Imagine this: you've received a check, but it's made out to someone else. Can you still cash it or deposit it into your Chase account? This is the heart of the matter when we talk about third-party endorsed checks. It's a common scenario, and understanding the ins and outs of how banks handle these checks is crucial for managing your finances effectively.

Dealing with third-party checks can seem like navigating a financial maze. There's a mix of banking policies, security concerns, and potential risks involved. In this article, we'll demystify the process, specifically focusing on whether Chase, one of the largest financial institutions in the US, accepts these checks. We'll equip you with the knowledge to make informed decisions when handling such situations.

Third-party checks, also known as two-party checks, come into play when the original payee, the person or entity to whom the check is initially written, signs it over to a different individual or business. This transfer of ownership adds a layer of complexity to the transaction. Banks, including Chase, have policies in place to mitigate potential fraud and ensure the security of their customers' funds when dealing with these checks.

The question of whether Chase accepts third-party endorsed checks isn't a simple yes or no. It depends on various factors, and the bank's approach is rooted in minimizing risk. While Chase's official stance might lean towards caution, there are nuances and exceptions to be aware of. Understanding these intricacies is essential to avoid surprises and ensure your financial transactions run smoothly.

Navigating the world of third-party checks can be tricky. You might find yourself facing questions like: What are the specific policies of different banks? What are the risks involved? Are there alternative methods to consider? By the end of this article, you'll have a clear understanding of Chase's position on these checks and be better prepared to handle your finances effectively.

Advantages and Disadvantages of Third-Party Checks

While not directly related to whether Chase accepts them, understanding the pros and cons of third-party checks is essential:

| Advantages | Disadvantages |

|---|---|

| Convenient way to transfer funds | Increased risk of fraud |

| Useful in specific situations (e.g., paying debts on someone's behalf) | May be subject to delays in processing |

| Can be a temporary solution when other payment methods aren't available | Not all banks accept them, or there might be restrictions |

Common Questions and Answers

Let's tackle some frequently asked questions surrounding Chase and third-party endorsed checks:

1. Does Chase accept third-party checks at all?

Chase is generally cautious about accepting third-party checks due to security concerns. They might have specific restrictions or require additional verification.

2. What are the risks involved with third-party checks?

The main risks include potential fraud, such as forged signatures or altered checks. It's crucial to trust the source of the check.

3. Are there alternatives to using third-party checks with Chase?

Yes, consider options like mobile check deposits, wire transfers, or online payment platforms like PayPal or Venmo.

