Opening a bank account is a fundamental step in navigating the financial world. It provides a secure platform for managing money, making transactions, and building a financial history. However, the process often requires more than just basic identification. In many cases, individuals and businesses need to provide additional documentation to verify their identity and purpose for opening an account. This is where the "Surat Sokongan Pembukaan Akaun Bank" or bank account opening support letter comes into play.

This document serves as a crucial piece of evidence that strengthens an applicant's case and assures the bank of their legitimacy. But what exactly is a Surat Sokongan Pembukaan Akaun Bank, and why is it so important? This comprehensive guide delves into the intricacies of this document, exploring its purpose, benefits, and the steps involved in obtaining and utilizing it effectively.

Imagine this: you're a young entrepreneur, fresh out of university, with a brilliant business idea. You've poured your heart and soul into developing your product, and you're finally ready to take the leap and register your company. You head to the bank, brimming with excitement, only to be met with a request for a "Surat Sokongan Pembukaan Akaun Bank." Suddenly, a wave of uncertainty washes over you. What is this document, and why is it necessary?

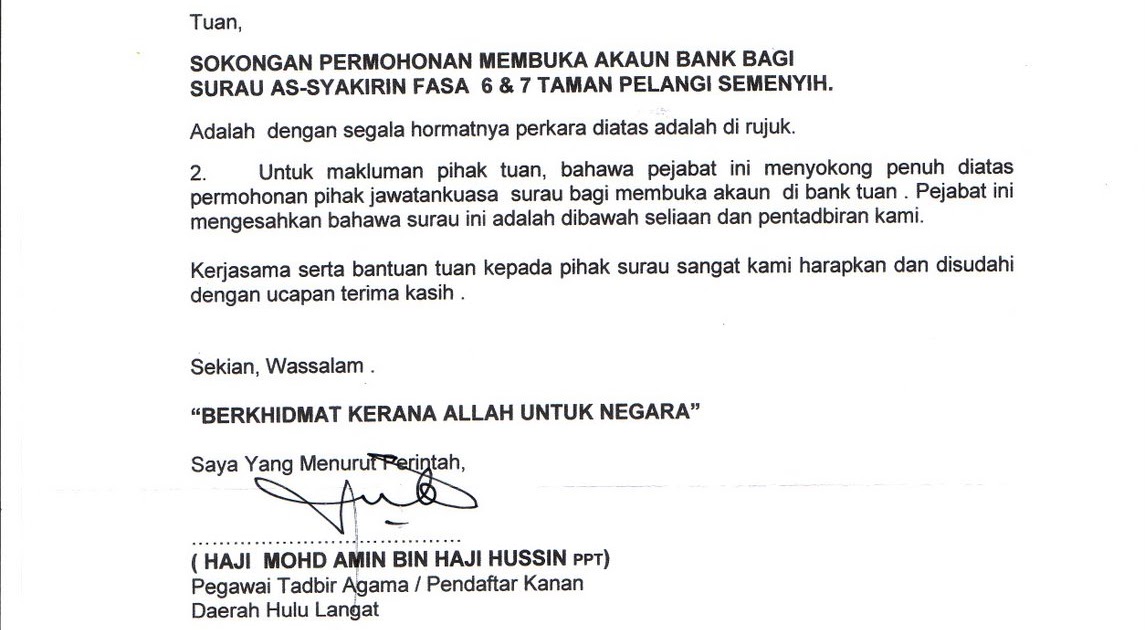

In essence, a Surat Sokongan Pembukaan Akaun Bank is a formal letter that verifies your identity and the legitimacy of your need for a bank account. It acts as a vote of confidence from a trusted source, assuring the bank that you are who you claim to be and that your intentions for opening the account are genuine. This document is particularly crucial for individuals or businesses that might not have extensive financial history or readily available documentation, such as students, startups, or foreigners residing in a new country.

The requirement for a Surat Sokongan Pembukaan Akaun Bank stems from the bank's commitment to preventing fraudulent activities like money laundering and identity theft. By requesting this additional layer of verification, banks can mitigate risks and ensure the security of their operations and their customers' funds. While it might seem like an added hurdle, understanding the rationale behind it can help you appreciate its significance in maintaining the integrity of the financial system.

Advantages and Disadvantages of Surat Sokongan Pembukaan Akaun Bank

| Advantages | Disadvantages |

|---|---|

| Increased Trust and Credibility | Time Consuming to Obtain |

| Easier Account Opening for Individuals with Limited Financial History | Potential for Rejection if Support Letter is Deemed Insufficient |

| Enhanced Security and Fraud Prevention | Dependence on a Third Party for Verification |

While not an exhaustive list, these advantages and disadvantages highlight the importance of understanding the role of a Surat Sokongan Pembukaan Akaun Bank in the account opening process.

Navigating the intricacies of bank account opening procedures can be daunting, especially with the added layer of a support letter. While the requirement might seem cumbersome, it ultimately contributes to a safer and more secure financial landscape for everyone involved.

surat sokongan pembukaan akaun bank - Trees By Bike

Contoh Surat Pengesahan Dari Penghulu Contoh Surat - Trees By Bike

Surat Permohonan Buka Akaun Bank - Trees By Bike

Maybank Contoh Surat Buka Akaun Bank Untuk Pekerja Servyoutube - Trees By Bike

Contoh Surat Pengesahan Untuk Buka Akaun Bank - Trees By Bike

Maybank Contoh Surat Buka Akaun Bank Untuk Pekerja - Trees By Bike

Cara Buat Surat Sokongan Contoh Surat Sokongan Majikan Untuk Sambung - Trees By Bike