We’ve all been there. You’re sorting through the mail, and amidst the bills and flyers, you find a pleasant surprise—a check! Maybe it’s a birthday gift from your great aunt, or perhaps it’s a refund you’d forgotten about. You’re ready to deposit it and treat yourself to something nice. But then you notice something: there’s already an endorsement on the back, and it’s not yours. Can you still deposit it, or is this check destined for the recycling bin?

The good news is that in many cases, checks with more than one endorsement, sometimes called “double endorsed checks,” are perfectly acceptable. However, banks can have different policies about these types of checks, and it’s important to understand the rules to avoid any hiccups with your deposit.

So, what about Chase Bank? Do they accept double endorsed checks? In short, while Chase Bank doesn't outright prohibit double endorsed checks, they generally discourage the practice due to the potential for fraud and increased risk. This stance is pretty common among many banks and financial institutions.

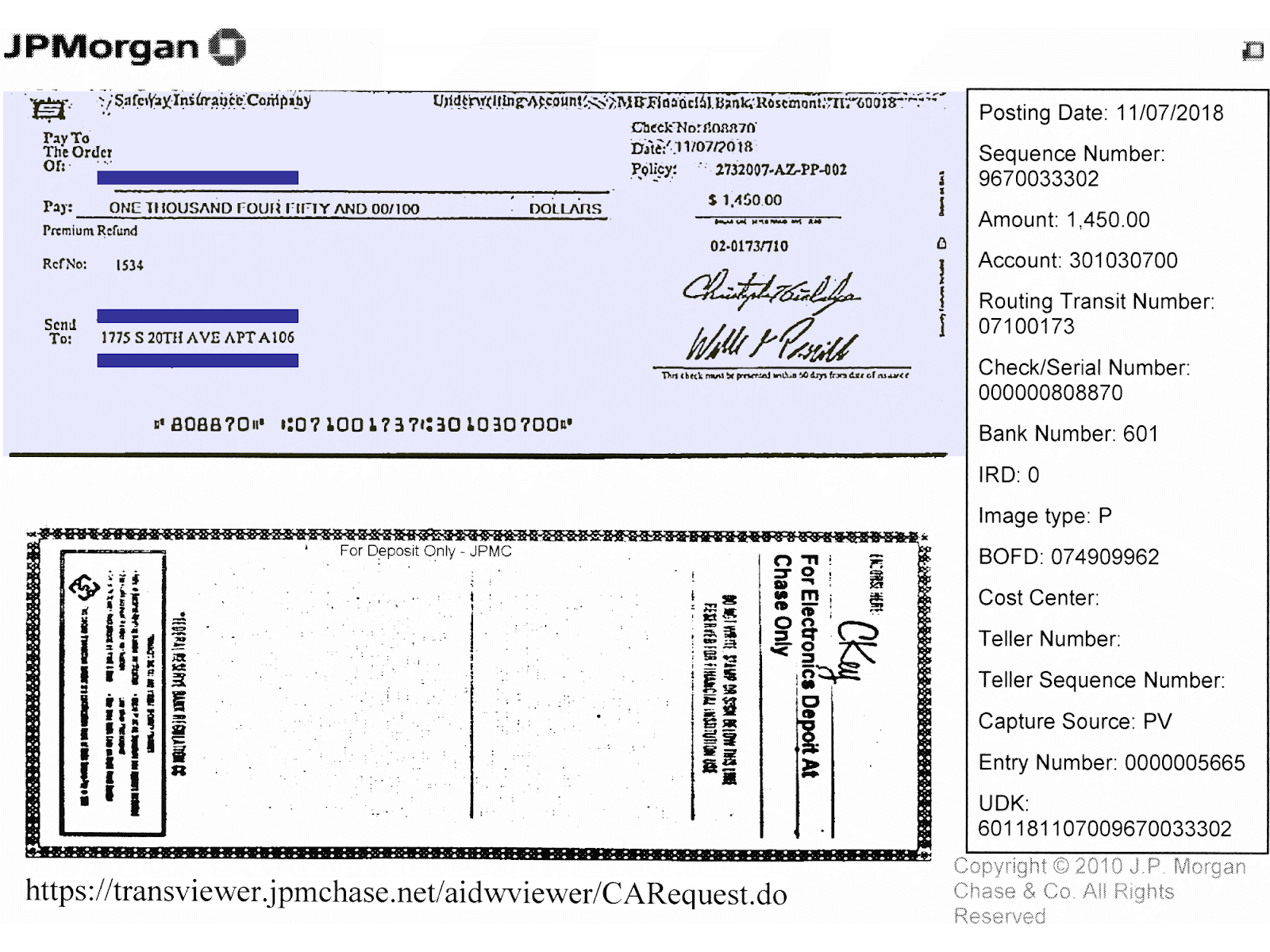

Understanding why banks are often hesitant about double endorsements requires a little background on how checks work. Essentially, endorsing a check is a way of transferring ownership. The first endorsement, signed by the original recipient (the payee), confirms they’ve received the funds. A second endorsement might indicate the payee is signing the check over to someone else. While this might seem straightforward, it adds complexity that can give banks pause.

The main concern for banks is the potential for fraud. With multiple endorsements, it becomes more difficult to verify the legitimacy of the check and the identities of everyone involved. This increased risk is why banks like Chase prefer to handle checks with a single endorsement.

While Chase Bank may be cautious about double endorsed checks, that doesn’t necessarily mean you’re out of luck if you have one. Here are a few tips for navigating this situation:

1. Contact Chase Directly: The best way to know for sure if your local Chase branch will accept your double endorsed check is to reach out to them directly. You can call the number on the back of your debit card or visit the branch in person.

2. Consider Alternative Deposit Methods: If you’re unable to deposit the check in person, you can try depositing it using the Chase mobile app. However, keep in mind that the app may have restrictions on double endorsed checks.

3. Request a New Check: If possible, the simplest solution might be to request a new check directly from the issuer. Explain the situation, and they may be willing to issue a replacement check without the extra endorsement.

In the world of digital transactions, checks might feel like a relic of the past. However, understanding how endorsements work and your bank's policies surrounding them is still essential. While double endorsed checks might be accepted in some cases, it's always best to err on the side of caution and contact your bank for clarification.

What is chase bank address for international wire transfer - Trees By Bike

How to Sign a Check Over to Somebody Else - Trees By Bike

does chase bank accept double endorsed checks - Trees By Bike

Endorsed A Check With A Different Name And Deposited It Flash Sales - Trees By Bike

Why Check Cashers in MD Will Not Accept a Pre - Trees By Bike

Chase Cashier Check Template - Trees By Bike

How To Write A Chase Check (8 Easy Steps) - Trees By Bike

cashiers check from chase @ Open aderall capsul in pour in water then - Trees By Bike

Exploring The Convenience Of Travelers Checks Issued By Chase Bank - Trees By Bike

does chase bank accept double endorsed checks - Trees By Bike

does chase bank accept double endorsed checks - Trees By Bike

does chase bank accept double endorsed checks - Trees By Bike

How To Endorse A Check - Trees By Bike

23.1: Los bancos y sus clientes - Trees By Bike

Everything You Need to Know About Cashing a Third Party Check - Trees By Bike

/instructions-and-problems-with-signing-a-check-over-315318-final-a7d51331576c42a6ab3cac0eb683901d.jpg)