Ever felt lost in the labyrinth of university finances? Juggling tuition fees, accommodation costs, and daily expenses can be a real headache. One crucial tool for navigating this financial maze is the student account statement, or in Malay, "contoh salinan penyata akaun pelajar." This document provides a detailed breakdown of your university-related transactions, giving you a clear picture of your financial standing.

Think of your student account statement as a financial GPS. It helps you track your payments, outstanding balances, and any financial aid you've received. Whether you're applying for scholarships, managing your budget, or simply trying to understand where your money is going, a student account statement is an invaluable resource.

Understanding these statements is essential for effective financial management. This comprehensive guide will delve into the intricacies of student account statements, covering everything from their importance and benefits to how to obtain them and common issues you might encounter. We'll explore real-world examples and provide practical tips for maximizing their use.

The concept of a student account statement is relatively modern, evolving alongside the increasing complexity of higher education financing. As universities moved beyond simple tuition payments to incorporate various fees, accommodation costs, and financial aid packages, the need for a comprehensive record-keeping system arose. The student account statement emerged as a solution, providing a centralized platform for tracking all these transactions.

Today, student account statements play a pivotal role in the financial lives of students worldwide. They are not merely records of transactions but essential tools for budgeting, financial planning, and accessing further financial assistance. For instance, when applying for scholarships or loans, a clear and accurate statement serves as proof of your financial need and responsible financial behavior.

A "contoh salinan penyata akaun pelajar," or student account statement copy, provides a detailed summary of all financial transactions related to a student's education. This includes tuition fees, accommodation charges, library fines, and other miscellaneous expenses. It also reflects payments made, outstanding balances, and any financial aid received, such as scholarships or grants. A simple example would be a statement showing a debit for tuition fees and a credit for a scholarship payment, leaving a remaining balance due.

Utilizing your student account statement effectively offers several key advantages. Firstly, it empowers you to budget wisely. By understanding your income and expenses, you can create a realistic budget and track your spending. Secondly, it facilitates transparency and accountability. You can quickly identify any discrepancies or errors in your account and address them promptly. Thirdly, it simplifies financial planning. Knowing your financial obligations allows you to plan for future expenses and avoid potential financial difficulties.

Advantages and Disadvantages of Utilizing Student Account Statements

| Advantages | Disadvantages |

|---|---|

| Improved budgeting and financial planning. | Potential for errors or discrepancies. |

| Enhanced transparency and accountability. | Requires regular monitoring and attention. |

| Easier access to financial aid and scholarships. | May not capture all informal financial transactions. |

FAQ:

Q: How can I obtain my student account statement?

A: Most universities provide online access to student account statements through their student portals. You may also request a physical copy from the student finance office.

Q: What should I do if I notice an error on my statement?

A: Contact your university's student finance office immediately to report the discrepancy and request a correction.

Q: How often are student account statements updated?

A: This varies depending on the university, but statements are typically updated monthly or quarterly.

Q: Can I use my student account statement as proof of enrollment?

A: While not always sufficient, it can sometimes be used as supporting documentation. Contact the requesting party for specific requirements.

Q: What information is typically included on a student account statement example?

A: Usually, you'll find details like student ID, name, date, transaction descriptions, amounts, and outstanding balance.

Q: How does a student account statement differ from a bank statement?

A: A student account statement focuses solely on university-related transactions, while a bank statement reflects all transactions within your personal bank account.

Q: How can I use my student account statement for scholarship applications?

A: It can demonstrate your financial need and responsible financial management.

Q: Are student account statements confidential?

A: Yes, your student account statement contains sensitive financial information and is treated confidentially by the university.

In conclusion, the "contoh salinan penyata akaun pelajar," or student account statement, is a critical tool for navigating the financial landscape of higher education. It provides a detailed roadmap of your university-related expenses, empowering you to budget effectively, track your payments, and plan for future financial obligations. Understanding and utilizing this document effectively is crucial for achieving financial stability and success throughout your academic journey. Take the time to familiarize yourself with your student account statement, and don't hesitate to reach out to your university's student finance office if you have any questions or concerns. Proactive financial management is an investment in your future, ensuring a smoother and more successful educational experience.

