Life, as we know, rarely goes according to plan. One minute you're cruising along, the next you're hit with a major change – a new job, a new baby, maybe even a new country (lucky you!). These big shake-ups aren't just life events, they're often "qualifying life events" – and understanding what that means for your health insurance can save you a world of headache (and potentially, a ton of money).

You've probably heard whispers of this mythical "30-day rule," but what does it actually mean? Simply put, the qualifying life event 30-day rule is a safety net. It gives you a special enrollment period to change your health insurance plan outside of the usual yearly open enrollment period. This means if you experience a major life change, you're not stuck with an unsuitable health plan.

This rule is especially crucial for those living a less conventional life. Think about it – changing jobs could mean losing employer-sponsored health insurance. Moving states? Your current plan might not even cover you in your new zip code. And don't even get me started on the insurance joys of international travel or expat life! Knowing when and how to leverage the qualifying life event 30-day rule is key to staying healthy and financially secure on your adventures.

But here's the catch – this rule is surrounded by a surprising amount of confusion. Not all life events qualify, and the clock starts ticking sooner than you might think. Plus, the specific rules and regulations can vary depending on where you live and what type of health insurance you have.

That's why we're diving deep into the ins and outs of the qualifying life event 30-day rule. We'll demystify the jargon, explore common qualifying events, and give you a clear roadmap for navigating this often-overlooked aspect of health insurance. So buckle up, grab your metaphorical passport, and let's get you prepared for whatever life throws your way.

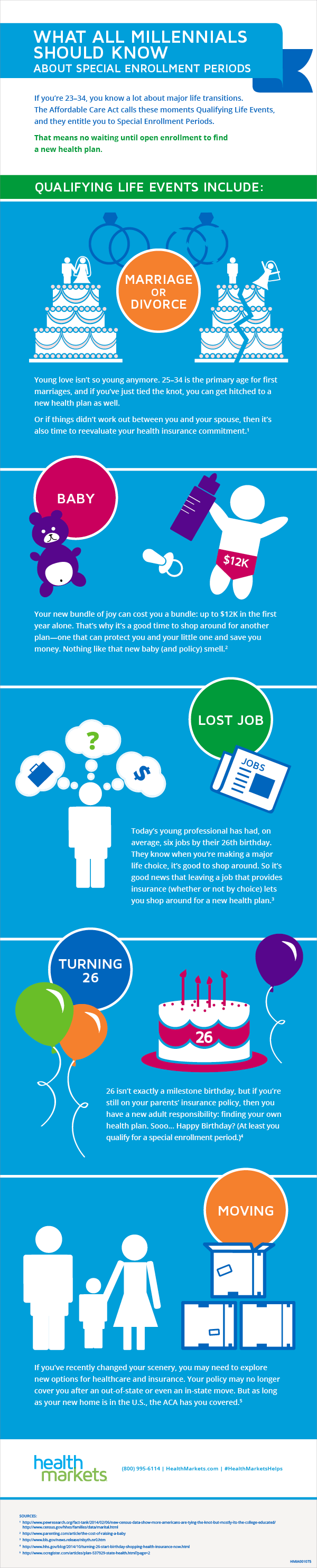

Let's start with the basics. What exactly counts as a "qualifying life event"? Think of it as any major change in your life that could impact your need for health insurance. Some common examples include:

- Losing your job-based health coverage (whether voluntary or involuntary)

- Getting married or entering into a domestic partnership

- Having a baby, adopting a child, or placing a child for foster care

- Moving permanently to a new coverage area or state

- Turning 26 and aging out of a parent's health plan

Now, the million-dollar question: How do you make this rule work for you? It's all about timing. Once a qualifying life event occurs, you have a 60-day window to enroll in a new health insurance plan or make changes to your existing one. This is called your Special Enrollment Period (SEP). Miss this window, and you might be stuck with your current plan until the next open enrollment period, which typically happens once a year.

The moral of the story? Don't wait! The moment you know a qualifying life event is on the horizon, start researching your health insurance options. Understanding your rights and options is the first step to navigating the sometimes-confusing world of health insurance and ensuring you're always covered, no matter where life takes you.

qualifying life event 30 day rule - Trees By Bike

Fillable Online Proof of qualifying life event form Fax Email Print - Trees By Bike

qualifying life event 30 day rule - Trees By Bike

The Amazing Truth About Qualifying Life Events for Millennials - Trees By Bike

Qualifying Life Events for Insurance: 2024 Guide - Trees By Bike

Qualifying Life Events Health Insurance South Dakota - Trees By Bike

What You Need to Know for Open Enrollment 2022 - Trees By Bike

Moving is a qualifying life event that allows you to get health - Trees By Bike

What Is a Qualifying Life Event? - Trees By Bike

Updating your benefits through a qualifying status change (life event) - Trees By Bike

What is a TRICARE Qualifying Life Event? > Air Force Wounded Warrior - Trees By Bike

What is a qualifying life event for health insurance? - Trees By Bike

Qualifying Life Events and the Impact on Health Insurance - Trees By Bike

What is a qualifying life event? - Trees By Bike

qualifying life event 30 day rule - Trees By Bike

/what-is-a-qualifying-event-for-health-insurance-4174114_4-54f1444bbef84c2aa79485ceffd1cee7.png)