4. Can I deposit a third-party check into my Chase online account?

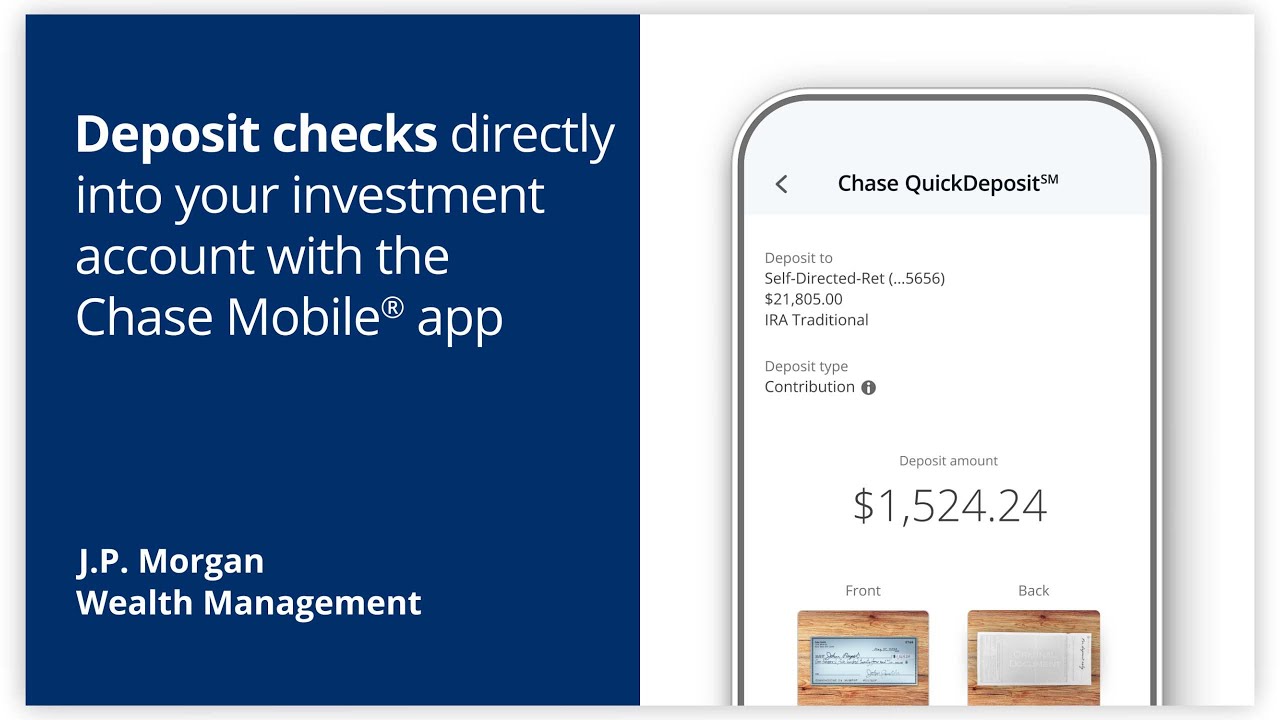

Chase's mobile app allows you to deposit checks, including some third-party checks. However, there might be limitations on the amount or type of check.

5. What should I do if I need to deposit a third-party check with Chase?

It's best to contact Chase directly or visit a branch to inquire about their current policies and procedures.

6. What information do I need when depositing a third-party check?

Be prepared to provide your account information, the payee's details, and endorse the check with your signature and account number.

7. How long does it take for a third-party check to clear with Chase?

The clearing time for third-party checks can vary but might take longer than regular checks due to additional verification processes.

8. What happens if there's an issue with a third-party check I deposited with Chase?

Contact Chase immediately if you suspect fraud or encounter problems. They can guide you through the necessary steps.

Tips and Tricks

Here are some handy tips when dealing with potential third-party check situations with Chase:

- Communication is key: Always reach out to Chase directly to confirm their current policies and any specific requirements.

- Explore alternatives: Consider other payment methods like mobile check deposits or online platforms whenever possible.

- Prioritize security: Be cautious about accepting third-party checks from unfamiliar sources to minimize the risk of fraud.

In conclusion, the question of "Does Chase accept third-party endorsed checks?" doesn't have a one-size-fits-all answer. Chase, like other financial institutions, prioritizes security and might have specific restrictions or requirements for these types of checks. It's always best to communicate with Chase directly, explore alternative payment options if possible, and exercise caution to ensure a smooth and secure financial transaction. Remember, staying informed about your bank's policies and understanding the nuances of third-party checks empowers you to make well-informed financial decisions.

How to Deposit Checks on Chase App in 2023 (By ex - Trees By Bike

How to Endorse Chase Bank Mobile Deposit? - Trees By Bike

Chase Bank Name And Address (How To Receive Direct, 50% OFF - Trees By Bike

4 manières de endosser un chèque bancaire - Trees By Bike

23.1: Los bancos y sus clientes - Trees By Bike

How To Endorse and Write Checks to Multiple People - Trees By Bike

Everything You Need to Know About Cashing a Third Party Check - Trees By Bike

Does Walmart Accept Endorsed Checks? - Trees By Bike

Can an employer take back a bonus if you quit? Leia aqui: Can an - Trees By Bike

does chase accept third party endorsed checks - Trees By Bike

How to Cash a Two Party Check Without the Other Person? - Trees By Bike

Depositing Check With Someone Else's Name On It Hot Sale - Trees By Bike

Techchecks: How the Federal Reserve Check Clearinghouse Operates - Trees By Bike

How to Endorse a Check to Someone Else - Trees By Bike

Does Chime Accept Third - Trees By Bike

:max_bytes(150000):strip_icc()/endorse-checks-payable-to-multiple-people-315299-v2-5bbdffc846e0fb0026eccaf4.png)

:max_bytes(150000):strip_icc()/instructions-and-problems-with-signing-a-check-over-315318-final-a7d51331576c42a6ab3cac0eb683901d.jpg)