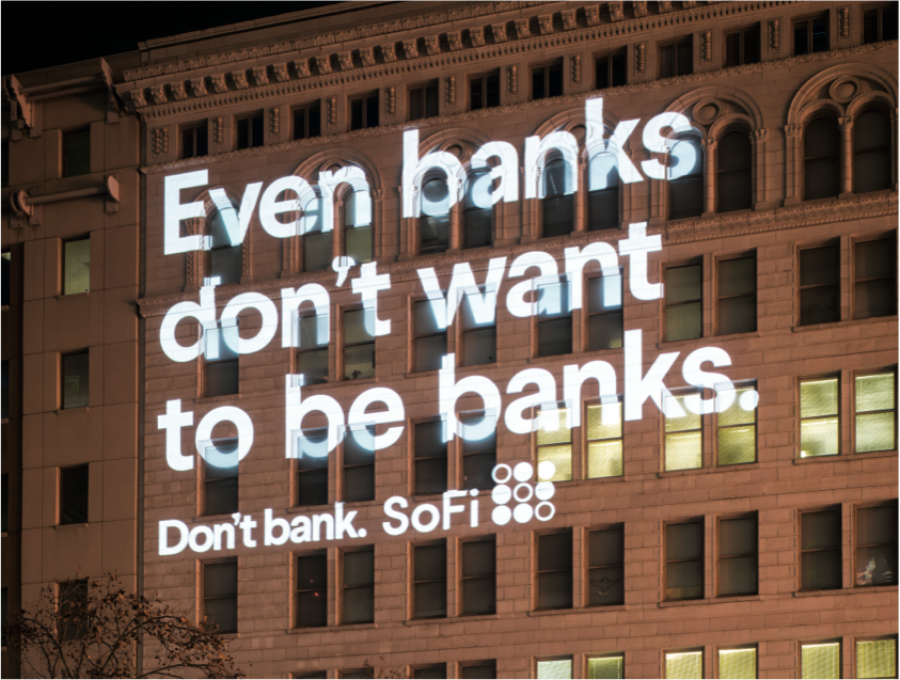

There's a certain energy in the air these days, a sense of transformation rippling through the archaic structures of traditional banking. It's a quiet revolution, driven by technology and fueled by a desire for something more, something…different. In the midst of this shift, a new breed of financial institution has emerged, challenging conventions and capturing the attention of a generation hungry for change. One such name echoing in this new landscape? SoFi. But what exactly *is* SoFi? What type of bank operates with the sleekness of a tech startup and the heart of a financial ally?

SoFi, short for Social Finance, isn't a bank in the traditional brick-and-mortar sense. It's a digital personal finance company, an online platform redefining how we interact with our money. Imagine a world without the constraints of physical branches, where financial services are streamlined, personalized, and accessible at your fingertips. This is the space SoFi occupies – a world where loans, banking, investing, and even insurance converge seamlessly in the digital realm.

The story of SoFi begins not in the hallowed halls of Wall Street, but amidst the vibrant energy of Stanford University. Founded in 2011 by Stanford business school students, SoFi's initial mission was to simplify student loan refinancing. They recognized a glaring disconnect in how financial institutions served young professionals burdened by student debt. With a vision to leverage technology and a community-centric approach, SoFi set out to reshape the financial landscape for the better.

Fast forward to today, and SoFi has blossomed into a financial powerhouse, expanding its offerings far beyond student loans. From personal and home loans to checking and savings accounts, investment options, and even insurance – SoFi has become a one-stop shop for all things personal finance. Their commitment to providing innovative solutions and a seamless user experience has resonated with millions of members seeking a modern, transparent, and accessible alternative to traditional banking.

The rise of SoFi and other online financial platforms signifies a larger shift in the financial landscape. The days of rigid banking hours, endless paperwork, and impersonal service are fading. In their place, a new era of finance is dawning – one defined by technology, transparency, and personalized service. It's a change fueled by the evolving needs and expectations of today's consumers, who are increasingly comfortable navigating their financial lives in the digital world. So, as we stand at the precipice of this financial evolution, the question remains: are you ready to embrace the change?

Advantages and Disadvantages of SoFi

| Advantages | Disadvantages |

|---|---|

| Typically lower fees than traditional banks | Limited physical branch access |

| Convenient online and mobile platform | May not offer all the services of a traditional bank |

| Competitive interest rates and loan options | Customer service accessibility can be different than traditional banks |

Common Questions about SoFi

1. Is SoFi a legitimate financial institution?

Yes, SoFi is a well-established and reputable online personal finance company regulated by various financial authorities.

2. What are the eligibility requirements to become a SoFi member?

Generally, you must be a U.S. resident, over 18 years old, and meet certain creditworthiness criteria.

3. How secure is my personal and financial information with SoFi?

SoFi utilizes industry-standard security measures, including encryption and multi-factor authentication, to protect your information.

4. Can I deposit cash into my SoFi account?

SoFi offers various deposit methods, but cash deposits may have limited options.

5. Does SoFi offer investment advice?

While SoFi provides investment options, they do not offer personalized investment advice.

6. How do I contact SoFi customer service?

SoFi offers various customer support channels, including phone, email, and online chat.

7. Does SoFi have a mobile app?

Yes, SoFi has a highly-rated mobile app for both Android and iOS devices.

8. What if I need access to a physical branch?

As an online platform, SoFi has limited physical branch access.

The financial world, much like the sartorial choices we make each morning, is shifting. There's a desire for something more tailored, more attuned to our individual needs. And while the allure of a classic, established institution remains, there's a growing fascination with those who dare to innovate, who offer a fresh perspective on how we manage our financial lives. SoFi embodies this spirit of innovation. It's a testament to the belief that finance can be as intuitive, as personalized, and as forward-thinking as we are. Whether you're seeking financial freedom, looking to invest wisely, or simply seeking a banking experience that aligns with your modern lifestyle, exploring SoFi's offerings might be the step you need to take charge of your financial future.

China needs reforms to halt 'significant' growth declines: IMF chief - Trees By Bike

All Gr Type Pokemon Names - Trees By Bike

TORTA SCENOGRAFICA ME CONTRO TE LUI' E SOFI' A 2 PIANI Baby Birthday - Trees By Bike

Intp Personality Type, Myers Briggs Personality Types, Myers Briggs - Trees By Bike

Inside SoFi Stadium: Cost, capacity & more to know about Los Angeles - Trees By Bike

Cognitive Functions Mbti, Things To Do With Boys, Boys Watches, Alvin - Trees By Bike

Intp Personality, Myers Briggs Personality Types, Myers Briggs - Trees By Bike

Free Typeface, Logo Fonts, Typography Fonts, Typography Design - Trees By Bike

Typography Fonts, Lettering, Typography Design, Font Design, Type - Trees By Bike

Myers Briggs Type, Mbti Personality, Typology, Isfj, Sentinel - Trees By Bike

what type of bank is sofi - Trees By Bike

Stupid Funny Memes, Funny Laugh, Hilarious, Type Of Girlfriend, Rainbow - Trees By Bike

Infj Traits, Intj And Infj, Infj Mbti, Intp T, Estp, Myers Briggs - Trees By Bike

Jeff For Banks: Don't Bank. SoFi - Trees By Bike

Infj Traits, Personality Archetypes, Personality Chart, Meyers Briggs - Trees By Bike