Planning for a secure financial future is a crucial aspect of life in Malaysia, and the Employees Provident Fund (EPF) plays a vital role in this endeavor. For both Malaysians and foreign workers, understanding 'cara membuka akaun KWSP,' which translates to 'how to open an EPF account,' is the first step towards securing your financial well-being.

The EPF is a robust social security institution that manages a compulsory savings plan and retirement planning for all working individuals in Malaysia. It serves as a financial safety net, ensuring that individuals have a source of income and financial security during their retirement years. Whether you are just starting your career or have been working for a while, opening an EPF account is essential.

The process of 'cara membuka akaun KWSP' is relatively straightforward, designed to be accessible and convenient for everyone. It involves understanding the necessary documentation, choosing the right registration method, and fulfilling the requirements set by the EPF. While the process may seem simple, having a comprehensive guide can make it even smoother and ensure you are well-informed about managing your EPF account effectively.

This article serves as a comprehensive resource for everything related to 'cara membuka akaun KWSP.' We will delve into the history and significance of the EPF, guide you through the account opening process step-by-step, and provide valuable insights on managing your EPF account to maximize your benefits. By understanding the ins and outs of 'cara membuka akaun KWSP,' you are taking a proactive step toward securing your financial future and ensuring peace of mind for your retirement years.

Whether you are a fresh graduate embarking on your career journey, a seasoned professional looking to streamline your financial planning, or a foreign worker seeking to understand the Malaysian social security system better, this guide will equip you with the knowledge and resources needed to navigate the world of EPF with confidence. Let's embark on this journey towards financial security together, starting with the fundamentals of 'cara membuka akaun KWSP.'

Advantages and Disadvantages of Opening an EPF Account

| Advantages | Disadvantages |

|---|---|

| Retirement Savings | Limited Access to Funds |

| Employer Contributions | Investment Risk |

While the concept of saving for retirement is universally acknowledged as crucial, the specifics of how it's implemented can differ significantly across countries and cultures. For individuals new to Malaysia's workforce, understanding these differences is essential for financial planning.

In many Western countries, individual retirement accounts (IRAs) are prevalent. These accounts offer a range of investment options and flexibility but often lack the employer contribution element that is a cornerstone of the EPF system. In contrast, the EPF's mandatory employer contributions ensure a consistent stream of savings growth, a significant advantage over solely self-funded retirement plans.

However, the EPF's structure also means individuals have limited control over their investment choices. The funds are managed by the EPF, and withdrawal options are restricted to specific life events like buying a home, funding education, or upon reaching retirement age. This lack of flexibility might be a drawback for individuals who prefer a more hands-on approach to their investments or require access to a larger portion of their savings before retirement.

Navigating these nuances requires a balanced perspective. Recognizing the strengths and limitations of the EPF system allows individuals to make informed decisions about their financial future in Malaysia. Supplementing EPF savings with personal investments or alternative retirement planning tools can be a viable strategy for individuals seeking greater control or flexibility, ensuring a well-rounded approach to securing financial well-being for the long term.

In conclusion, understanding 'cara membuka akaun KWSP' and how the EPF operates is not just about learning a process; it's about taking a proactive step towards financial security and planning for a brighter future. By understanding the importance of the EPF, knowing how to open and manage your account, and exploring additional avenues for retirement planning, you can pave the way for a financially secure and fulfilling life in Malaysia. Remember, the journey to a comfortable retirement starts with a single step – opening your EPF account today.

Kwsp Majikan, Cara Register Akaun Kwsp Gov my (EPF) - Trees By Bike

Cara Daftar Akaun KWSP : Panduan daftar online dengan mudah! - Trees By Bike

Pengeluaran KWSP Melalui Akaun 3 - Trees By Bike

Contoh Surat Sokongan Majikan Contoh Surat Pengesahan Majikan Dan - Trees By Bike

cara membuka akaun kwsp - Trees By Bike

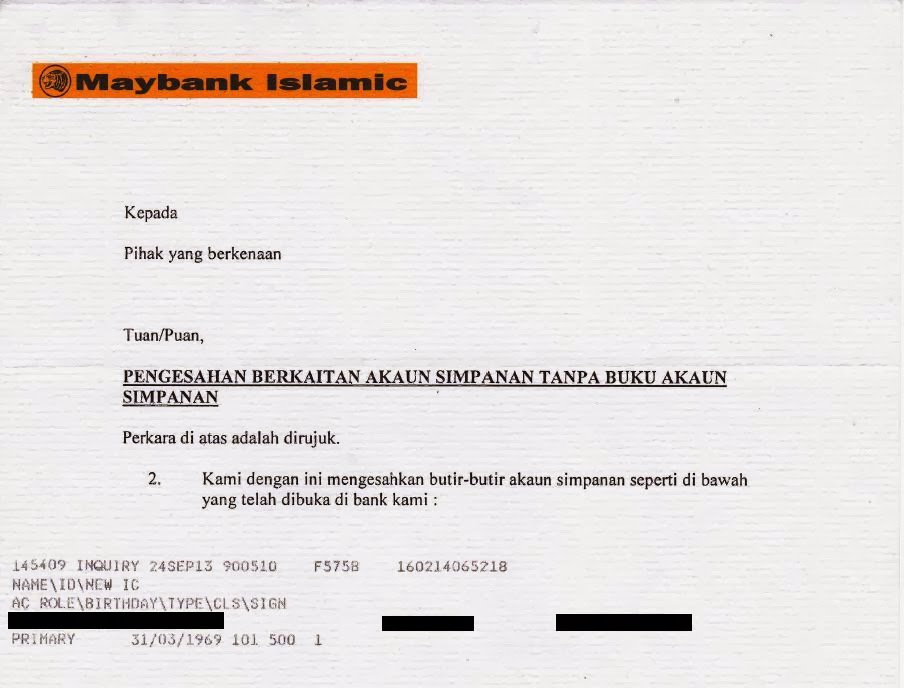

Maybank Contoh Surat Buka Akaun Bank Untuk Pekerja - Trees By Bike

cara membuka akaun kwsp - Trees By Bike

Kwsp Majikan, Cara Register Akaun Kwsp Gov my (EPF) - Trees By Bike

Cara Buka Akaun KWSP (Daftar Kali Pertama) - Trees By Bike

Akaun 3 KWSP : Pengeluaran Berkala Pasca Persaraan - Trees By Bike

cara membuka akaun kwsp - Trees By Bike

Surat Permohonan Buka Akaun Bank Persatuan - Trees By Bike