Remember the last time you deposited a check? You probably flipped it over, scribbled your name, and maybe even saw a strange-looking stamp from your bank. That, my friend, is the often-overlooked but surprisingly important bank check endorsement stamp. In an age of instant digital transactions, it's easy to forget the humble paper check. But for many businesses and individuals, they remain a vital part of financial life. And wherever checks go, that endorsement stamp follows.

But what exactly is this stamp, and why should you care about it? Think of it as a secret handshake in the financial world, a way for banks to quickly and securely process your checks. It's a small detail that plays a big role in making sure your money ends up in the right place.

The history of the bank check endorsement stamp is closely tied to the development of banking itself. As paper checks became a common way to transfer funds, banks needed a secure and efficient way to verify and process them. The endorsement stamp emerged as a solution, allowing banks to quickly identify the depositing party and streamline the clearing process.

Fast forward to today, and the endorsement stamp remains a crucial part of check processing. It helps prevent fraud, ensures accountability, and keeps the wheels of commerce turning smoothly. While we increasingly live in a digital world, the bank check endorsement stamp reminds us that even the smallest details can have a big impact on the way we handle money.

In this digital age, understanding the nuances of seemingly old-fashioned banking tools like the bank check endorsement stamp can feel a bit like learning a forgotten language. But just like that dusty old book of poetry in your attic, it’s full of hidden gems and valuable lessons. So, let’s dust off the cobwebs and take a closer look at this unsung hero of the financial world, exploring its purpose, benefits, and how it fits into our modern financial lives.

Advantages and Disadvantages of Bank Check Endorsement Stamps

Like any tool, bank check endorsement stamps have their pros and cons:

| Advantages | Disadvantages |

|---|---|

|

|

Best Practices for Using Bank Check Endorsement Stamps

To get the most out of your endorsement stamp and keep your finances secure, consider these best practices:

- Secure Storage: Treat your stamp like a credit card—keep it in a safe place when not in use.

- Regular Inspections: Check your stamp for wear and tear. A faded stamp could lead to processing delays.

- Proper Ink: Use permanent, quick-drying ink designed for financial documents to prevent smudging or fading.

- Accurate Placement: Always stamp endorsements within the designated area on the back of the check.

- Employee Training: If your business uses endorsement stamps, ensure all employees handling checks are trained on proper usage and security protocols.

Common Questions and Answers About Bank Check Endorsement Stamps

Still have questions about endorsement stamps? We've got answers:

