In the intricate tapestry of life, where time weaves its threads, the prospect of retirement emerges as a significant milestone. It signifies a transition, a departure from the familiar rhythms of working life into a new chapter filled with possibilities. Central to this transition is the question that lingers in the minds of many: When will this new chapter begin? When can I embrace the freedom of retirement?

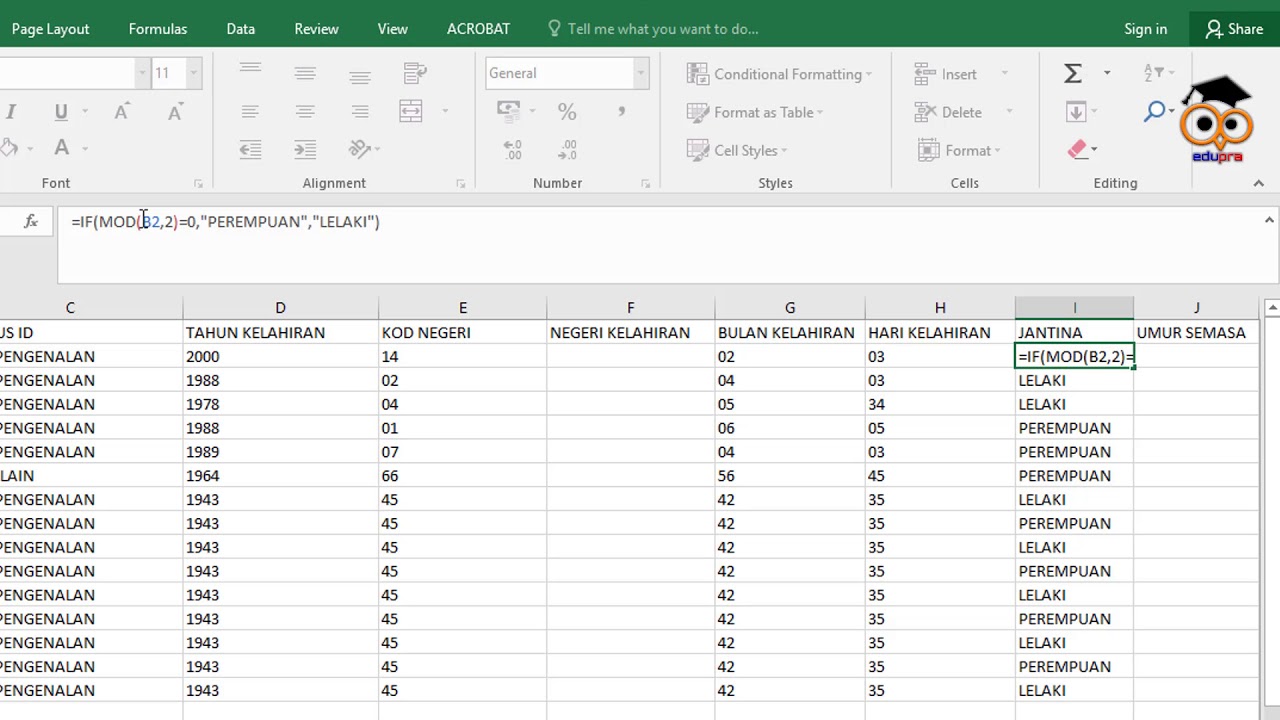

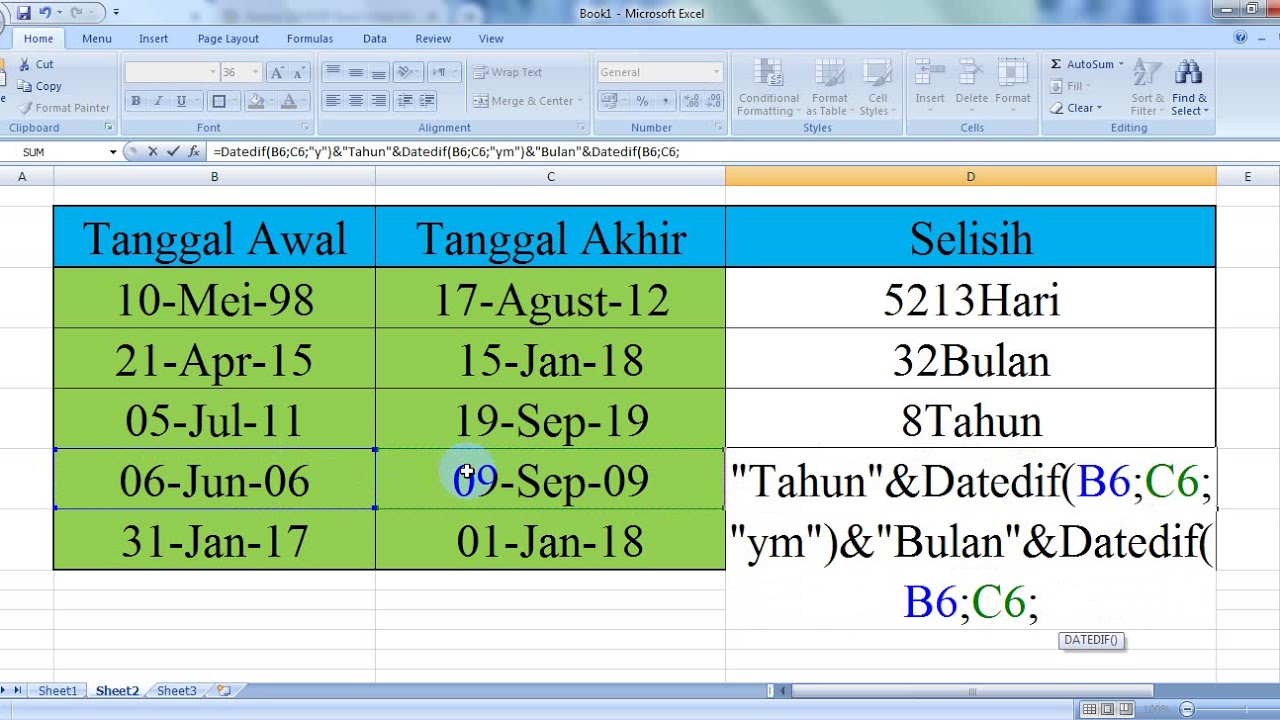

For those seeking a clear and calculated answer, Excel, the ubiquitous spreadsheet software, emerges as a powerful ally. With its arsenal of functions and formulas, Excel provides the tools to calculate retirement dates with precision and ease. This exploration delves into the world of Excel-based retirement date calculations, uncovering its nuances and showcasing its ability to empower individuals on their journey toward a well-planned retirement.

Imagine a spreadsheet transformed into a time-traveling oracle, capable of peering into the future and revealing the precise date of your retirement. This is the essence of using Excel for retirement date calculation. By inputting key data points such as your birthdate and anticipated retirement age, Excel can compute the exact date when you can bid farewell to the workforce.

The beauty of Excel lies not only in its ability to perform this calculation but also in its flexibility. It empowers you to model different scenarios, adjusting variables such as your desired retirement age or factoring in potential changes to retirement regulations. This dynamic approach ensures that you remain in control, equipped with the knowledge to make informed decisions about your future.

Beyond the allure of precise date calculation, utilizing Excel for retirement planning unlocks a treasure trove of benefits. It fosters a deeper understanding of the financial implications of your retirement plans, allowing you to adjust savings strategies, explore investment options, and ultimately ensure a comfortable and fulfilling retirement. The insights derived from these calculations transcend mere numbers; they serve as guideposts, illuminating the path toward a secure and well-deserved retirement.

Advantages and Disadvantages of Using Excel for Retirement Date Calculation

While Excel offers a powerful toolset for retirement planning, it's essential to acknowledge both its strengths and limitations. Let's explore the advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

|

|

Understanding these aspects empowers you to leverage Excel effectively while mitigating potential drawbacks. Consider complementing your Excel-based planning with professional financial advice for a comprehensive approach to retirement.

As you embark on the journey of retirement planning, embrace the power of Excel as a valuable companion. Its ability to calculate retirement dates, model different scenarios, and provide financial insights makes it an indispensable tool for anyone seeking to shape a secure and fulfilling future. Remember, the key to a successful retirement lies not just in knowing the date but in actively planning and preparing for it, and Excel can be your steadfast ally every step of the way.

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike

formula kira tarikh pencen dalam excel - Trees By Bike