In the vibrant state of Selangor, Malaysia, where faith and modernity intertwine, the concept of Zakat holds deep significance for Muslims. Zakat, one of the five pillars of Islam, emphasizes the importance of giving back to the community and purifying one's wealth. To facilitate this noble practice, the Selangor Zakat Board offers a convenient and efficient method for individuals to fulfill their Zakat obligations – the Selangor Zakat salary deduction form, often referred to as "borang kebenaran potongan gaji zakat Selangor".

This form acts as a bridge between individuals who wish to fulfill their Zakat and the beneficiaries who rely on this support. But what exactly is this form, and how does it simplify the process of Zakat payment? This article will serve as your comprehensive guide to understanding the Selangor Zakat salary deduction form and its benefits.

The concept of Zakat is deeply rooted in Islamic tradition, emphasizing the equitable distribution of wealth and social responsibility. "Borang kebenaran potongan gaji zakat Selangor" directly translates to "Salary Deduction Authorization Form for Zakat Selangor". This form allows individuals employed in Selangor to automate their Zakat payments by authorizing their employers to deduct a pre-determined amount of Zakat directly from their salaries each month.

This system not only streamlines the process of Zakat payment but also encourages consistent giving. The deducted Zakat is then distributed by the Selangor Zakat Board to eligible recipients, ensuring transparency and accountability in the allocation of funds.

Before the introduction of this simplified system, individuals had to physically go to Zakat collection centers or navigate online platforms, which could be time-consuming and pose challenges for some. The introduction of the Selangor Zakat salary deduction form marked a significant step towards making Zakat payment hassle-free and accessible to all segments of society.

Advantages and Disadvantages of Using the Selangor Zakat Salary Deduction Form

Let's delve into the pros and cons of utilizing this system:

| Advantages | Disadvantages |

|---|---|

| Convenience and Time-Saving: Automates Zakat payments, eliminating manual processes. | Potential for Errors: Requires careful review of salary slips to ensure accurate deductions. |

| Consistent Giving: Promotes regular Zakat contributions, fostering a culture of giving. | Limited Control: May not suit individuals who prefer making lump-sum Zakat payments. |

| Transparency and Accountability: Ensures funds are managed and distributed efficiently by the Selangor Zakat Board. | Requires Employer Participation: Only applicable to employed individuals whose employers facilitate the deduction system. |

While the Selangor Zakat salary deduction form offers significant advantages, it's important to consider individual circumstances and preferences when deciding on the most suitable Zakat payment method. This system highlights Selangor's commitment to leveraging technology and accessible solutions to facilitate religious practices and social responsibility.

Borang Potongan Gaji Bayar Zakat Format Melaka - Trees By Bike

Borang kebenaran potongan gaji bagi bayaran balik pembiayaan pendidikan - Trees By Bike

