Navigating the world of salaries can feel like deciphering a secret code. You receive a job offer with what seems like an impressive figure, only to find out the amount hitting your bank account is noticeably lower. This, my friend, is the difference between your gross salary and your net salary. Understanding this difference is crucial for managing your finances effectively and avoiding any unwelcome surprises.

Imagine this: You land your dream job with a salary that promises a life of comfort and luxury. You envision designer bags, exotic vacations, and maybe even that vintage car you've always dreamed of. But hold on! Before you start planning your lavish spending sprees, there's a crucial detail you need to understand: the difference between your gross salary and your net salary. Your gross salary is like the initial spark of excitement, while your net salary is the grounded reality of what you actually take home.

Your gross salary is the total amount you earn before any deductions. It's that dazzling figure that catches your eye on the job offer. However, this amount is not what you actually get to spend. Before your salary reaches your bank account, various deductions take a bite out of it, like hungry little birds nibbling on breadcrumbs. These deductions can include taxes, social security contributions, health insurance premiums, and retirement plan contributions, to name a few.

Now, let's talk about the star of the show: your net salary. This is the actual amount of money you receive in your bank account after all those deductions have taken their share. It's the figure that truly matters when it comes to budgeting, planning your finances, and understanding your actual purchasing power. Think of it as your salary after it has gone through a financial filter.

Understanding the difference between gross and net salary is not just about knowing how your paycheck is calculated. It's about taking control of your financial well-being. It allows you to budget realistically, make informed financial decisions, and avoid any surprises when you check your bank balance. After all, who wants to live in a constant state of financial uncertainty?

Knowing how to calculate your net salary empowers you to plan your finances realistically. You can set a budget that aligns with your actual take-home pay, ensuring you have enough to cover your expenses and achieve your financial goals. It's about taking the reins of your financial journey and steering it in the direction you want to go.

Advantages and Disadvantages of Understanding Gross vs Net Salary

| Advantages | Disadvantages |

|---|---|

| Accurate budgeting and financial planning. | May initially be disheartening to see deductions. |

| Informed financial decision-making. | Requires understanding of tax and deduction systems. |

| Avoidance of financial surprises. | - |

Understanding the difference between your gross and net salary is essential for anyone who earns a paycheck. It's about taking control of your financial well-being and making informed decisions about your money. By understanding these concepts, you can budget realistically, plan for the future, and ensure that your hard-earned money is working as hard for you as you are for it.

Contoh Data Penduduk Rt Excel - Trees By Bike

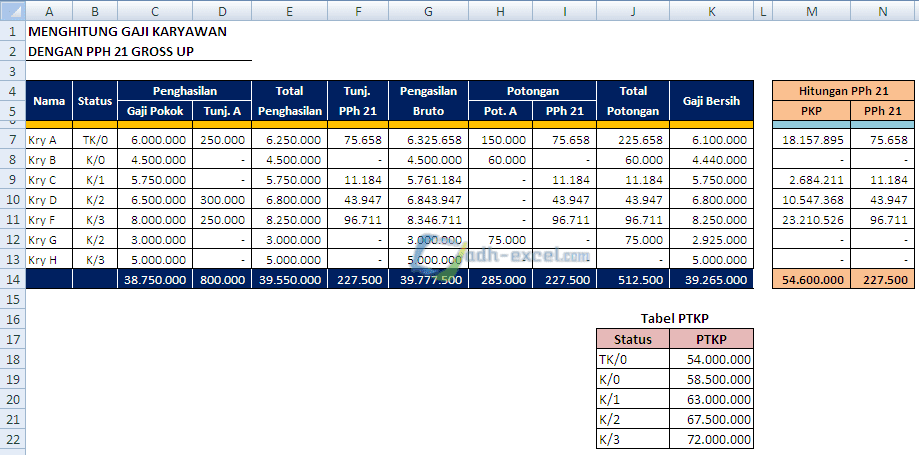

cara menghitung gaji netto dari gross - Trees By Bike

cara menghitung gaji netto dari gross - Trees By Bike

cara menghitung gaji netto dari gross - Trees By Bike

cara menghitung gaji netto dari gross - Trees By Bike

Contoh Pengisian Spt Tahunan Pph Wajib Pajak Orang Pribadi 1770ss - Trees By Bike

Pengukuran Pendapatan Nasional.docx - Trees By Bike

cara menghitung gaji netto dari gross - Trees By Bike

cara menghitung gaji netto dari gross - Trees By Bike

cara menghitung gaji netto dari gross - Trees By Bike

cara menghitung gaji netto dari gross - Trees By Bike

cara menghitung gaji netto dari gross - Trees By Bike

cara menghitung gaji netto dari gross - Trees By Bike

Perhitungan Penghasilan Neto Karyawan - Trees By Bike

cara menghitung gaji netto dari gross - Trees By Bike