There's a certain point in your twenties when the realities of adulthood set in – filing taxes, navigating career moves, and yes, figuring out health insurance. In California, turning 26 marks a significant milestone in your healthcare journey. No longer able to cruise on your parents' plan, you're faced with a decision: forge your own path or find a way to maintain the coverage you've known.

The transition can feel daunting, particularly when you're already juggling the demands of building your life in the Golden State. But like a perfectly tailored blazer, the right health insurance plan can provide a sense of security and confidence as you navigate the exciting, albeit sometimes unpredictable, terrain of your late twenties.

California, known for its progressive approach to healthcare, offers a range of options for young adults seeking coverage. Understanding these choices, from qualifying life events to special enrollment periods, is crucial to making informed decisions about your health and well-being.

While the prospect of venturing into the world of individual health insurance might seem overwhelming, it also presents an opportunity – a chance to curate a plan specifically tailored to your needs and lifestyle. Whether you're a freelancer embracing the gig economy, a budding entrepreneur chasing your dreams, or a recent graduate embarking on a new career path, having the right health insurance coverage can provide peace of mind and empower you to focus on what truly matters.

This shift in responsibility also encourages young adults to become more proactive about their health. By taking ownership of their healthcare decisions, they gain a deeper understanding of their needs, learn to navigate the complexities of the healthcare system, and ultimately, develop a greater sense of agency over their well-being.

Advantages and Disadvantages of Staying on a Parent's Plan Until 26

| Advantages | Disadvantages |

|---|---|

| Continued coverage under a familiar plan | May have limited plan options |

| Potentially lower out-of-pocket costs | Could be more expensive than individual plans |

| Simplified enrollment process | May not align with your current healthcare needs |

Common Questions and Answers:

Q: Can I stay on my parent's health insurance plan after I turn 26 in California?

A: Generally, no. However, some exceptions exist, such as being a full-time student or having a qualifying life event.

Q: What are my health insurance options when I turn 26 in California?

A: You can explore Covered California (the state's health insurance marketplace), private insurers, or employer-sponsored plans if you're eligible.

Q: What is a qualifying life event?

A: Life events like marriage, having a baby, or losing job-based coverage may qualify you for a special enrollment period to purchase health insurance outside the usual open enrollment window.

Q: When can I enroll in health insurance in California?

A: Open enrollment typically runs from November 1st to January 15th. Outside of this period, you may qualify for special enrollment due to specific life events.

Q: What are the penalties for not having health insurance in California?

A: California has a state-based individual mandate penalty. You may have to pay a penalty when you file your state taxes if you don't have qualifying health coverage.

Navigating the world of health insurance as a young adult in California can seem complex, but remember, you're not alone. Just as you carefully curate your wardrobe to reflect your personal style, take the time to understand your health insurance options and choose a plan that fits your needs and aspirations.

Whether it's exploring Covered California, considering employer-sponsored plans, or researching individual health insurance policies, empower yourself with knowledge and make choices that support your health and well-being. After all, your health is your most valuable asset, and investing in the right coverage is a testament to your commitment to a bright and fulfilling future.

My Life Before and After Turning Twenty - Trees By Bike

Blue Shield Health Insurance Coverage - Trees By Bike

Health insurance for senior citizens: How to pick the best insurance - Trees By Bike

Losing health insurance at age 26 - Trees By Bike

[Infographic] Paid Sick Leave Law in California - Trees By Bike

California health insurance agent and broker - Trees By Bike

Average Cost of Health Insurance by State - Trees By Bike

Blue Shield Of California Health Insurance Covered California, PNG - Trees By Bike

Third World Finance (@FinanceThird) / Twitter - Trees By Bike

2020 Form 3895 California Health Insurance Marketplace / 2020 - Trees By Bike

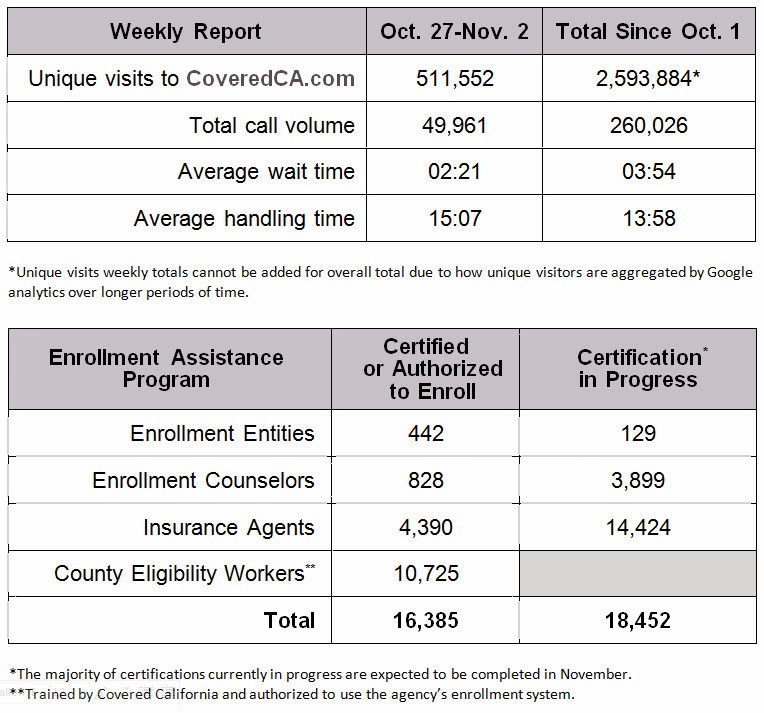

Covered California Releases Statistics For Its Health Insurance - Trees By Bike

california health insurance age 26 - Trees By Bike

Need Health Insurance in San Diego, CA? Call 888 - Trees By Bike

Best Covered California Health Plan 2024 - Trees By Bike

california health insurance age 26 - Trees By Bike

![[Infographic] Paid Sick Leave Law in California](https://i.pinimg.com/originals/3b/d4/8c/3bd48c383bffe82eaf1686c29e20c066.jpg)