Imagine this: you're going through your mail and stumble upon an official-looking letter. You hesitantly open it, and to your surprise, it informs you that you have a significant sum of unclaimed money waiting to be claimed. It might sound too good to be true, but the reality is that billions of dollars are sitting unclaimed in various accounts worldwide, just waiting for their rightful owners.

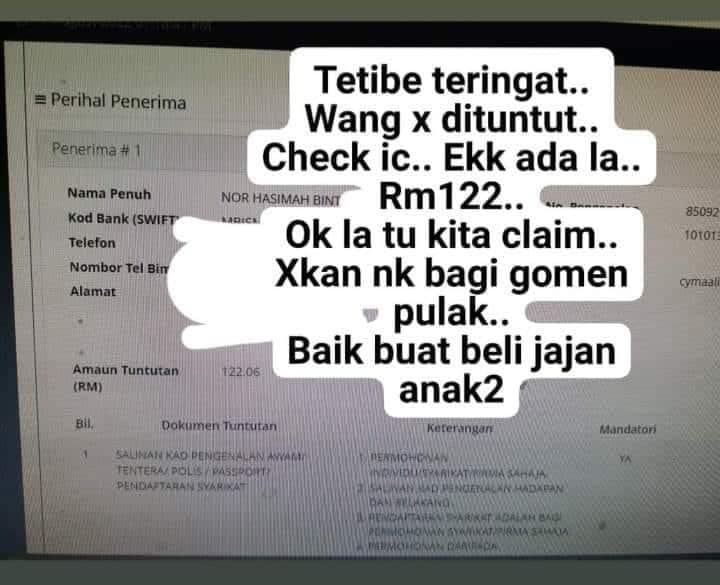

This unclaimed money, often referred to as "kumpulan wang yang tidak dituntut" in Malay, encompasses a wide range of financial assets. From forgotten bank accounts and uncashed checks to unclaimed insurance benefits and utility deposits, these funds can originate from various sources.

The reasons why this money remains unclaimed are diverse. People move, forget about old accounts, or simply don't realize they're entitled to these funds. In other cases, beneficiaries might be unaware of their inheritance or lack the necessary documentation to make a claim.

The existence of unclaimed money presents both challenges and opportunities. On the one hand, it highlights the importance of financial literacy and keeping track of personal finances. On the other hand, it offers a glimmer of hope for individuals facing financial hardship or those simply seeking to recover what's rightfully theirs.

Navigating the world of unclaimed money can seem daunting, but it doesn't have to be. Numerous resources and government agencies are dedicated to reuniting individuals with their lost assets. Online databases, public records searches, and professional tracing services can all be valuable tools in this endeavor.

Advantages and Disadvantages of Searching for Unclaimed Money

| Advantages | Disadvantages |

|---|---|

| Potential to recover significant sums of money | Time-consuming research and paperwork |

| Free or low-cost search options available | Risk of scams and fraudulent schemes |

| Sense of satisfaction and closure upon claiming what's rightfully yours | No guarantee of finding unclaimed funds |

Common Questions About Unclaimed Money (Kumpulan Wang Yang Tidak Dituntut)

1. What are the most common types of unclaimed money?

Common types include dormant bank accounts, uncashed checks, unclaimed life insurance policies, forgotten retirement funds, and utility deposits.

2. How can I find out if I have unclaimed money?

Start by searching online databases like those offered by your state's treasury department or unclaimed property office. Consider using reputable unclaimed money search engines and explore national databases like the National Association of Unclaimed Property Administrators (NAUPA).

3. Is there a fee to claim unclaimed money?

While legitimate government agencies typically don't charge fees for claiming, be wary of companies that require upfront payments or a percentage of your recovered funds.

4. What documents do I need to claim unclaimed money?

Required documentation varies but often includes proof of identity, Social Security number, and documentation supporting your claim (e.g., bank statements, policy numbers).

5. How long does it take to receive unclaimed money?

The process can range from a few weeks to several months, depending on the complexity of the claim and the responsiveness of the holding institution.

6. Is there a time limit to claim unclaimed money?

While some states impose time limits, many allow rightful owners (or their heirs) to claim funds indefinitely.

7. What happens to unclaimed money if it's never claimed?

In most cases, unclaimed funds are held by the state in perpetuity. However, the specific rules vary by jurisdiction.

8. How can I prevent my money from becoming unclaimed?

Keep track of your financial accounts, update your contact information with institutions holding your assets, and inform beneficiaries about any accounts or policies they might be entitled to.

Conclusion

The pursuit of unclaimed money, or "kumpulan wang yang tidak dituntut," can be an intriguing endeavor. While there's no guarantee of striking it rich, the potential to recover forgotten funds is a prospect worth exploring. By understanding the ins and outs of unclaimed money, being aware of potential scams, and adopting responsible financial habits, you can increase your chances of reuniting with any lost assets and gain greater control over your financial well-being. So, why not embark on this financial treasure hunt today? You never know what forgotten fortune might be waiting for you.

Apa Itu Wang Tidak Dituntut? - Trees By Bike

Dalam IC Kita Ada Duit? Ini Cara Nak 'Claim' Duit Yang Tidak Dituntut - Trees By Bike

EGumis : Semak Wang Yang Tidak Dituntut - Trees By Bike

eGumis : Semakan Wang Yang Tak Dituntut Online Tahun 2023 - Trees By Bike

Harapandaily on Twitter: "Kerajaan akan mempertimbang cadangan untuk - Trees By Bike

Cara Semak Wang Tak Dituntut Online 2024 - Trees By Bike

[VIDEO] Dewan Rakyat: Wang tidak dituntut mencecah RM11.2 bilion - Trees By Bike

Semakan Tuntutan Wang Tidak Dituntut (WTD) Bulan Januari 2023 - Trees By Bike

Wang Tak Dituntut : Semakan Online Di Portal eGumis - Trees By Bike

Cara Claim Wang Yang Tidak Dituntut (WTD) Tahun 2023 - Trees By Bike

eGUMIS: Sistem Semakan Wang Tidak Dituntut Secara Online - Trees By Bike

Permohonan Pembayaran Balik Wang Tidak Dituntut di Jabatan Akauntan Negara - Trees By Bike

Wang Tak Dituntut : Cara Semak Melalui eGumis 2024 - Trees By Bike

eGumis : Semak Wang Tidak Dituntut Anda Bulan Disember 2022, Tempoh - Trees By Bike

Semak Wang Tidak Dituntut(WTD) Bulan Disember Anda Segera - Trees By Bike

![[VIDEO] Dewan Rakyat: Wang tidak dituntut mencecah RM11.2 bilion](https://i2.wp.com/media.buletintv3.my/2023/05/vIigXWZq-BULETIN-TV3-9.jpg)