In today's fast-paced world, efficient financial management is paramount. The rise of digital banking has transformed how we interact with our finances, and a Bank of America online checking account stands as a prominent example of this evolution. Imagine effortlessly managing your funds, paying bills, and tracking transactions from the convenience of your laptop or smartphone. This is the promise of online banking.

A Bank of America online checking account provides a digital gateway to your finances, offering a suite of tools and services to streamline your financial life. From real-time balance checks to mobile check deposits, the platform empowers users with control and accessibility. But beyond the basic functionalities, what makes an online checking account with Bank of America a compelling choice in the modern financial landscape?

The advent of online banking with institutions like Bank of America signifies a shift away from traditional brick-and-mortar banking. It reflects a growing demand for convenient, accessible, and digitally-driven financial solutions. The ability to manage your finances anytime, anywhere, has become less of a luxury and more of a necessity for many.

Bank of America's online checking account platform has evolved over time, incorporating new technologies and features to enhance the user experience. From basic online balance inquiries to sophisticated mobile banking apps, the platform has adapted to the changing needs of its users. Security measures have also been continuously strengthened to protect user data and funds in the digital realm.

A central concern for many considering online banking is security. Bank of America addresses this concern through multi-factor authentication, encryption technologies, and fraud monitoring systems. These measures are designed to safeguard user accounts and transactions against unauthorized access and fraudulent activities.

The history of online banking at Bank of America parallels the broader evolution of online banking itself. Early online banking platforms offered limited functionalities, primarily focusing on balance inquiries and basic transactions. As technology advanced, so did the capabilities of these platforms, incorporating features like bill pay, fund transfers, and mobile check deposits. Bank of America played a significant role in shaping this evolution, consistently innovating and expanding its online banking services.

One of the primary benefits of a Bank of America online checking account is its 24/7 accessibility. You can access your account information and perform transactions anytime, anywhere, eliminating the need to visit a physical branch during limited business hours.

Another advantage is the convenience of online bill pay. You can schedule payments, set up recurring transactions, and manage your bills electronically, saving time and reducing the risk of late payment fees.

Mobile banking is an integral part of the Bank of America online checking account experience. The mobile app allows you to deposit checks, transfer funds, pay bills, and monitor your account activity from your smartphone or tablet.

To open a Bank of America online checking account, you'll generally need to provide personal information, such as your name, address, Social Security number, and date of birth. You'll also need to choose an account type and make an initial deposit.

Advantages and Disadvantages of a Bank of America Online Checking Account

| Advantages | Disadvantages |

|---|---|

| 24/7 Account Access | Limited In-Person Support |

| Convenient Bill Pay | Potential Security Risks (if proper precautions aren't taken) |

| Mobile Banking Capabilities | Technical Difficulties/Outages |

Five Best Practices for using a Bank of America online checking account:

1. Regularly monitor your account activity for unauthorized transactions.

2. Use strong, unique passwords and enable multi-factor authentication.

3. Keep your software and operating systems up to date to protect against vulnerabilities.

4. Avoid accessing your account on public Wi-Fi networks.

5. Be cautious of phishing scams and never share your login credentials with anyone.

Frequently Asked Questions:

1. How do I open a Bank of America online checking account? (Answer: Visit the Bank of America website or mobile app to begin the application process.)

2. What are the fees associated with a Bank of America online checking account? (Answer: Fee information can be found on the Bank of America website.)

3. How do I deposit checks into my online checking account? (Answer: You can use the mobile app to deposit checks remotely or visit a physical ATM or branch.)

4. Can I transfer funds between my Bank of America accounts online? (Answer: Yes, you can easily transfer funds between linked accounts through the online platform or mobile app.)

5. What should I do if I suspect fraudulent activity on my account? (Answer: Contact Bank of America immediately to report the suspected fraud.)