Contoh Surat Permohonan Penyata Akaun Bsn Medical - Trees By Bike

Contoh Excel Laporan Kewangan Pibg Sekolah - Trees By Bike

Permohonan Statement Contoh Surat Permohonan Penyata Bank Cimb - Trees By Bike

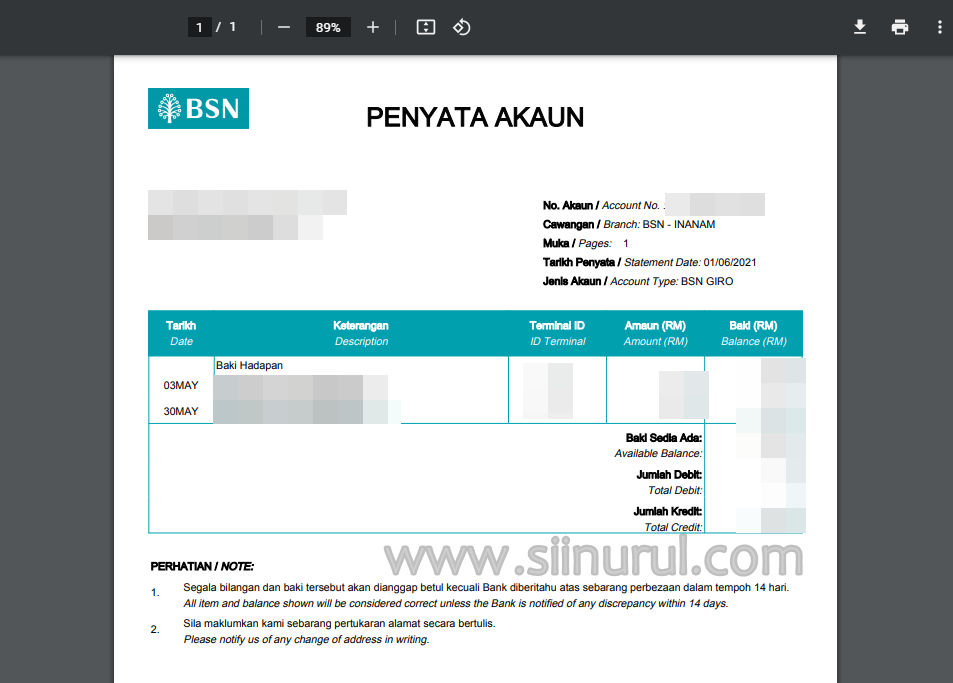

Contoh Penyata Akaun Bank Ruth Clark - Trees By Bike

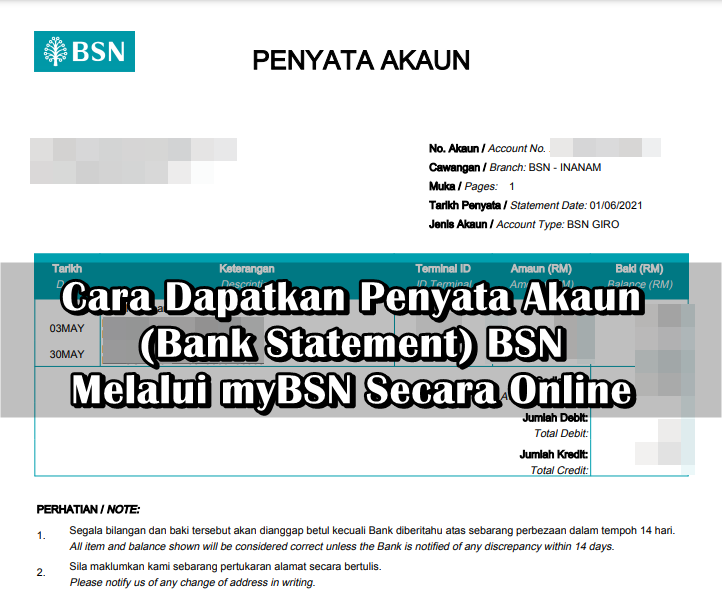

Cara Dapatkan Penyata Akaun Bank Statement BSN Melalui myBSN Secara - Trees By Bike

contoh salinan penyata akaun pelajar - Trees By Bike

Contoh Penyata Kewangan Pibg Sekolah - Trees By Bike

Contoh Penyata Kewangan Persatuan Penyata Kewangan Kelab Matematik - Trees By Bike

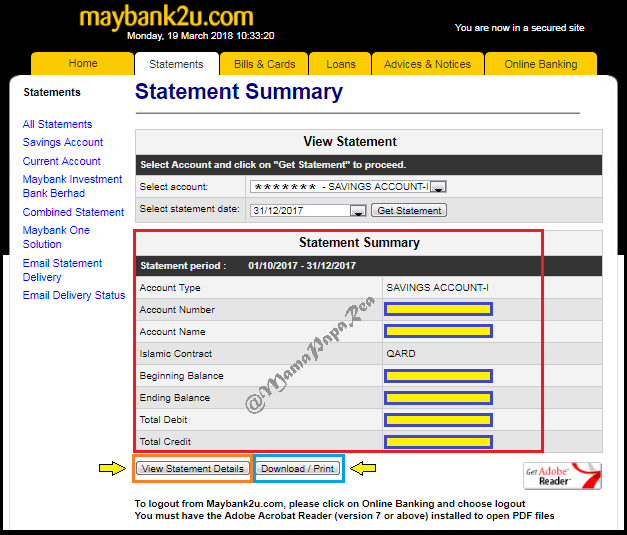

Contoh Statement Bank Maybank at Cermati - Trees By Bike

contoh salinan penyata akaun pelajar - Trees By Bike

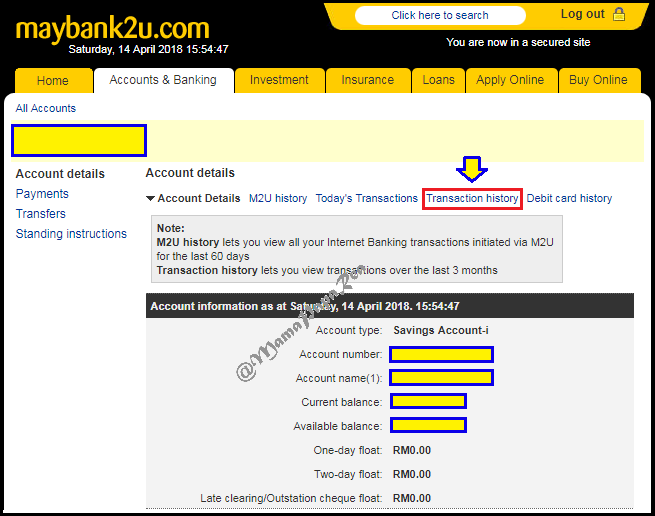

Cara Ambil Statement Bank Maybank2U - Trees By Bike

salinan akaun bank cimb - Trees By Bike

Salinan Akaun Bank Maybank - Trees By Bike

Contoh Penyata Kewangan Pdf - Trees By Bike

Contoh Salinan Akaun Bank Islam - Trees By Bike