Planning a trip abroad? That familiar flutter of excitement for new experiences is likely accompanied by a list of practicalities. One of the first on your mind might be: how do I get foreign currency? While the world seems increasingly digital, the need to exchange your dollars for euros, yen, or pesos remains a travel essential. But with the rise of online currency exchange services and airport kiosks, you might be wondering: do banks still exchange foreign currency?

The short answer is yes, most banks still offer foreign currency exchange services. This service is a holdover from a time before the ease of online transactions and globalized banking, a time when travelers relied heavily on their local banks for all their foreign currency needs.

However, the landscape of currency exchange has become more diverse. While banks remain a viable option, they're no longer the only player in the game. This leaves travelers with a choice, and as with any financial decision, it's essential to be informed. Understanding the nuances of exchanging currency at a bank versus exploring alternatives can save you time, money, and unnecessary hassle on your journey.

Before the age of credit cards and digital payments, exchanging currency at a bank was practically a non-negotiable step in international travel preparations. This system was straightforward: you visited your local bank, requested the desired currency, paid a fee, and received your foreign banknotes. Banks, having pre-existing infrastructure for handling foreign currencies, were the natural choice.

While this traditional method persists, its dominance has been challenged by the emergence of online currency exchange services, currency exchange bureaus in airports and tourist areas, and even the option to withdraw local currency directly from ATMs abroad. This shift prompts an important question: in our increasingly digital and interconnected world, why do banks still exchange foreign currency?

Banks continue to offer currency exchange for several reasons. Firstly, it remains a significant service for some demographics, particularly those less comfortable with online transactions or who prefer the personalized service of a bank. Secondly, it provides banks with an additional revenue stream through exchange rate markups and fees. Finally, offering currency exchange allows banks to maintain a comprehensive suite of financial services, catering to a wider customer base.

However, the convenience of exchanging currency at a bank often comes at a price. Banks, especially larger institutions, are known for offering less favorable exchange rates compared to other options. Additionally, they might charge transaction fees or require a minimum exchange amount, potentially cutting into your travel budget.

Advantages and Disadvantages of Exchanging Currency at Banks

To help you navigate this aspect of your travel planning, let's delve into the advantages and disadvantages of exchanging currency at banks:

| Advantages | Disadvantages |

|---|---|

| Familiar and trusted institution | Often less favorable exchange rates compared to other options |

| Personalized service and advice from bank staff | May charge transaction fees or require minimum exchange amounts |

| Convenient for existing bank customers | Limited hours of operation compared to online services or airport kiosks |

As you weigh your options, remember that knowledge is your best ally in securing the most advantageous exchange rates. By understanding the evolving landscape of currency exchange and considering all available avenues, you can make informed financial decisions that maximize your travel budget.

Where Should You Exchange Foreign Currency? - Trees By Bike

Does Chase Bank Exchange Foreign Currency? Chase Bank Exchange Rates - Trees By Bike

do banks still exchange foreign currency - Trees By Bike

do banks still exchange foreign currency - Trees By Bike

Who sets the euro exchange rate? - Trees By Bike

Coin Counting Machines Still Exist: Which Banks Have Them? - Trees By Bike

Yelian Garcia on Global Central Banks & the Decline in Foreign Exchange - Trees By Bike

US Dollar Share of Global Foreign Exchange Reserves Drops to 25 - Trees By Bike

Where can I exchange foreign currency in South Africa safely? - Trees By Bike

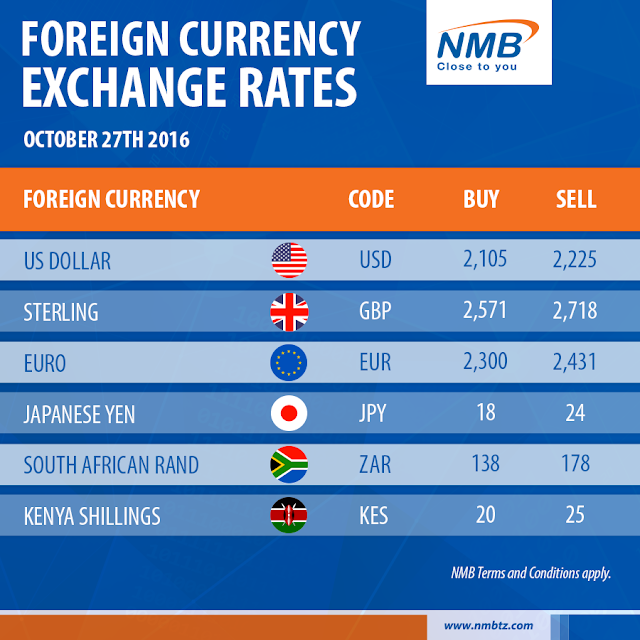

Bank of tanzania foreign currency exchange rates and with it online - Trees By Bike

Iraq to regulate foreign trade from China in Yuan - Trees By Bike

The Fundamental Importance of Foreign Currency Exchange - Trees By Bike

Do banks still exchange foreign currency? (2024) - Trees By Bike

Understanding How Central Banks Manage Foreign Exchange Reserves - Trees By Bike

a green and red line with numbers on it in the shape of an upward arrow - Trees By Bike

:max_bytes(150000):strip_icc()/what-are-exchange-rates-3306083_FINAL-ad4aa801c7ff4b52810c734d345dc401.png)