In our increasingly digital age, the sight of a checkbook might seem as antiquated as a rotary phone. Yet, despite the rise of mobile payments and online banking, the humble check persists. It remains a vital financial tool, a tangible representation of funds exchanged, and a testament to the enduring power of traditional banking practices. Whether you're a newcomer to the world of personal finance or simply need a refresher on the specifics of check writing, understanding the nuances of this seemingly simple document is crucial.

Navigating the financial world can feel like traversing a complex labyrinth, especially for those just starting. One of the first hurdles many encounter is mastering the art of check writing. While seemingly straightforward, a misplaced decimal or an incorrect date can have frustrating consequences. This is where a firm grasp on the fundamentals becomes invaluable.

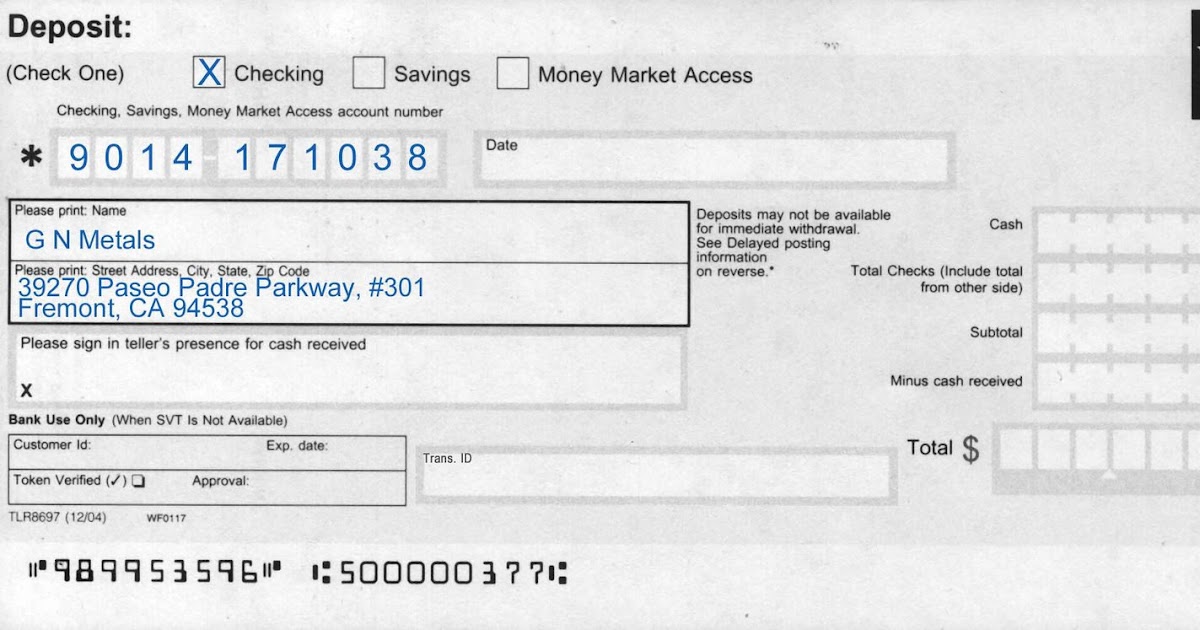

This comprehensive guide delves into the intricacies of filling out a Wells Fargo check. We'll demystify the process, providing you with the knowledge and confidence to navigate any check-writing situation. From the significance of accurate routing numbers to the importance of legible handwriting, consider this your roadmap to becoming a check-writing expert.

Before we dive into the step-by-step instructions, it's important to note that while this guide focuses on Wells Fargo checks, the principles apply broadly to most checks. The layout may differ slightly between financial institutions, but the core information required remains consistent.

Mastering the art of check writing empowers you to take control of your finances and engage confidently in various financial transactions. Whether you're paying rent, sending a gift, or making a purchase, a properly filled-out check serves as a reliable and secure payment method. So, let's unlock the secrets of this enduring financial tool and equip you with the knowledge to navigate the world of checks with ease.

Advantages and Disadvantages of Using Checks

While checks offer a certain familiarity and convenience, it's essential to weigh their advantages and disadvantages in today's digital landscape:

| Advantages | Disadvantages |

|---|---|

| Widely Accepted | Slower Processing Time |

| Physical Record of Transactions | Risk of Loss or Theft |

| No Need for Recipient to Have a Bank Account | Potential for Overdraft Fees |

| Useful for Large Transactions | Less Convenient Than Digital Payments |

Best Practices for Writing Checks

To ensure your checks are processed smoothly and securely, follow these best practices:

- Use a Pen: Always use a pen with blue or black ink for durability and legibility.

- Write Clearly: Ensure all information is legible and avoid cursive if your handwriting is difficult to read.

- Accurate Information: Double-check all details, including dates, amounts, and recipient information.

- Proper Formatting: Follow the designated lines and spaces on the check for clarity.

- Voiding a Check: If you make a mistake, write "VOID" in large letters across the check and record it in your check register.

Common Questions and Answers

Q: Can I write a check to myself?

A: Yes, you can write a check to yourself. Simply fill out your name in the "Pay to the order of" line.

Q: What happens if I make a mistake on a check?

A: If you make a minor error, you can try correcting it and initialing the change. However, for significant errors, it's best to void the check and start over.

Q: How long are checks valid?

A: While there's no official expiration date for personal checks, banks typically won't honor checks older than six months.

As we've explored, the ability to confidently fill out a check remains a valuable skill in today's financial landscape. While digital payment methods continue to rise in popularity, checks provide a sense of security and tangibility that electronic transactions often lack. By mastering the steps outlined in this guide and adhering to best practices, you can navigate the world of personal finance with confidence, knowing that you have the tools to manage your money effectively. Remember, every check you write tells a story—make sure yours is one of accuracy, clarity, and financial responsibility.

Wells Fargo Printable Checks - Trees By Bike

how to fill a check wells fargo - Trees By Bike

Wells fargo affidavit of domicile: Fill out & sign online - Trees By Bike

Wells Fargo Check Template - Trees By Bike

New 2023 Wells Fargo Bank Statement Template - Trees By Bike

Wells fargo print checks: Fill out & sign online - Trees By Bike

how to fill a check wells fargo - Trees By Bike

Wells Fargo Blank Check Template - Trees By Bike

How to Fill Out a Wells Fargo Check: A Step - Trees By Bike

How to Fill Out a Wells Fargo Check: A Step - Trees By Bike

Wells Fargo Blank Check Template - Trees By Bike

Can I Print A Wells Fargo Deposit Slip - Trees By Bike

Wells Fargo Bank Statement Pdf - Trees By Bike

Wells Fargo Blank Check Template - Trees By Bike

Wells Fargo Blank Check Template - Trees By Bike