Navigating the complexities of personal finance can feel like charting a course through uncharted waters. Especially when it comes to securing a comfortable retirement, having a solid plan is essential. In Malaysia, the Employees Provident Fund (EPF) or Kumpulan Wang Simpanan Pekerja (KWSP) plays a crucial role in helping individuals achieve their financial goals. One powerful tool within the EPF system is the Akaun 3, a voluntary savings account designed to provide additional financial security during retirement.

But what exactly is cara daftar akaun 3 KWSP, and how does it work? This comprehensive guide delves into the intricacies of this savings mechanism, providing you with the knowledge and tools you need to make informed decisions about your financial future. From its historical context to its numerous benefits, we'll cover everything you need to know about harnessing the power of Akaun 3.

Imagine a life after retirement where your finances are not a source of stress but a wellspring of comfort and opportunity. Akaun 3 empowers you to turn this vision into reality. Whether you're just starting your career or approaching your golden years, understanding the ins and outs of this savings account can make a significant difference in your long-term financial well-being.

Throughout this guide, we'll explore the various aspects of cara daftar akaun 3 KWSP, including eligibility criteria, registration processes, contribution limits, and investment options. We'll delve into the potential benefits, such as higher dividends and tax advantages, as well as address any potential drawbacks or limitations. Our goal is to equip you with the information you need to decide if opening an Akaun 3 aligns with your financial objectives.

Join us as we demystify the world of cara daftar akaun 3 KWSP, empowering you to take control of your financial destiny and build a secure and prosperous future.

Advantages and Disadvantages of Akaun 3 KWSP

| Advantages | Disadvantages |

|---|---|

| Potential for higher dividends than Akaun 1 and 2 | Funds are locked in until retirement age (currently 55/60) |

| Tax relief on contributions up to a certain limit | Limited withdrawal options before retirement |

| Provides an additional avenue for retirement savings | Investment risk depends on chosen investment funds |

Best Practices for Maximizing Your Akaun 3 KWSP

1. Start Early: The power of compounding is significant. The earlier you start contributing, the more time your money has to grow.

2. Consistent Contributions: Make regular contributions, even small amounts, to build your savings steadily.

3. Understand Your Risk Tolerance: Choose investment funds that align with your risk appetite and investment horizon.

4. Review and Rebalance: Periodically review your portfolio performance and rebalance your investments as needed.

5. Seek Professional Advice: Consult with a licensed financial advisor for personalized guidance on maximizing your Akaun 3.

Common Questions and Answers about Akaun 3 KWSP

Q1: Who is eligible to open an Akaun 3 KWSP?

A1: Malaysian citizens and permanent residents who are EPF members.

