Navigating the waters of financial responsibility within the framework of Islam involves understanding and fulfilling the obligation of Zakat. This pillar of Islam, often translated as "purification" or "growth," serves as a means of societal balance and spiritual growth. Among the various types of Zakat, Zakat on income, or Zakat Pendapatan, holds significant importance for Muslims earning an income. This article focuses specifically on understanding "cara kiraan zakat pendapatan Selangor," meaning the method of calculating Zakat on income in the state of Selangor, Malaysia.

For Muslims residing in Selangor, understanding the specific guidelines set forth by the Selangor Islamic Religious Council (MAIS) is crucial for fulfilling this religious duty accurately. This involves not only grasping the fundamental principles of Zakat but also delving into the nuances specific to income sources, deductions, and the Nisab (minimum threshold) as determined by MAIS.

The calculation of Zakat on income in Islam is based on the lunar calendar year, also known as the Hijri year. This means that your Zakat year will differ from the Gregorian calendar year. To determine if you are eligible to pay Zakat on your income in Selangor, it is essential to consider your total earnings and assets against the current Nisab value set by MAIS. The Nisab for Zakat on income can fluctuate based on the prevailing market price of gold.

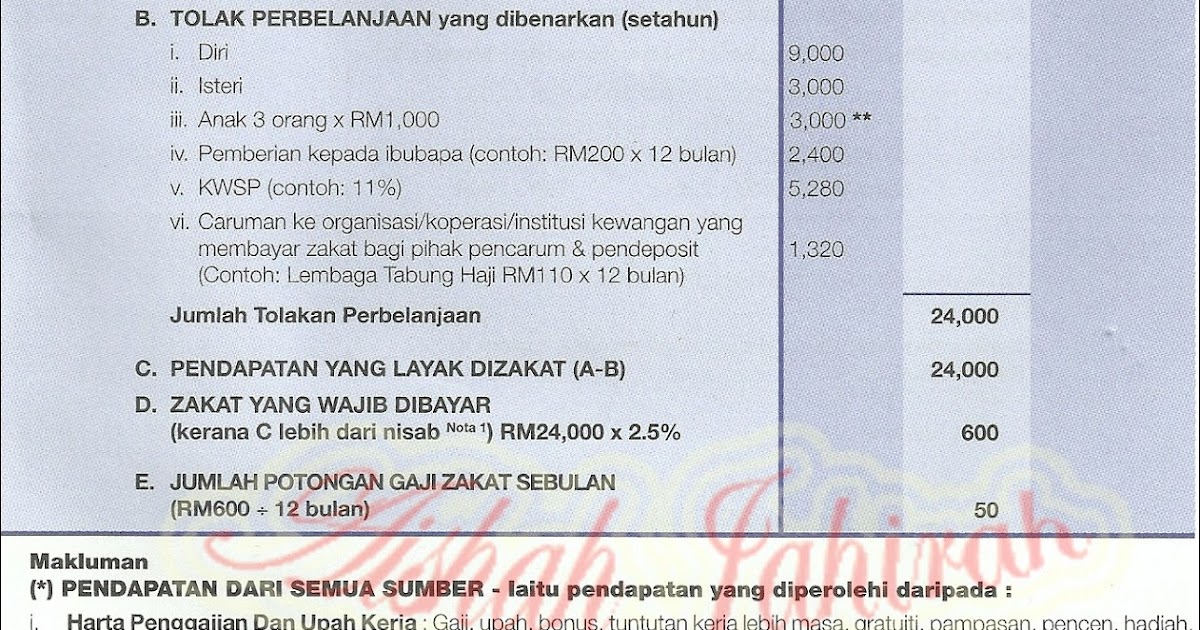

Once you have determined your eligibility, the next step involves understanding the specific deductions allowed by MAIS. These deductions typically encompass essential living expenses, such as housing, food, education, and medical costs, among others. Deducting these allowable expenses from your total income provides you with your net taxable income for Zakat purposes.

Calculating Zakat on income is relatively straightforward. The standard rate for Zakat on income is 2.5%. However, it is crucial to refer to the latest guidelines and rate provided by MAIS, as they may be subject to change. By diligently calculating and fulfilling your Zakat obligations, you contribute to the well-being of the less fortunate within the community while seeking spiritual purification and blessings from Allah. Remember, Zakat is not merely a financial obligation but a profound act of worship that fosters social solidarity and uplifts the Muslim community.

Advantages and Disadvantages of Understanding 'Cara Kiraan Zakat Pendapatan Selangor'

While there are no inherent disadvantages to understanding Zakat calculations, let's frame the concept as benefits and challenges:

| Benefits | Challenges |

|---|---|

| Fulfilling your religious obligation accurately. | Keeping up-to-date with any changes in regulations or Nisab value. |

| Contributing to the well-being of the less fortunate in Selangor. | Understanding the specific deductions allowed by MAIS. |

| Potentially reducing your tax liability. | Calculating Zakat for those with complex income sources. |

Best Practices for Managing Zakat on Income

- Stay Informed: Regularly check the official MAIS website for the most up-to-date information on Nisab, calculation methods, and any changes in regulations.

- Seek Guidance: If you have questions or complex financial situations, don't hesitate to consult with a qualified Islamic scholar or financial advisor knowledgeable about Zakat in Selangor.

- Maintain Records: Keep accurate records of your income, expenses, and Zakat payments. This will make future calculations easier and provide documentation for tax purposes.

- Utilize Technology: Explore online Zakat calculators and resources provided by MAIS or reputable Islamic financial institutions to simplify the calculation process.

- Pay Zakat on Time: Aim to pay your Zakat promptly within the Islamic lunar year to fulfill your obligation on time and ensure your contribution reaches those in need.

By understanding and diligently fulfilling your Zakat obligations, you are not only fulfilling a fundamental pillar of Islam but also contributing to the betterment of society and your own spiritual growth.

BAGAIMANA CARA KIRAAN ZAKAT EMAS SELANGOR? - Trees By Bike

Cara Pengiraan Zakat Pendapatan - Trees By Bike

Pengiraan Zakat Pendapatan 2024 Cara Bayar Jadual Kiraan - Trees By Bike

cara kiraan zakat pendapatan selangor - Trees By Bike

Kaedah Kiraan, Cara Bayar Zakat Simpanan di Malaysia 2024 - Trees By Bike

cara kiraan zakat pendapatan selangor - Trees By Bike

Cara Mudah Kira Zakat Pendapatan - Trees By Bike

Cara Pengiraan Zakat Pendapatan dan Zakat Simpanan (2.5%) - Trees By Bike

Bila perlu bayar zakat pendapatan dan berapa kadarnya? - Trees By Bike

Zakat Fitrah dan Jenis - Trees By Bike

Zakat Pendapatan & Cara Kiraan Mudah Hanya Rujuk Jadual Yang Disediakan - Trees By Bike

Panduan Bayar Zakat Untuk Newbies - Trees By Bike

Jangan Lupa Bayar Zakat Pendapatan Tahun 2020. Ini Cara Kiraannya Yang - Trees By Bike

Zakat Pendapatan Dan Cara Kiraan Mudah Hanya Rujuk Jadual Yang - Trees By Bike

Cara Kiraan ZAKAT EMAS ambil tahu sebab ianya wajib bayar! - Trees By Bike