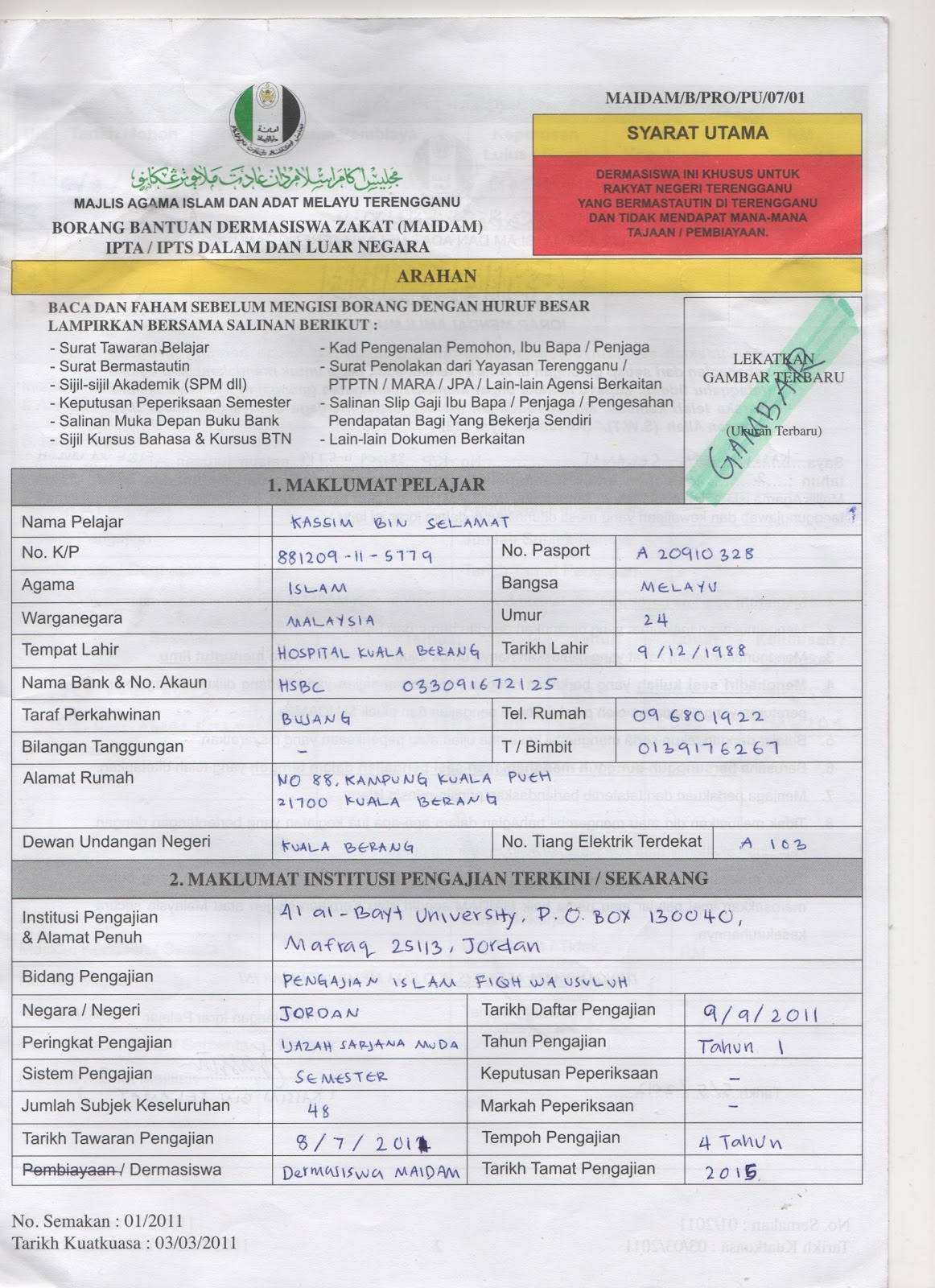

Borang Potongan Zakat Maidam - Trees By Bike

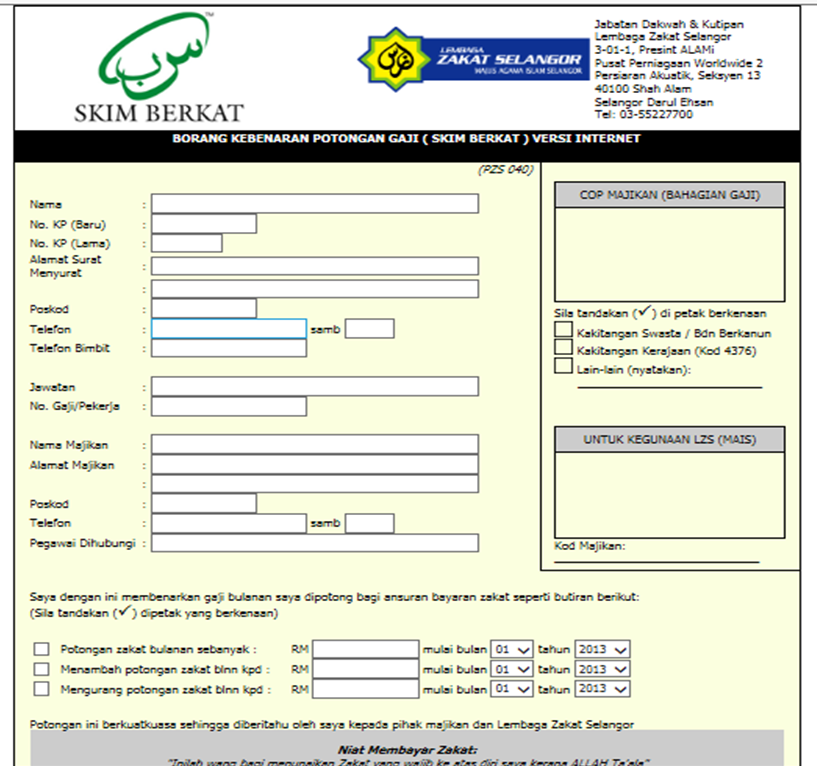

borang kebenaran potongan gaji zakat selangor - Trees By Bike

Borang Kebenaran Bayaran Balik Pinjaman Latihan Kemahiran Melalui - Trees By Bike

borang kebenaran potongan gaji zakat selangor - Trees By Bike

Borang A Zakat Selangor - Trees By Bike

BORANG POTONGAN ZAKAT MAJLIS AGAMA ISLAM JOHOR (MAIJ) FORMAT B - Trees By Bike

PERMOHONAN POTONGAN GAJI PTPTN:CARA BAYAR MELALUI POTONGAN GAJI (Borang - Trees By Bike

Borang A Zakat Selangor - Trees By Bike