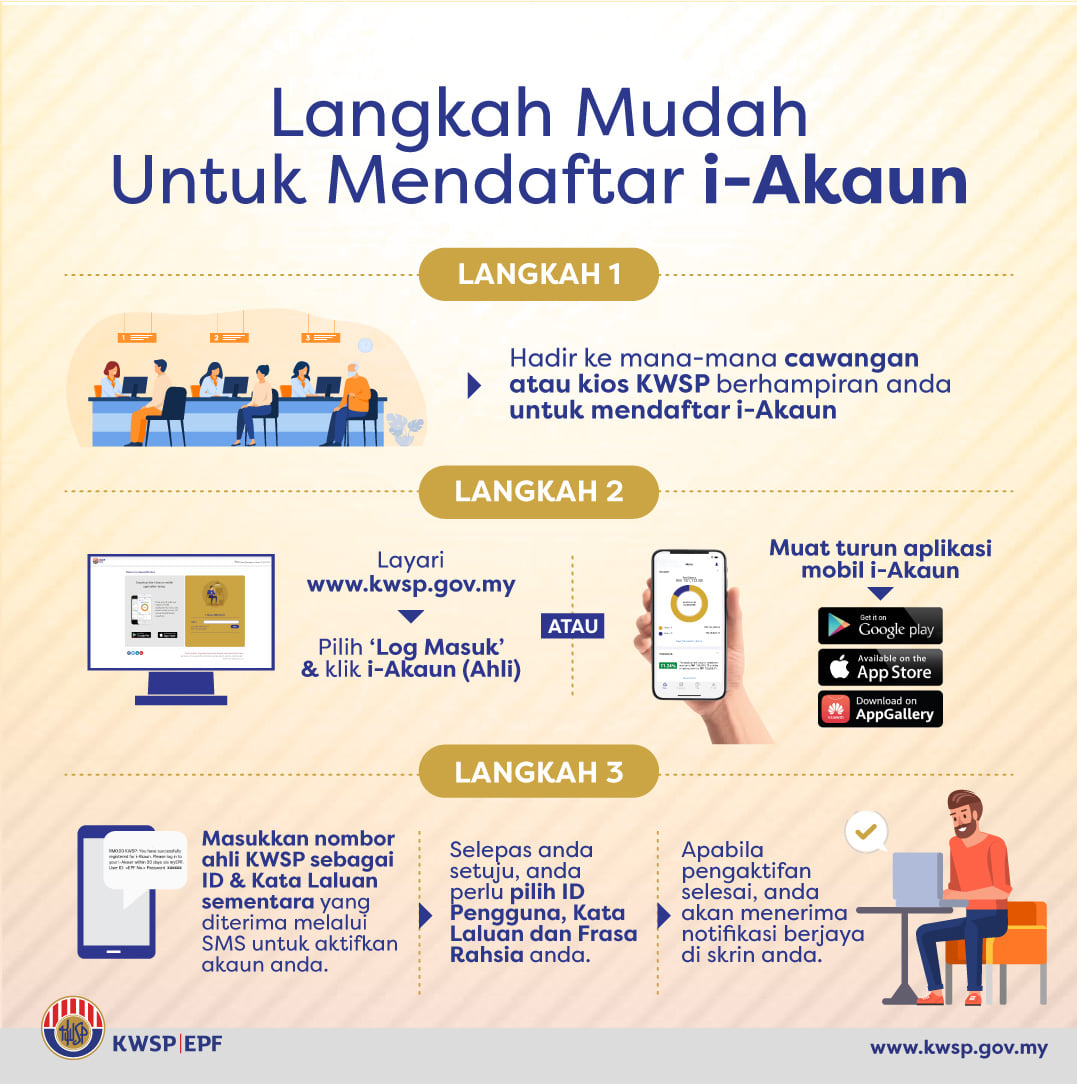

Q2: How do I register for Akaun 3?

A2: You can register online via the KWSP i-Akaun portal or visit a KWSP branch.

Q3: What is the contribution limit for Akaun 3?

A3: The contribution limit varies and is subject to change, refer to the KWSP website for the latest information.

Q4: Can I withdraw funds from my Akaun 3 before retirement?

A4: Withdrawals are generally restricted before retirement, with some exceptions for specific purposes like housing or education.

Q5: Are there any tax benefits to contributing to Akaun 3?

A5: Yes, contributions to Akaun 3 are eligible for tax relief up to a certain limit.

Q6: What happens to my Akaun 3 funds upon my death?

A6: The funds will be distributed to your beneficiaries as per your nominated details.

Q7: Can I transfer funds from my Akaun 1 or Akaun 2 to Akaun 3?

A7: Yes, you can transfer a portion of your savings from Akaun 1 to Akaun 3.

Q8: Where can I get more information about Akaun 3 KWSP?

A8: Visit the official KWSP website or contact their customer service hotline.

Conclusion: Taking Charge of Your Financial Well-being with Akaun 3

Securing your financial future is a journey that requires careful planning, informed decisions, and a commitment to long-term goals. In Malaysia, the Employees Provident Fund (EPF) offers valuable tools to empower individuals in their pursuit of financial security, and the Akaun 3 stands out as a powerful instrument for building a comfortable retirement. By understanding the intricacies of cara daftar akaun 3 KWSP, you unlock the potential to enhance your savings, benefit from tax advantages, and potentially enjoy higher returns on your contributions.

While navigating the world of personal finance can seem daunting, remember that knowledge is power. By taking the time to understand the mechanisms of Akaun 3, you take a proactive step towards shaping a brighter financial future. Consider the information presented in this guide, weigh the advantages and disadvantages, and, if necessary, seek guidance from qualified financial advisors. Your retirement years should be a time of relaxation and fulfillment, and taking control of your financial well-being is a crucial step in making that vision a reality.

Cara Daftar Dan Aktifkan i - Trees By Bike

cara daftar akaun 3 kwsp - Trees By Bike

Dividen Akaun 3 KWSP & Cara Daftar Akaun Fleksibel - Trees By Bike

Akaun 3 KWSP Fleksibel Cara Pindahan Simpanan » EduBestari - Trees By Bike

CARA DAFTAR AKAUN 3 FLEKSIBEL KWSP 2024 : MOHON ONLINE SEKARANG - Trees By Bike

Pengeluaran KWSP Melalui Akaun 3 - Trees By Bike

Dividen Akaun 3 KWSP & Cara Daftar Akaun Fleksibel - Trees By Bike

CARA DAFTAR I AKAUN KWSP TANPA KE KAUNTER - Trees By Bike

Akaun 3 KWSP Akan Diperkenalkan - Trees By Bike

Pengeluaran Khas KWSP 2024 : Mohon Sekarang - Trees By Bike

Pindahan Akaun Fleksibel KWSP - Trees By Bike

How to increase EPF Contributions for Employee and Employer? - Trees By Bike

cara daftar akaun 3 kwsp - Trees By Bike

cara daftar akaun 3 kwsp - Trees By Bike

Ini Cara Daftar Dan Aktifkan i - Trees By Bike