6. Is mobile banking secure? (Answer: Bank of America employs security measures to protect mobile banking transactions.)

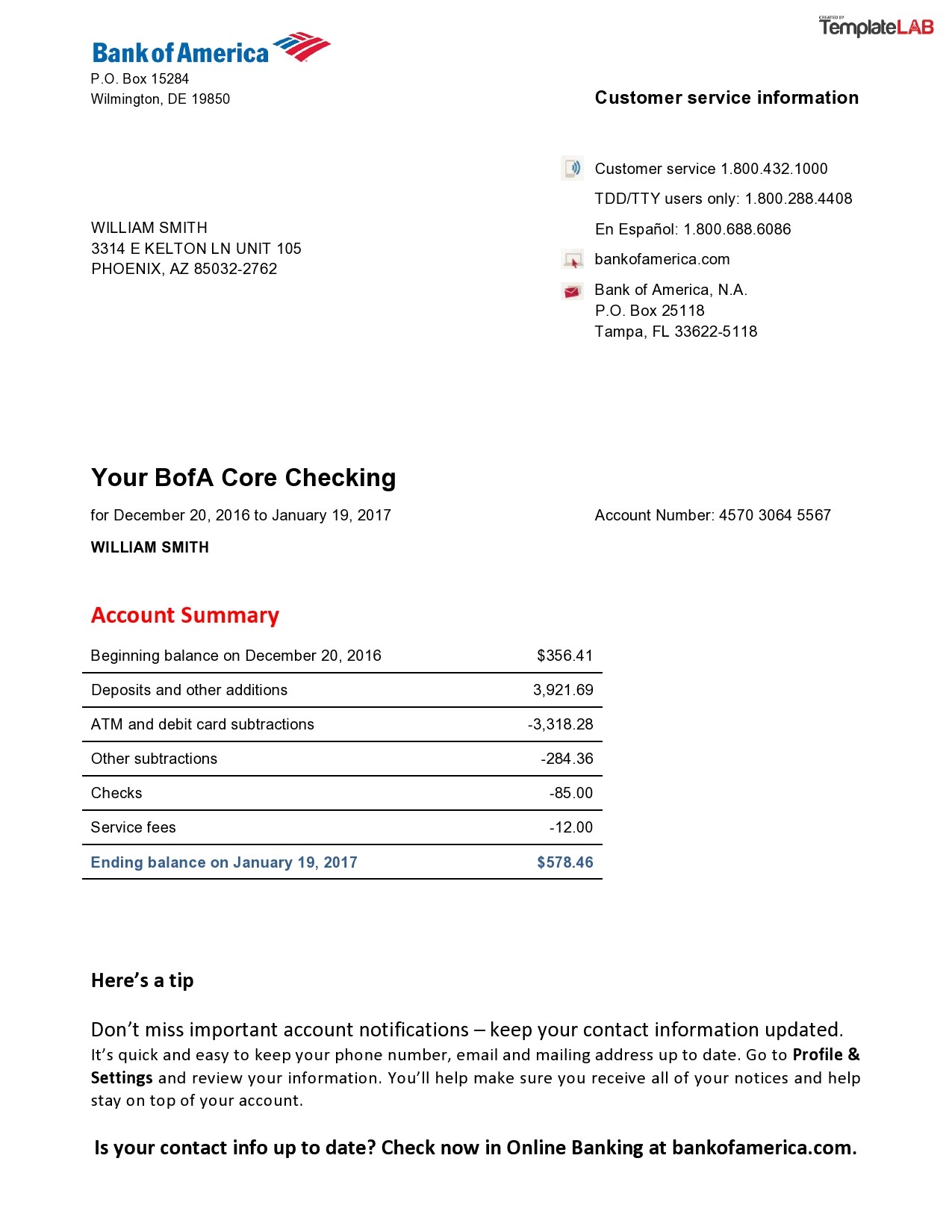

7. Can I access my account statements online? (Answer: Yes, you can view and download your account statements through the online platform.)

8. Are there any transaction limits for online banking? (Answer: Specific transaction limits may apply and can be found on the Bank of America website.)

In conclusion, a Bank of America online checking account offers a powerful and convenient way to manage your finances in today's digital age. From 24/7 account access to mobile banking capabilities, the platform provides a suite of tools to streamline your financial life. While it's important to be aware of potential security risks and take necessary precautions, the benefits of online banking, including convenience, accessibility, and control, make it a compelling choice for those seeking efficient financial management. Embracing online banking can empower you to take control of your financial well-being and navigate the modern financial landscape with ease and confidence. Explore the possibilities and experience the future of banking with a Bank of America online checking account.

Bank Statement Bank America Template - Trees By Bike

online bank checking account bank of america - Trees By Bike

What Is The Purpose Of A Business Checking Account at Wanda King blog - Trees By Bike

Will Bank Of America Cash My Check If I Dont Have An Account at Arthur - Trees By Bike

Can I Have More Than 1 Checking Account at Arlette Smith blog - Trees By Bike

Where do I find my routing number - Trees By Bike

What Time Does Bank Of America Call Center Open at Steven Graham blog - Trees By Bike

online bank checking account bank of america - Trees By Bike

Bank of America Bank Statement Personal Checking Account - Trees By Bike

Fake bank of america statements - Trees By Bike

Test Confirmation Number at Vivian Bender blog - Trees By Bike

Bank Of America Statement Template Beautiful 023 Bank America Statement - Trees By Bike

Check Account And Routing Number Location at Justin Kim blog - Trees By Bike

Bank of America Checking Account 2024 Review - Trees By Bike