Navigating the complexities of health insurance can be daunting, especially as we age. Many turn to trusted organizations like AARP for guidance. One common question revolves around the relationship between Medicare and AARP plans: Does AARP insurance act as secondary coverage to Medicare? Let's unravel this important topic and gain a clearer understanding of how these plans interact.

AARP, a respected advocacy group for seniors, doesn't directly offer Medicare benefits. Instead, they endorse Medicare Supplement Insurance plans (also known as Medigap) offered by UnitedHealthcare. These plans are designed to supplement Original Medicare (Parts A and B) by helping to cover some of the out-of-pocket costs that Medicare doesn't pay, such as copayments, coinsurance, and deductibles. In essence, AARP-endorsed Medigap plans work in conjunction with, not as a replacement for, Original Medicare.

The interplay between Original Medicare and AARP Medigap plans is designed to provide a more comprehensive safety net for healthcare expenses. Medicare pays its share of covered services first, then the Medigap plan steps in to pick up some or all of the remaining costs, depending on the specific plan chosen. This coordinated approach helps reduce the financial burden on beneficiaries, providing greater peace of mind when facing medical bills.

Understanding the distinction between Medicare Advantage (Part C) and Medicare Supplement plans is crucial. Medicare Advantage plans are an alternative to Original Medicare, offered by private insurance companies. They typically include prescription drug coverage and often offer additional benefits like vision, hearing, and dental. AARP Medigap plans, on the other hand, work alongside Original Medicare and focus specifically on covering gaps in cost-sharing.

The need for supplemental coverage arose from the fact that Original Medicare, while providing valuable benefits, doesn't cover 100% of all medical expenses. Medigap plans aim to fill these gaps, reducing the financial risk for beneficiaries. AARP's endorsement of UnitedHealthcare's plans offers a trusted option for seniors seeking reliable supplemental coverage.

