Life, with its intricate tapestry of experiences, is often marked by transitions—moments that subtly shift the direction of our paths. A new job in a bustling city, the quiet joy of a growing family, the bittersweet parting of ways—each milestone carries its own weight, its own set of adjustments. And amidst these changes, there's often a need to re-evaluate, to make choices that align with our transformed realities. It's within this space of reevaluation that we encounter the concept of a "qualifying life event time limit."

Imagine, for instance, a young professional relocating for a coveted opportunity. The move brings with it a whirlwind of logistical adjustments, not least of which is securing health insurance. In such a scenario, the "qualifying life event time limit" emerges as a critical factor, dictating the timeframe within which they can enroll in a new health insurance plan outside the typical open enrollment period. This time limit, often 60 days, acts as a window of opportunity, allowing individuals to adapt their coverage based on their altered circumstances.

The concept of a qualifying life event time limit extends beyond health insurance, permeating various aspects of our lives. It touches upon areas like retirement plan contributions, flexible spending accounts, and even certain legal benefits. Each domain has its own nuances, its own set of rules governing the time-sensitive window for modifications. Understanding these nuances can make all the difference in navigating life's transitions with financial and logistical clarity.

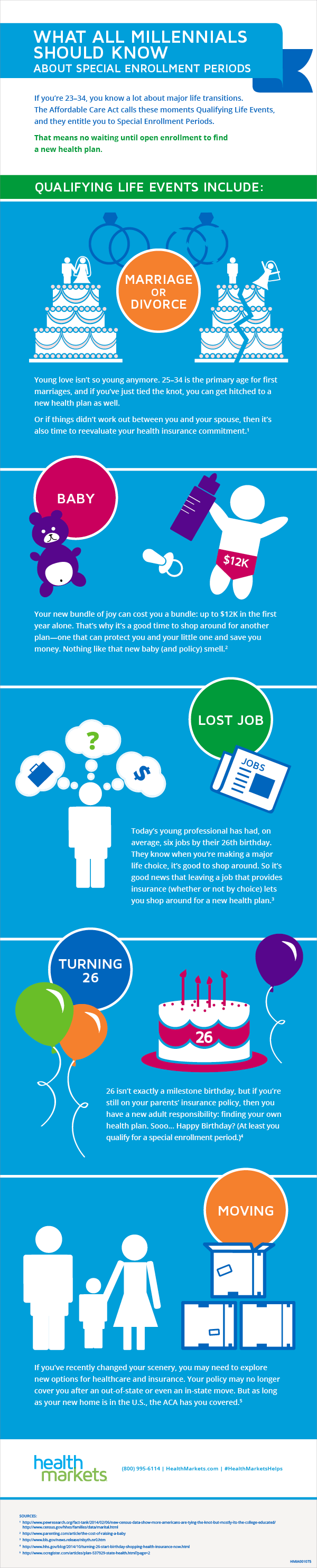

The origins of the qualifying life event time limit can be traced back to the need for structure and fairness within various systems. Take, for example, health insurance. If individuals could change plans at any given moment, it could lead to instability within the risk pool, potentially impacting premiums for everyone. Establishing specific periods for enrollment and allowing changes only during qualifying events like marriage, birth, or job loss helps maintain a balance, ensuring both individual flexibility and the sustainability of the system.

However, the concept of a qualifying life event time limit, while serving a critical purpose, isn't without its challenges. The rigid timeframes, while intended to maintain order, can sometimes feel like hurdles, particularly for individuals already grappling with the emotional and logistical weight of a major life event. There's a delicate balance to be struck between maintaining systematic integrity and ensuring accessibility and understanding for those navigating these significant life changes.

Navigating these waters requires awareness, preparation, and a keen understanding of the specific rules governing each life event and the associated time limits. It's about anticipating change, understanding the options available, and making informed decisions within the designated timeframe. In essence, it's about taking control of life's transitions, one carefully considered step at a time.

qualifying life event time limit - Trees By Bike

Qualifying Event for Health Insurance - Trees By Bike

What You Need to Know for Open Enrollment 2022 - Trees By Bike

Init feature become verify via who Supervisors for Choice at of - Trees By Bike

Qualifying Life Events FAQs - Trees By Bike

What is a qualifying life event? - Trees By Bike

The Amazing Truth About Qualifying Life Events for Millennials - Trees By Bike

Qualifying Life Events for Insurance (2023) - Trees By Bike

qualifying life event time limit - Trees By Bike

Mark Your Calendar: 2017 Open Enrollment Period Need - Trees By Bike

Fillable Online Proof of Qualifying Life Event Form Fax Email Print - Trees By Bike

Qualifying Life Events for Insurance: 2024 Guide - Trees By Bike

qualifying life event time limit - Trees By Bike

Qualifying Life Event (QLE) - Trees By Bike

What is a qualifying life event for health insurance? - Trees By Bike