Turning 65 is a major milestone, often associated with retirement and significant changes to your healthcare landscape. One question that frequently pops up is: What happens to my Health Savings Account (HSA)? More specifically, can I still contribute to it during the year I turn 65?

Understanding the rules surrounding HSAs and Medicare eligibility is crucial for making informed financial decisions as you approach this age. This isn't just about avoiding penalties; it's about leveraging every available tool to manage healthcare costs, especially during retirement.

The good news is that you might still be able to contribute to your HSA in the year you turn 65, but there's a catch. Eligibility hinges on a critical factor: your Medicare enrollment. Let's unpack this further.

If you're turning 65, it means you're aging into Medicare, the federal health insurance program for those 65 and older. This program plays a significant role in determining your HSA eligibility.

Here's the key: you can contribute to your HSA up to the month before your Medicare Part A coverage begins. Most people enroll in Medicare Part A around their 65th birthday, as it's often premium-free if you or your spouse worked and paid Medicare taxes for a specific duration. However, if you delay your Medicare Part A enrollment for any reason, you might have a window to continue your HSA contributions.

Let's illustrate this with a scenario. Imagine Sarah's 65th birthday is in July. If she enrolls in Medicare Part A in July, her HSA contributions must stop by June 30th. But, if Sarah delays her Medicare Part A enrollment until September, she can continue contributing to her HSA until August 31st.

It's important to note that once you're enrolled in Medicare, you are generally not eligible to contribute to an HSA. This is because Medicare and HSAs are fundamentally different in their approach to healthcare coverage and savings.

However, contributing to an HSA, even for a portion of the year you turn 65, can provide valuable benefits:

Tax Savings: HSA contributions are tax-deductible, reducing your taxable income and potentially lowering your tax liability for the year.

Continued Growth: Even if you can't contribute after enrolling in Medicare, the funds in your HSA can continue to grow tax-free. This means your healthcare savings have the potential to accumulate faster.

Flexibility: HSAs offer incredible flexibility. You can use the funds to pay for qualified medical expenses, including deductibles, copayments, and even some dental and vision care, both now and in the future.

Navigating the rules surrounding HSAs and Medicare can be complex. Here's a simplified action plan to help you make the most of your healthcare savings as you approach 65:

1. Know Your Medicare Enrollment Date: Determine the exact date your Medicare Part A coverage will begin. This information is crucial for planning your HSA contributions.

2. Calculate Your Maximum Contribution: Based on your Medicare enrollment date, calculate the maximum amount you can contribute to your HSA in the year you turn 65. Remember, contributions are prorated based on the months you're eligible.

3. Consider a Catch-Up Contribution: If you're 55 or older, you may be eligible to make an additional "catch-up" contribution to your HSA. This allows you to boost your savings as you approach retirement.

4. Consult a Financial Advisor: For personalized guidance tailored to your specific financial situation and healthcare needs, consider consulting with a qualified financial advisor.

Understanding the interplay between HSAs and Medicare eligibility in the year you turn 65 is paramount for informed financial planning. While you might not be able to contribute for the entire year, even partial contributions can provide significant tax advantages and long-term healthcare savings.

Remember, knowledge is power. Arm yourself with the right information, plan strategically, and enter this new chapter with confidence, knowing you've optimized your healthcare finances for the future.

HSA, HRA, HEALTHCARE FSA AND DEPENDENT CARE ELIGIBILITY LIST - Trees By Bike

Maximum Annual Hsa Contribution 2024 Married Filing - Trees By Bike

How much should I put into my HSA? - Trees By Bike

How Much Should You Contribute To Your HSA This Year? - Trees By Bike

11 Tax Breaks That Only People Over 50 Get - Trees By Bike

Max Amount For Hsa 2024 - Trees By Bike

How Much Can I Contribute to My HSA in 2022? - Trees By Bike

2019 FSA and HSA Contribution Limits - Trees By Bike

HSA Contribution Limits 2024: What You Can Contribute in the USA - Trees By Bike

can i contribute to my hsa the year i turn 65 - Trees By Bike

Can I Use My Hsa To Pay For Someone Else S Medical Expenses at Tony - Trees By Bike