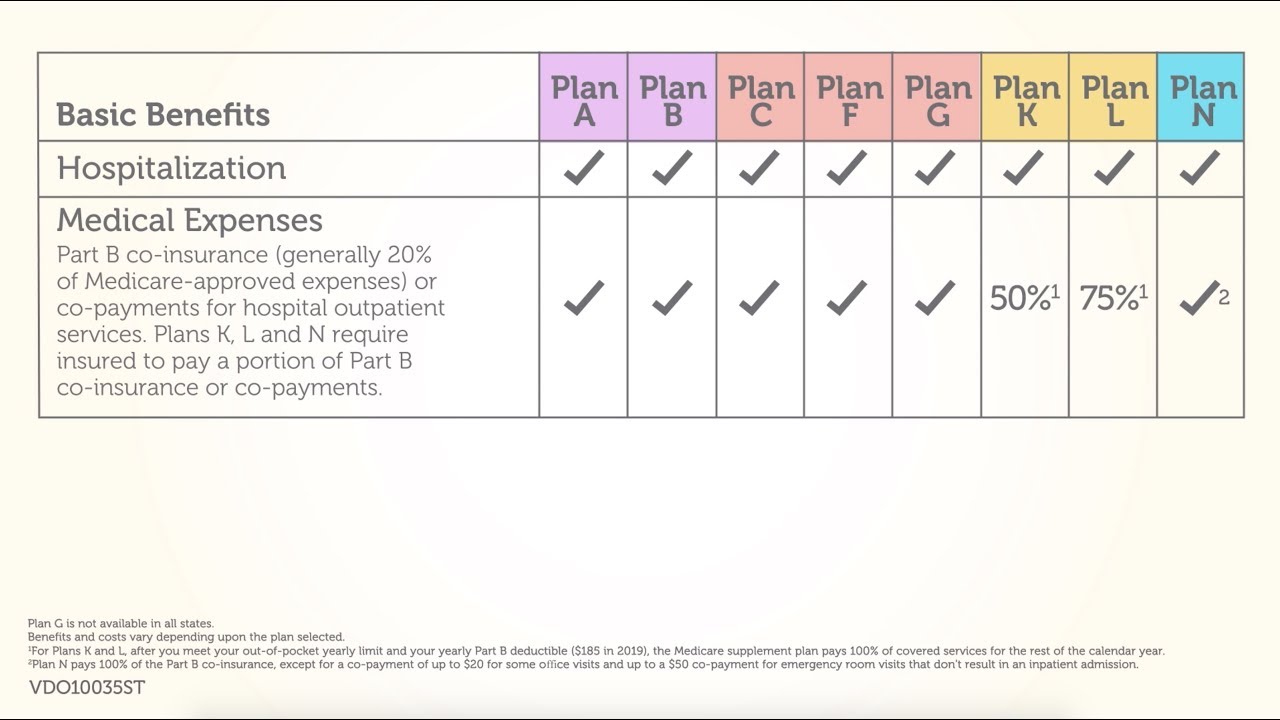

Medigap plans are standardized, meaning they offer the same basic benefits regardless of the insurance company selling them. This standardization allows for easier comparison shopping. AARP plans, like other Medigap plans, are labeled with letters (Plan A, Plan G, etc.), each signifying a specific set of benefits.

One key advantage of AARP Medigap plans is the potential for household discounts, making coverage more affordable for spouses or partners who both enroll. Another benefit is the access to UnitedHealthcare's large network of healthcare providers. Lastly, the AARP brand provides a level of trust and recognition for many seniors.

If you're considering an AARP Medigap plan, you can explore options and get quotes on the UnitedHealthcare website or by contacting them directly. Comparing different plan options and considering your individual healthcare needs and budget will help you choose the best fit.

Advantages and Disadvantages of AARP Medicare Supplement Plans

| Advantages | Disadvantages |

|---|---|

| Predictable out-of-pocket costs | Monthly premiums in addition to Medicare Part B premium |

| Access to a large network of providers | May not cover all out-of-pocket expenses |

| Household discounts may be available | May not be the best option for those with limited budgets |

A common question is whether AARP offers secondary insurance specifically for Medicare Part D (prescription drug coverage). AARP does not offer standalone Medigap plans for Part D. However, some Medicare Advantage plans endorsed by AARP include prescription drug coverage.

Five Best Practices:

1. Compare Medigap plans from different insurers.

2. Review the plan benefits carefully.

3. Consider your healthcare needs and budget.

4. Understand the enrollment periods.

5. Contact UnitedHealthcare or visit their website for detailed information.

FAQ:

1. What is the difference between Medicare and Medigap?

Answer: Medicare provides basic coverage, while Medigap helps pay for out-of-pocket costs.

2. Does AARP offer its own Medicare plans?

Answer: No, AARP endorses plans offered by UnitedHealthcare.

3. What are the different AARP Medigap plans?

Answer: They are standardized plans labeled with letters (A, G, etc.).

4. How much do AARP Medigap plans cost?

Answer: Costs vary depending on the plan and location.

5. How do I enroll in an AARP Medigap plan?

Answer: Contact UnitedHealthcare or visit their website.

6. Can I switch Medigap plans?

Answer: Yes, but you may be subject to underwriting.

7. Does AARP offer Medigap for Part D?

Answer: No, but some AARP Medicare Advantage plans include drug coverage.

8. Where can I find more information?

Answer: Visit the Medicare.gov and UnitedHealthcare websites.

In conclusion, AARP plays a valuable role in helping seniors navigate the complexities of Medicare by endorsing Medicare Supplement plans offered by UnitedHealthcare. These plans act as secondary insurance to Original Medicare, covering some of the costs that Medicare doesn't. Understanding the role of Medigap, the various plan options, and how these plans interact with Medicare is essential for making informed decisions about your healthcare coverage. By carefully considering your needs and comparing available options, you can find the best plan to supplement your Medicare benefits and provide greater financial security in retirement. Take the time to research, compare plans, and seek guidance if needed. Your health and financial well-being are worth the effort. Reach out to UnitedHealthcare or visit their website to explore the AARP Medigap plans available in your area and take a proactive step toward securing your healthcare future.

New Medicare Cards Coming Soon - Trees By Bike

Aarp Supplemental Insurance Plans - Trees By Bike

Medicare Advantage Plans 2024 Comparison Chart - Trees By Bike

Simplifying AARP Secondary Insurance to Medicare Your Essential Guide - Trees By Bike

Aarp Supplemental Insurance To Medicare - Trees By Bike

is medicare aarp a secondary ins to medicare - Trees By Bike

What Is Medicare Supplement Plan G Plus at Patricia Roberts blog - Trees By Bike

AARP Medicare Supplement Insurance Plan from UnitedHealthcare - Trees By Bike

is medicare aarp a secondary ins to medicare - Trees By Bike

Aarp Supplemental Insurance To Medicare - Trees By Bike