Navigating the world of taxes can often feel like venturing into uncharted territory, especially when it comes to claiming what's rightfully yours. In Malaysia, "cara claim cukai pendapatan," which translates to "how to claim income tax," is a phrase that echoes in the minds of many as tax season approaches. It's a process shrouded in a mix of confusion and hope – confusion about the intricacies of tax regulations and hope for a much-welcomed refund.

But what exactly does "cara claim cukai pendapatan" entail? It's more than just filling out forms and hoping for the best. It's about understanding the Malaysian tax system, identifying the reliefs and deductions you're eligible for, and ensuring you're not overpaying your hard-earned ringgit. This comprehensive guide will demystify "cara claim cukai pendapatan," providing you with the knowledge and tools to navigate the process confidently.

Whether you're a seasoned taxpayer or a fresh graduate filing your taxes for the first time, this guide will equip you with valuable insights into maximizing your tax savings. We'll delve into the history and importance of tax reliefs in Malaysia, explore the various types of reliefs available, and provide a step-by-step guide on how to claim them. We'll also address common challenges faced by taxpayers and offer practical solutions to overcome them.

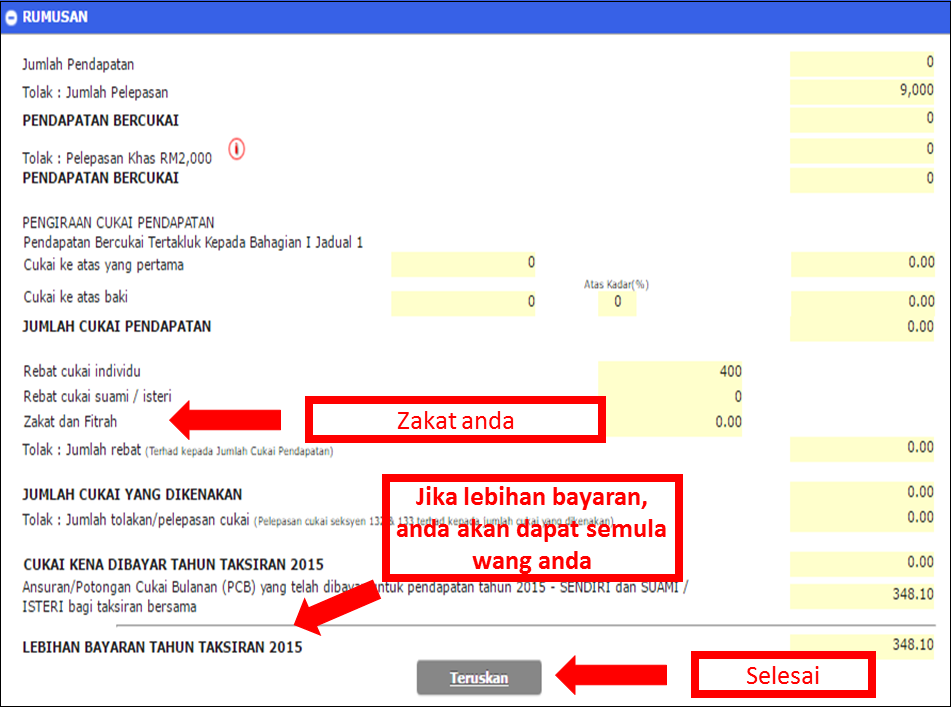

Imagine receiving a tax refund and finally ticking off that dream vacation from your bucket list. Or perhaps using the extra funds to invest in your future or pay off outstanding debts. With the right knowledge and a strategic approach, "cara claim cukai pendapatan" can empower you to make the most of your finances and achieve your financial goals.

Ready to unlock the secrets of "cara claim cukai pendapatan" and embark on your journey towards financial freedom? Let's dive in and explore the world of tax reliefs in Malaysia together!

Advantages and Disadvantages of Cara Claim Cukai Pendapatan

While "cara claim cukai pendapatan" offers numerous benefits, it's essential to be aware of potential drawbacks.

| Advantages | Disadvantages |

|---|---|

| Potential for tax refunds | Time-consuming process |

| Maximizes tax savings | Possibility of errors |

| Financial planning opportunities | Requires meticulous record-keeping |

Best Practices for Cara Claim Cukai Pendapatan

Follow these best practices to streamline your tax filing process:

- Maintain Organized Records: Keep all relevant documents, including income statements, receipts, and tax forms, neatly organized throughout the year.

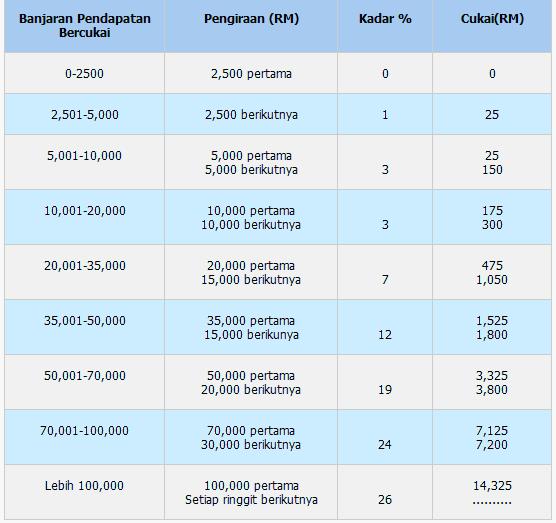

- Understand Your Eligibility: Thoroughly research and understand the specific tax reliefs and deductions you qualify for to avoid missing out on potential savings.

- File Early: Don't wait until the last minute! Filing your taxes early allows ample time to gather documents, correct errors, and avoid late penalties.

- Seek Professional Assistance: If you find the tax filing process overwhelming, consider consulting a qualified tax professional for guidance and support.

- Double-Check Your Submission: Before submitting your tax return, meticulously review all information for accuracy to prevent delays or complications.

cara claim cukai pendapatan - Trees By Bike

Senarai Pelepasan Cukai 2022 Untuk E - Trees By Bike

cara claim cukai pendapatan - Trees By Bike

cara claim cukai pendapatan - Trees By Bike

Borang E Filing Cukai Pendapatan - Trees By Bike

cara claim cukai pendapatan - Trees By Bike

Senarai Pelepasan Cukai 2023 untuk Isi e - Trees By Bike

Cara Mudah Pengiraan Cukai Pendapatan Tips Bijak Menguruskan Wang Sah - Trees By Bike

Senarai Pelepasan Cukai 2022 Untuk e - Trees By Bike

Cara claim cukai ibu menyusu yang bekerja dan membayar cukai - Trees By Bike

Cara Memfailkan Cukai Pendapatan Dengan e - Trees By Bike

Senarai pelepasan cukai pendapatan LHDN untuk e - Trees By Bike

Panduan Lengkap Cara Isi eFiling Bagi Pengiraan Cukai Pendapatan - Trees By Bike

Cara Daftar LHDN Pertama Kali Untuk Declare Income Tax (e - Trees By Bike

Cara Daftar LHDN Pertama Kali Untuk Declare Income Tax (e - Trees By Bike