Planning for a secure retirement is a universal aspiration, and for Malaysians, the Employees Provident Fund (EPF) stands as a cornerstone of this endeavor. The EPF is a comprehensive social security institution that helps individuals save for their retirement, but navigating its intricacies can seem daunting. One crucial aspect that often raises questions is the allocation of funds between EPF Account 1 and Account 2, often referred to as "Pembahagian KWSP Akaun 1 dan 2" in Malay.

Understanding this allocation is paramount as it directly influences your long-term financial well-being. It's not just about numbers on a statement; it's about ensuring you have the financial resources to maintain your quality of life during your golden years. This article aims to demystify the concept of EPF Account 1 and Account 2 allocation, providing you with the knowledge to make informed decisions about your retirement savings.

Imagine this: you're picturing your retirement, free from work commitments and ready to enjoy the fruits of your labor. This is where the importance of understanding your EPF savings comes into play. The EPF scheme is designed to ensure a financially secure retirement for Malaysian employees. It's a structured savings plan where both the employee and employer contribute a portion of the employee's salary each month.

Now, within your EPF account, your savings are divided into two distinct accounts: Account 1 and Account 2. This segregation, known as "Pembahagian KWSP Akaun 1 dan 2," is not arbitrary; it serves a specific purpose. Each account plays a different role in securing your financial future. Account 1, holding the larger portion of your contributions, is your primary retirement fund. It's meant to be a safety net, ensuring you have enough to support yourself after retirement.

On the other hand, Account 2 offers a degree of flexibility, allowing you to utilize a portion of your savings for specific purposes before retirement. These permitted withdrawals cover essential needs such as housing, healthcare, and education, offering financial support during your working years.

Advantages and Disadvantages of EPF Account 1 and 2 Allocation

While the system is designed to benefit you, it's crucial to be aware of both the advantages and potential drawbacks of this allocation. Let's delve deeper into the pros and cons to gain a comprehensive understanding:

| Feature | Advantages | Disadvantages |

|---|---|---|

| Account 1 |

|

|

| Account 2 |

|

|

Understanding the benefits and drawbacks of "Pembahagian KWSP Akaun 1 dan 2" empowers you to make well-informed decisions about your EPF savings. It's about finding the right balance between utilizing funds for present needs and ensuring a comfortable retirement.

Remember, securing your financial future is a journey, and understanding the tools at your disposal is the first step. "Pembahagian KWSP Akaun 1 dan 2" is not just a financial mechanism; it's a pathway to a brighter and more secure retirement.

Akaun 3 KWSP Akan Dilaksanakan Seawal Bulan Mei 2024 - Trees By Bike

pembahagian kwsp akaun 1 dan 2 - Trees By Bike

Pengeluaran KWSP 2024 : Cara Mohon Pengeluaran Akaun 1 & 2 - Trees By Bike

KWSP : Ini 18 jenis Pengeluaran Akaun 1 Dan 2 Sebelum Pencarum Berpencen - Trees By Bike

KWSP : Pengeluaran Melalui Akaun 1 & 2 Kini Dibenarkan - Trees By Bike

pembahagian kwsp akaun 1 dan 2 - Trees By Bike

Pengeluaran KWSP Melalui Akaun 1 Dan 2 - Trees By Bike

pembahagian kwsp akaun 1 dan 2 - Trees By Bike

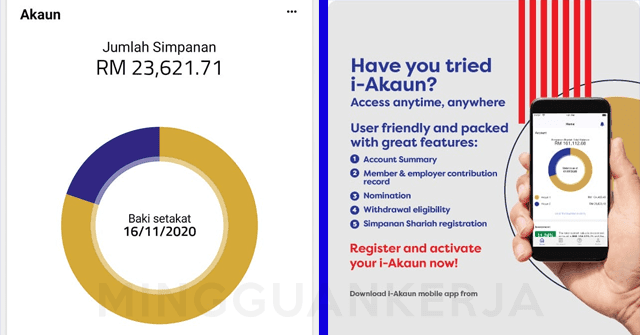

Rujuk Cara Daftar i - Trees By Bike

Cara Semak Akaun KWSP : Akaun 1 dan Akaun 2 - Trees By Bike

Cara Tambah Caruman / Simpanan KWSP Online Melalui i - Trees By Bike

Caruman KWSP Turun Kepada 9%, Maksudnya gaji kita lebih banyak - Trees By Bike

Fungsi Akaun 1 Dan Akaun 2 KWSP Yang Ramai Tak Tahu » EduBestari - Trees By Bike

Contoh Surat Tamat Lesen Perniagaan - Trees By Bike

Permohonan Dan Semakan KWSP i - Trees By Bike