In the realm of modern finance, where digital transactions reign supreme, there exists a curious relic of a bygone era – the third-party check. These paper emissaries, often bearing the weight of significant transactions, evoke a sense of both nostalgia and trepidation. And when the name "Chase Bank" enters the equation, the stakes, much like the ink on these checks, seem to deepen.

Imagine, if you will, receiving a check, not directly from the expected source, but from an intermediary – a third party. Perhaps it's a generous gift from a distant relative, routed through their trust, or a business payment filtered through a legal entity. The funds, while tangible, carry an air of mystery, a whisper of a journey taken, a story waiting to be unraveled.

Chase Bank, with its storied history and vast network, plays a pivotal role in this intricate dance of third-party checks. As a financial institution that prides itself on both innovation and tradition, Chase navigates the delicate balance between facilitating these transactions and safeguarding its customers from potential pitfalls.

The allure of a third-party check, especially one drawn on a reputable institution like Chase, can be intoxicating. Yet, beneath the surface of convenience and tradition lies a complex web of regulations, security measures, and potential risks that demand our attention.

For some, the mere thought of handling a third-party check evokes a sense of unease. Questions arise, swirling like loose leaves in the autumn wind: Are these checks safe? How long does it take for them to clear? What measures are in place to protect against fraud? These are the very questions we aim to explore, to demystify the world of Chase bank third-party checks and empower you with the knowledge to navigate this often-misunderstood financial terrain.

Advantages and Disadvantages of Chase Bank 3rd Party Checks

| Advantages | Disadvantages |

|---|---|

| Can be used for large transactions | Potential for fraud |

| Widely accepted | Can take longer to clear than other payment methods |

| Convenient for payers who don't have other payment methods | May be subject to fees |

Best Practices for Chase Bank 3rd Party Checks

Navigating the world of third-party checks doesn't have to be daunting. By following a few simple practices, you can mitigate risks and ensure a smooth transaction:

- Verify the Source: Always confirm the identity of the payer and the legitimacy of the check.

- Inspect the Check Carefully: Look for any discrepancies, alterations, or signs of tampering.

- Understand Clearing Times: Be aware that third-party checks can take longer to clear than other forms of payment.

- Communicate with Your Bank: If you have any concerns, reach out to Chase Bank for guidance and support.

- Consider Alternatives: Explore alternative payment methods, such as wire transfers or online payment platforms, if feasible.

Common Questions and Answers About Chase Bank 3rd Party Checks

Here are some frequently asked questions about Chase Bank 3rd party checks:

Q: How long does it take for a Chase bank 3rd party check to clear?

A: Clearing times can vary, but it's best to allow for up to 7-10 business days.

Q: What should I do if I suspect fraud with a Chase bank 3rd party check?

A: Contact Chase Bank immediately to report your suspicions.