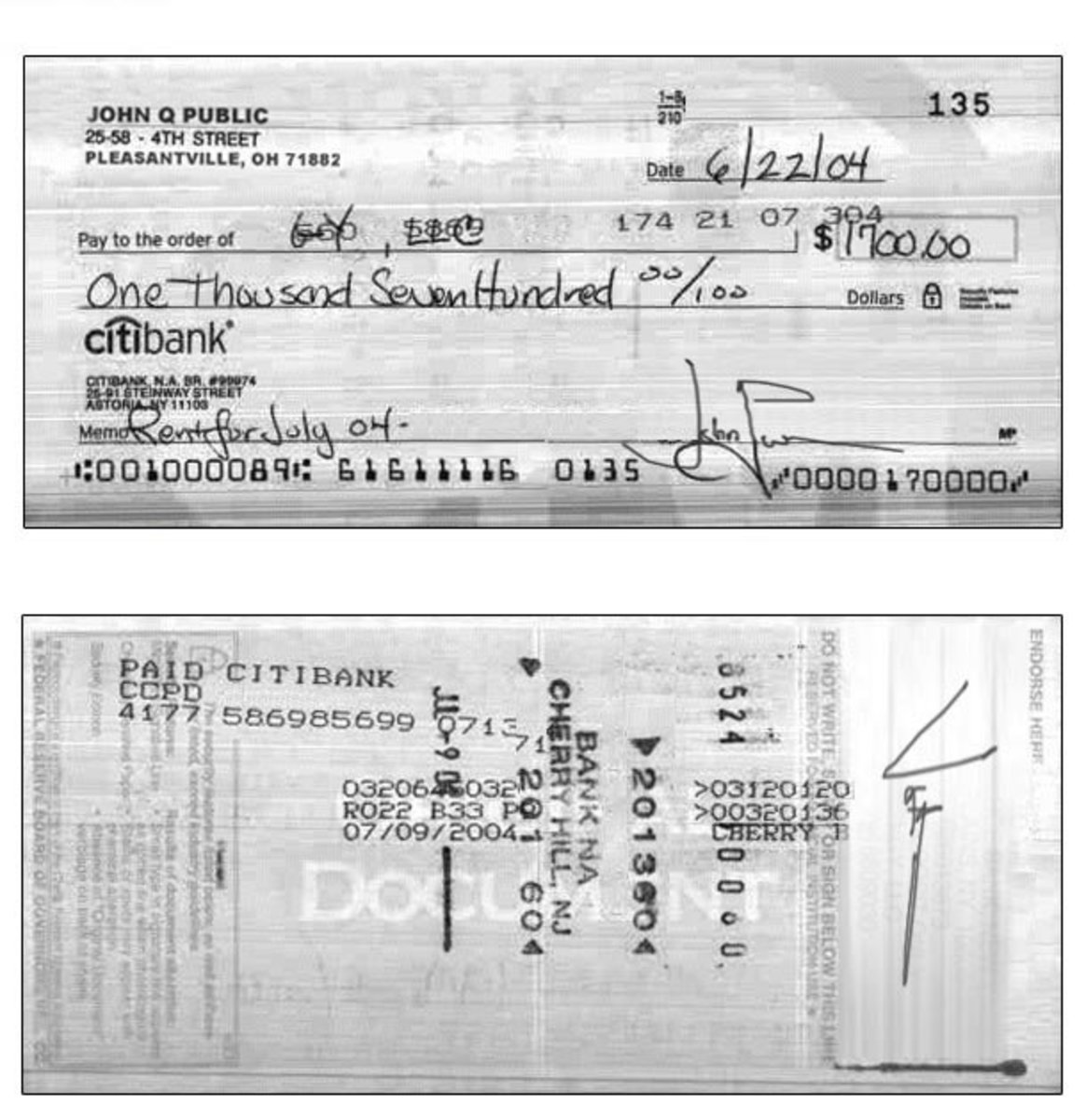

- Q: What information is typically included in an endorsement stamp?

A: It often includes the payee's name (your name or your business name), account number, and sometimes a pre-printed endorsement message like "For Deposit Only." - Q: Can I use a regular rubber stamp for endorsements?

A: While it's technically possible, it's not recommended. Banks prefer specialized endorsement stamps for security and clarity. - Q: What happens if my endorsement stamp is lost or stolen?

A: Report it to your bank immediately to prevent fraudulent use. They will likely cancel any associated accounts or issue you a new one. - Q: Do I need a separate endorsement stamp for each of my bank accounts?

A: Yes, it's generally recommended to use a unique stamp for each account to prevent confusion and ensure accurate processing. - Q: Can I get an endorsement stamp from my bank?

A: Many banks provide endorsement stamps to their business customers. Contact your bank to inquire about their specific policies and requirements. - Q: What is a restrictive endorsement stamp?

A: It's a type of endorsement that places specific limitations on how the check can be used. For example, "For Deposit Only" restricts the check to being deposited into an account and not cashed. - Q: What is a mobile endorsement?

A: It's a digital alternative to physical endorsement stamps, often used for remote check deposits via mobile apps. - Q: Are endorsement stamps still necessary in the age of mobile banking?

A: While their use is declining, they remain relevant, especially for businesses that handle a significant volume of paper checks. However, digital alternatives like mobile endorsements are becoming increasingly popular.

Tips and Tricks for Using Bank Check Endorsement Stamps

- Test Your Stamp: Before using a new stamp, test it on a scrap piece of paper to ensure the ink flow and clarity are good.

- Keep It Clean: Regularly clean your stamp with a damp cloth to remove any ink buildup that could affect the quality of the impression.

- Consider a Dual-Sided Stamp: Some stamps allow you to endorse and date checks simultaneously, streamlining the process.

In the intricate world of finance, even the smallest details can make a significant difference. The bank check endorsement stamp, though often overlooked, plays a vital role in ensuring the secure and efficient processing of checks. By understanding its history, purpose, and best practices for use, you can navigate the world of paper transactions with confidence, knowing that your finances are in safe hands. As we move toward an increasingly digital future, it's essential to remember that the lessons learned from these traditional tools remain relevant, reminding us that security, accuracy, and efficiency are timeless principles in the ever-evolving landscape of finance. So, the next time you reach for that seemingly insignificant stamp, remember that you're participating in a long legacy of financial innovation, one check at a time.

bank check endorsement stamp - Trees By Bike

How to Endorse a Check - Trees By Bike

Check Endorsement Bank Deposit Stamp - Trees By Bike

Deposit Stamp For Deposit Only Stamp Endorsement Stamp Bank - Trees By Bike

Manual Personal Checks, Personal Checks, Manual Checks, Wallet Checks - Trees By Bike

Sample Cheque Writing at Kerry Cruz blog - Trees By Bike

bank check endorsement stamp - Trees By Bike

bank check endorsement stamp - Trees By Bike

bank check endorsement stamp - Trees By Bike

For Deposit Only Stamp - Trees By Bike

23.1: Los bancos y sus clientes - Trees By Bike

bank check endorsement stamp - Trees By Bike

Chase Bank Endorsement Stamp Ten Mind Numbing Facts About Chase Bank - Trees By Bike

Endorsement Stamps: Endorsement Stamp, Checks, Personal Checks, Order - Trees By Bike

Bank Of America Check Endorsement Pictures to Pin on - Trees By Bike

/back-of-check-endorsed2-57a350e95f9b589aa907ed7e.jpg)