Imagine this: you're on the cusp of realizing a lifelong dream – starting your own business, funding your education, or finally purchasing your dream home. But there's a catch – you need a little financial boost to make it happen. This is where the "surat permohonan pengajuan pinjaman" comes in, acting as a bridge between aspiration and reality in the Indonesian financial landscape.

"Surat permohonan pengajuan pinjaman" translates directly to "loan application letter" in English. While it might seem like just paperwork, it represents a formal request for financial assistance, outlining your plans and demonstrating your commitment to repayment. This seemingly simple document plays a crucial role in Indonesia's financial ecosystem, particularly for individuals and small businesses seeking access to credit.

Historically, access to formal financial institutions in Indonesia has been limited for certain segments of the population. This is where the "surat permohonan pengajuan pinjaman" comes in, serving as a vital tool for individuals and small businesses to demonstrate their creditworthiness and secure the funds they need to achieve their goals.

But the significance of this document extends beyond its functional purpose. It represents a commitment to transparency and accountability between the borrower and the lender. For borrowers, it's an opportunity to articulate their financial needs and demonstrate their dedication to fulfilling their financial obligations. For lenders, it provides valuable insights into the borrower's financial situation and helps them assess the risks associated with the loan.

Navigating the world of loans and financial applications can seem daunting, especially if you're unfamiliar with the process. However, understanding the "surat permohonan pengajuan pinjaman" and its significance is the first step towards unlocking financial opportunities and taking control of your financial future.

Advantages and Disadvantages of Surat Permohonan Pengajuan Pinjaman

| Advantages | Disadvantages |

|---|---|

| Provides a structured way to request financing | Can be time-consuming to prepare |

| Encourages transparency and accountability | Requires careful documentation and financial planning |

| Essential for accessing formal financial services | Approval is not guaranteed and depends on various factors |

While the "surat permohonan pengajuan pinjaman" plays a crucial role in Indonesia's financial landscape, it's essential to approach the process with a thorough understanding of its nuances and potential challenges. However, with careful planning, clear communication, and a commitment to financial responsibility, it can be a powerful tool for individuals and businesses seeking to unlock their full potential.

25+ Contoh Surat Permohonan Bantuan Dana, Barang, DLL - Trees By Bike

Contoh Surat Permohonan Keringanan Pelunasan Kpr Maybank Imagesee - Trees By Bike

Contoh Surat Permohonan Pengajuan Pinjaman Ke Bank - Trees By Bike

Cara Buat Surat Pengajuan Pinjaman - Trees By Bike

Detail Contoh Surat Permohonan Pinjaman Uang Ke Kantor Koleksi Nomer 11 - Trees By Bike

11 Contoh Surat Permohonan Pembayaran Piutang - Trees By Bike

Contoh Surat Pengajuan Pinjaman Ke Kantor - Trees By Bike

Contoh Surat Permohonan Kesediaan Membuka Acara - Trees By Bike

Contoh Surat Pengajuan Pinjaman Uang - Trees By Bike

Surat Permohonan Pengajuan Pinjaman Doc Surat Permohonan Keringanan - Trees By Bike

Contoh Surat Pengajuan Pinjaman Ke Perusahaan - Trees By Bike

Surat Permohonan Dan Jaminan - Trees By Bike

Contoh Surat Permohonan Pengajuan Pinjaman Koperasi Kakitangan - Trees By Bike

Surat Permohonan Pembayaran Pekerjaan - Trees By Bike

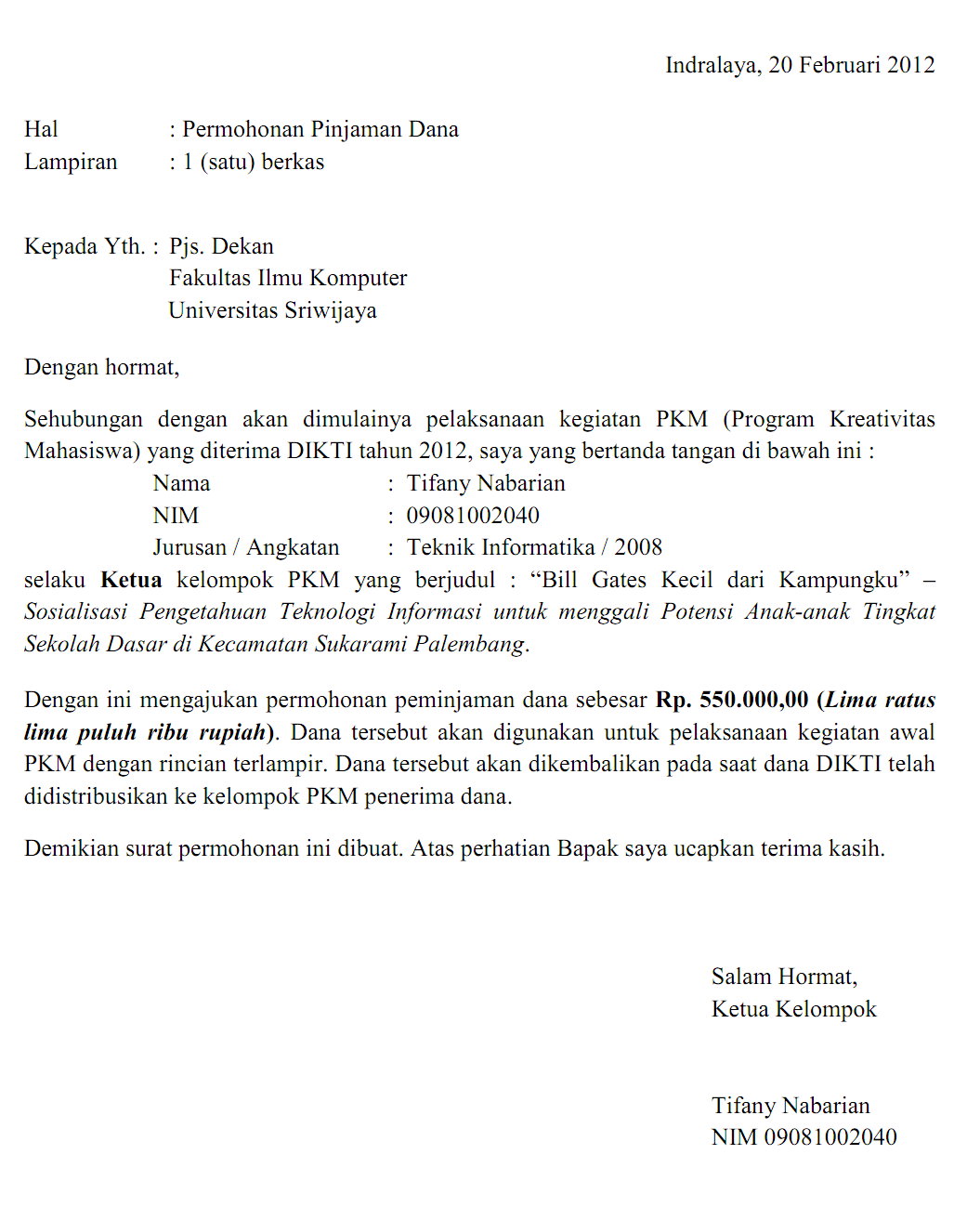

Surat Permohonan Pengajuan Pinjaman - Trees By Bike