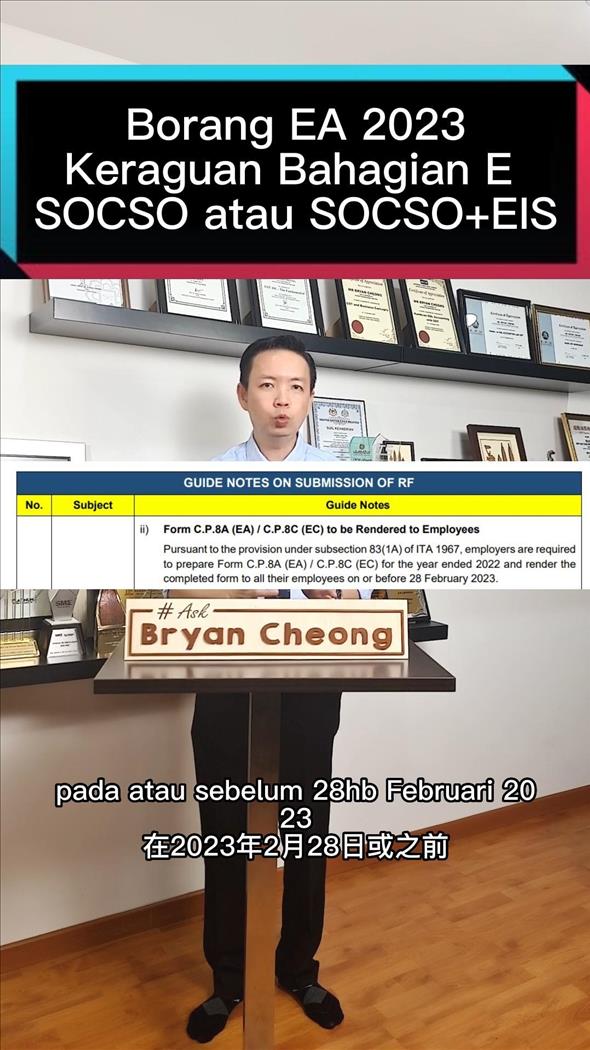

Borang EA 2023 Keraguan Bahagian E amaun ialah SOCSO atau SOCSOEIS - Trees By Bike

SOCSO and EIS Contribution Guide for Employers 2024 - Trees By Bike

SOCSO EIS submission and payment methods - Trees By Bike

SOCSO EIS Can NOW Both Submit and Pay Together - Trees By Bike

SOCSO EIS submission and payment methods - Trees By Bike

SOCSO EIS submission and payment methods - Trees By Bike

What is EPF and SOCSO - Trees By Bike

Contribution on EPF SOCSO EIS in Malaysia as an Employer - Trees By Bike

SOCSO EIS submission and payment methods - Trees By Bike

SOCSO EIS submission and payment methods - Trees By Bike

is bonus subject to socso and eis - Trees By Bike

Salary Payments That Need to Contribute to Payroll - Trees By Bike

MUST KEEP SHAREWhat Payment Subject or Not Subject To EPF SOCSO - Trees By Bike