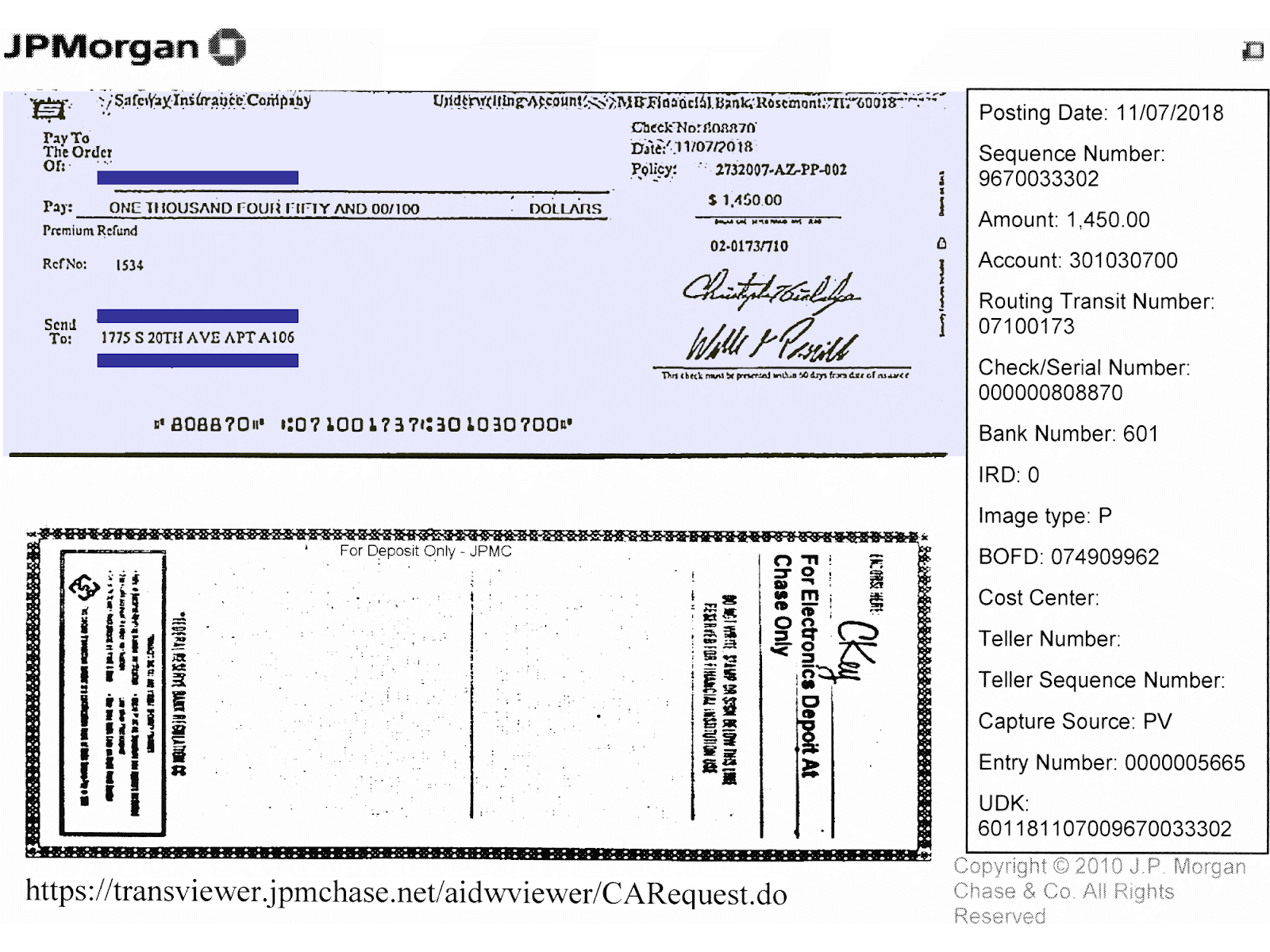

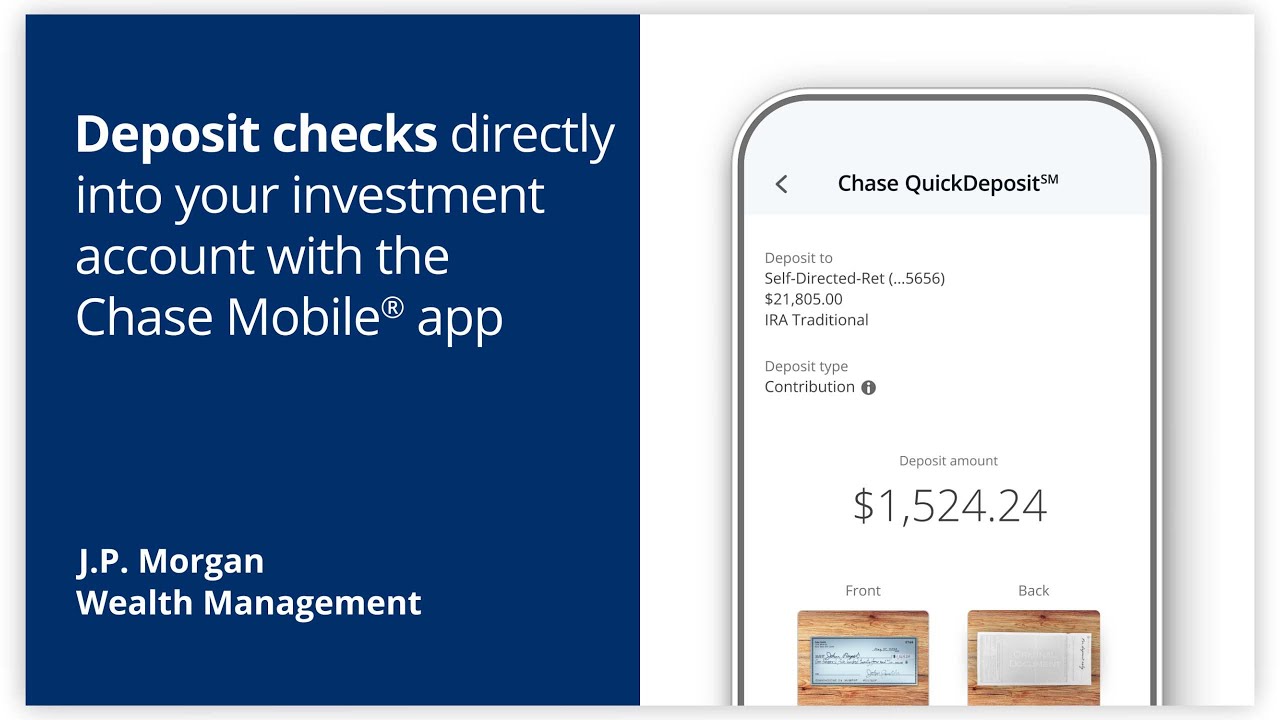

Q: Can I mobile deposit a Chase bank 3rd party check?

A: Policies vary, so it's best to check with Chase Bank directly.

Q: Are there any fees associated with depositing a Chase bank 3rd party check?

A: Fees may apply, so inquire with your local branch or check their fee schedule online.

Q: What information do I need to provide when depositing a Chase bank 3rd party check?

A: Be prepared to provide your account information, the check details, and possibly identification.

In Conclusion: Embracing the Nuances of Third-Party Checks

The world of finance is a tapestry woven with threads of tradition and innovation. While digital transactions dominate our modern landscape, third-party checks persist as tangible reminders of a bygone era. These instruments, often associated with significant transactions, evoke a sense of both intrigue and uncertainty. Chase Bank, with its legacy of trust and its commitment to evolving with the times, stands as a steadfast guide in navigating this complex terrain. By understanding the nuances of third-party checks, embracing best practices, and seeking guidance from your financial institution, you can navigate this realm with confidence and peace of mind. Remember, knowledge is power, especially when it comes to managing your finances.

53rd Bank How To Close Checking Account - Trees By Bike

23.1: Los bancos y sus clientes - Trees By Bike

How To Cash A Third Party Check - Trees By Bike

How to Endorse Chase Bank Mobile Deposit? - Trees By Bike

List of 10+ Third Party Check Cashing Places Near Me 2023 - Trees By Bike

chase bank 3rd party checks - Trees By Bike

chase bank 3rd party checks - Trees By Bike

How To Check Deposit Cheque Status - Trees By Bike

Check stock is dead, long live the 3rd Party Check - Trees By Bike

chase bank 3rd party checks - Trees By Bike

Insurance Claim Check Chase - Trees By Bike

What is a Third Party Check - Trees By Bike

chase bank 3rd party checks - Trees By Bike

How To Write A Check Chase - Trees By Bike

Depositing Check With Someone Else's Name On It Hot Sale - Trees By Bike

:max_bytes(150000):strip_icc()/back-of-check-endorsed2-57a350e95f9b589aa907ed7e.jpg)

/how-to-endorse-checks-315300-156cf43ec02848b9b6ac30864994d91a.jpg)