Are you approaching Medicare eligibility and wondering about the financial implications? One of the most common questions is, "How much will Medicare Part B cost me?" This is a crucial question, as Part B covers essential medical services like doctor visits, outpatient care, and some preventive services. Navigating the complexities of Medicare can feel overwhelming, but understanding the costs associated with Part B is a vital step in preparing for your healthcare needs in retirement.

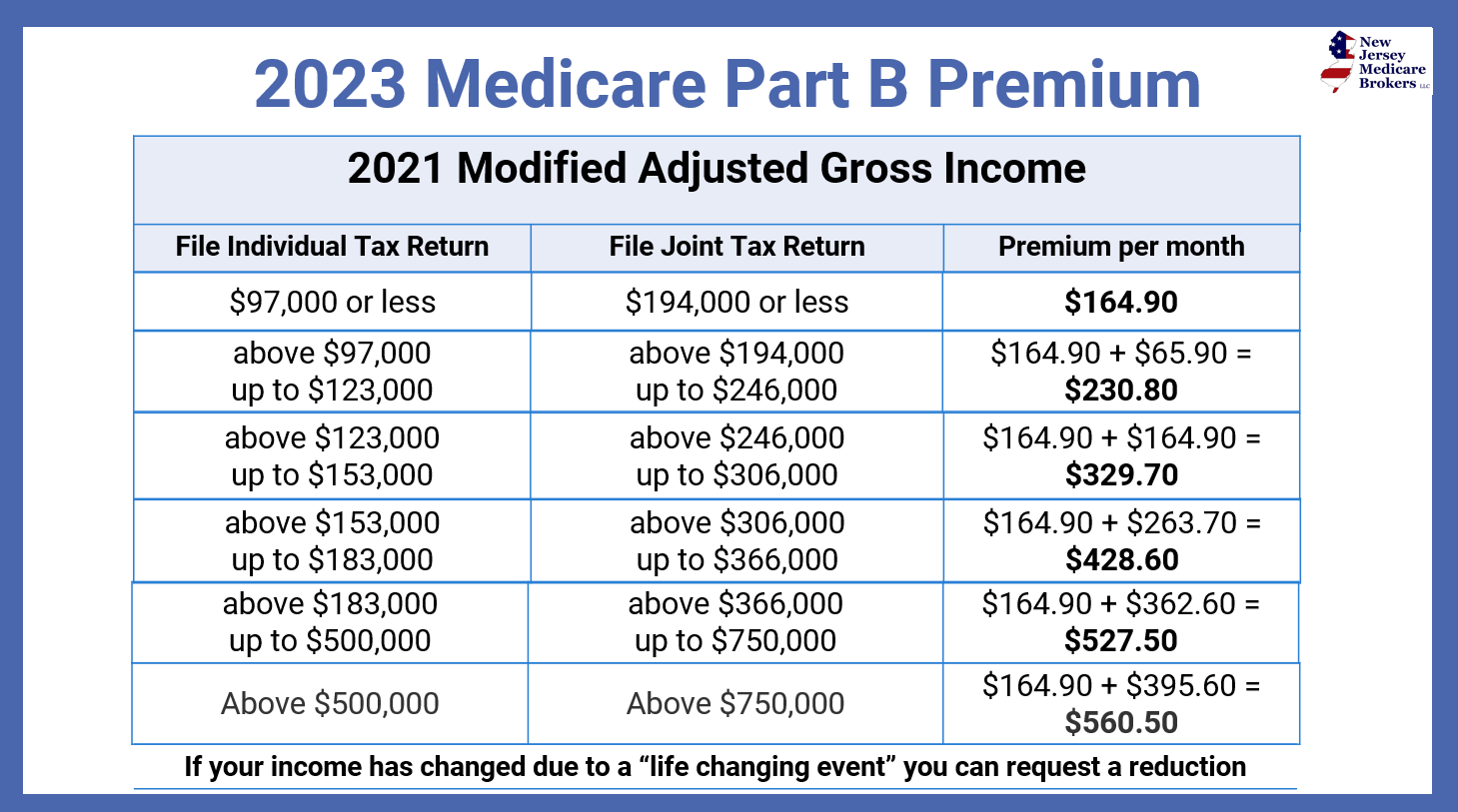

Medicare Part B premiums aren't one-size-fits-all. The cost is determined by several factors, including your income. Most beneficiaries pay the standard premium, which is adjusted annually. However, higher-income earners may pay a higher premium, often referred to as the Income-Related Monthly Adjustment Amount (IRMAA). It's essential to understand these potential cost variations to accurately budget for your healthcare expenses.