How Much Can I Contribute to My HSA in 2023? - Trees By Bike

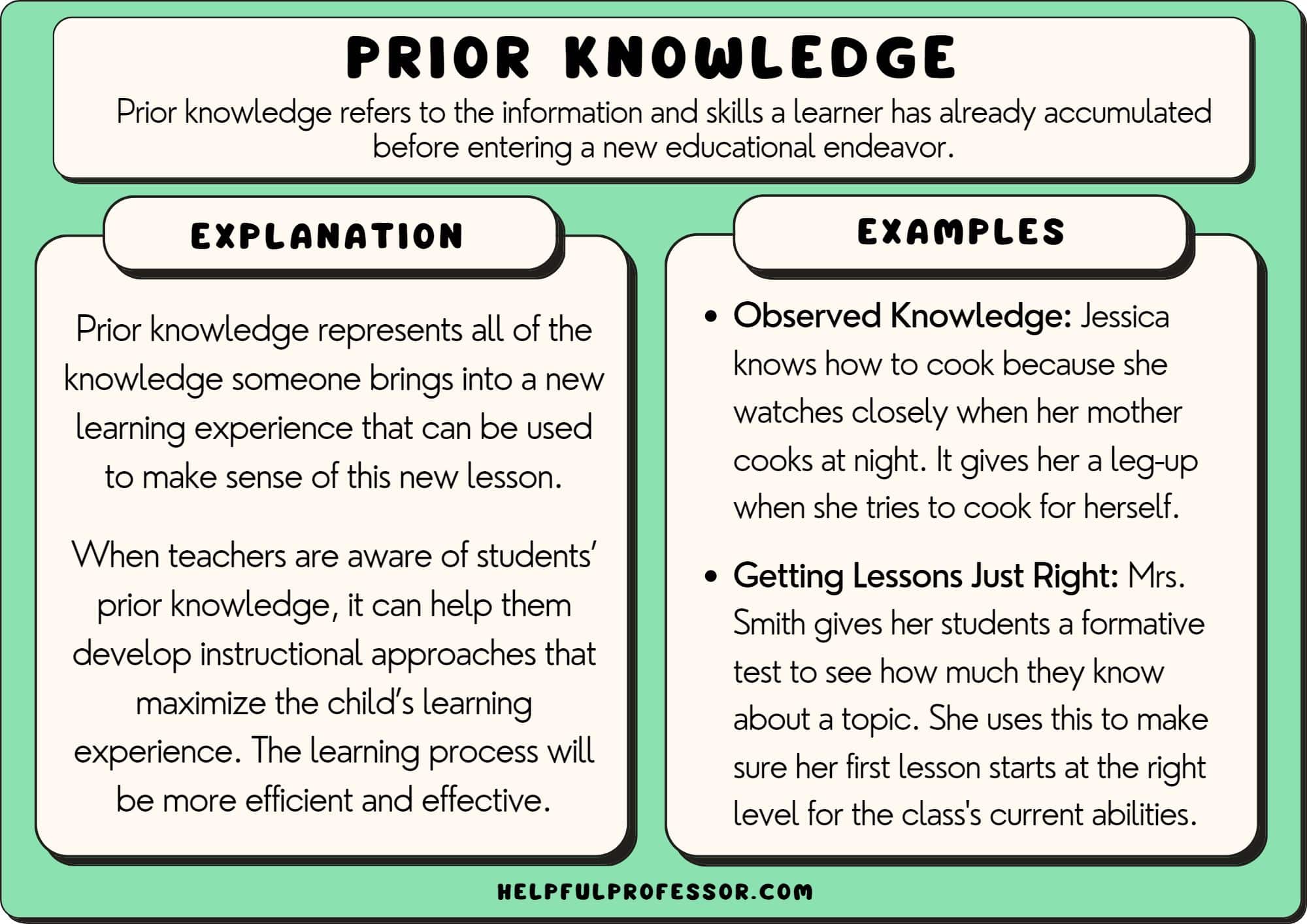

Prior Knowledge (Educational Concept): Meaning & Examples (2024) - Trees By Bike

Max Hsa Contribution 2024 Single Over 55 - Trees By Bike

Who can contribute to your HSA? When should they do it? How much is - Trees By Bike