The history of Medicare Part B pricing reflects the changing landscape of healthcare costs in the United States. Since its inception in 1965, Part B premiums have generally risen, reflecting the increasing costs of medical services and technological advancements. Understanding this historical context helps illuminate the importance of planning for these expenses.

Medicare Part B plays a vital role in ensuring access to necessary medical services. Without it, many beneficiaries would face significant financial burdens for routine doctor visits, outpatient procedures, and essential medical equipment. Planning for the cost of Part B is crucial for protecting your financial well-being in retirement.

One of the main issues surrounding Medicare Part B costs is affordability, particularly for beneficiaries with fixed or limited incomes. Understanding the different premium levels and available assistance programs is crucial for navigating these challenges. Resources like the Social Security Administration and State Health Insurance Assistance Programs (SHIPs) can provide valuable guidance.

Beyond the standard monthly premium, Medicare Part B also includes an annual deductible. This is the amount you must pay out-of-pocket for covered services before Medicare begins to pay. It's important to factor this deductible into your healthcare budget. After meeting the deductible, you typically pay 20% of the Medicare-approved amount for most covered services. This cost-sharing aspect is important to understand when planning for your healthcare expenses.

Predicting future Medicare Part B premiums can be challenging, as they are subject to change based on various economic and healthcare factors. Regularly reviewing updates from the Centers for Medicare & Medicaid Services (CMS) can help you stay informed about potential cost adjustments. Several online resources and publications offer projections and analyses of Medicare costs, providing valuable insights for future planning.

One way to mitigate the impact of Medicare Part B costs is to explore supplemental insurance options, such as Medigap plans. These plans can help cover some of the out-of-pocket expenses, like copayments, coinsurance, and deductibles. Comparing different Medigap plans and understanding their coverage options is crucial for choosing the best plan for your needs.

Another strategy for managing Medicare Part B costs is to maintain a healthy lifestyle. Preventive care is covered under Part B, and taking advantage of these services can help prevent more costly medical issues down the line. This proactive approach can contribute to both your overall well-being and your long-term financial health.

Advantages and Disadvantages of Understanding Medicare Part B Costs

| Advantages | Disadvantages |

|---|---|

| Better Budgeting and Financial Planning | Can be Complex to Understand |

| Informed Decision-Making about Supplemental Coverage | Premium Increases Can Be Unpredictable |

Frequently Asked Questions:

1. What does Medicare Part B cover? (Answer: Doctor visits, outpatient care, preventive services, etc.)

2. How is the Part B premium calculated? (Answer: Based on income and adjusted annually.)

3. What is IRMAA? (Answer: Income-Related Monthly Adjustment Amount.)

4. How can I find out my specific Part B premium? (Answer: Contact Social Security or visit Medicare.gov)

5. What is the Part B deductible? (Answer: The amount you pay out-of-pocket before Medicare pays.)

6. Are there programs to help with Part B costs? (Answer: Yes, such as Medicaid and Medicare Savings Programs.)

7. How can I learn more about Medigap plans? (Answer: Contact your State Health Insurance Assistance Program (SHIP).)

8. Where can I find updates on Medicare Part B costs? (Answer: Centers for Medicare & Medicaid Services (CMS) website.)

In conclusion, understanding how much Medicare Part B will cost is a critical step in planning for your healthcare needs in retirement. While the costs can seem complex, taking the time to research and understand the various factors that influence pricing, exploring supplemental coverage options, and staying informed about updates and resources can empower you to manage your healthcare expenses effectively. Don't hesitate to reach out to resources like the Social Security Administration and SHIPs for personalized guidance. Planning for Medicare Part B costs is an investment in your future health and financial security. By taking proactive steps to understand and manage these costs, you can navigate the complexities of Medicare with confidence and ensure access to the essential healthcare services you need.

How Much Is Medicare Part B Going Down In 2024 - Trees By Bike

Medicare Part B Cost 2024 Deductible - Trees By Bike

Medicare Part B Cost Per Month 2024 Chart - Trees By Bike

How Much Is Medicare Cost In 2024 - Trees By Bike

Medicare Announces 2023 Medicare Cost - Trees By Bike

What Does Medicare Cost - Trees By Bike

How Much Does Medicare Part B Cost In 2024 - Trees By Bike

What Does Medicare Cost - Trees By Bike

Fica And Medicare Rates 2024 - Trees By Bike

How Much Does Medicare Part B Cost In 2024 - Trees By Bike

What Will Medicare Cost Me in 2023 - Trees By Bike

What Does Medicare Cost Me in 2022 - Trees By Bike