In today's fast-paced world, where time is a precious commodity, we seek streamlined solutions that seamlessly integrate into our lives. Imagine effortlessly depositing checks from the comfort of your home, bypassing the need for a physical bank visit. This is the allure of mobile check deposit. But what if you're dealing with substantial sums? Understanding the nuances of Wells Fargo's mobile deposit limits becomes paramount.

Navigating the world of mobile banking can sometimes feel like traversing a hidden labyrinth. One crucial aspect to demystify is the Wells Fargo mobile deposit limit. This threshold dictates the maximum amount you can deposit via your smartphone or tablet. While mobile banking offers unparalleled convenience, understanding these limitations is crucial for a frictionless experience. This exploration will delve into the depths of Wells Fargo's mobile deposit policies, empowering you with the knowledge to navigate this financial landscape.

The genesis of mobile check deposit is intertwined with the rise of smartphones and the increasing demand for digital banking solutions. Traditional banking methods, often requiring physical presence, felt increasingly archaic in our connected world. Mobile deposit emerged as a revolutionary solution, enabling users to deposit checks anytime, anywhere. Wells Fargo, recognizing this evolving need, adopted this technology, offering customers a more convenient banking experience. However, with this convenience came certain limitations, primarily concerning the maximum deposit amount.

The significance of understanding Wells Fargo's mobile deposit cap lies in optimizing your financial flow. Knowing the upper limit allows you to strategically plan your deposits, ensuring a smooth and efficient process. Exceeding the limit can lead to delays, rejected deposits, and unnecessary frustration. By understanding these parameters, you can harness the full potential of mobile banking without encountering unexpected roadblocks.

One of the main issues surrounding mobile deposit limits is the potential for fraud. Financial institutions, including Wells Fargo, must strike a delicate balance between convenience and security. Higher deposit limits can potentially expose banks and customers to greater risks. Therefore, understanding these limitations is not just about convenience; it's also about contributing to a safer banking environment.

Wells Fargo’s mobile deposit limits vary depending on several factors, including account history, customer relationship, and individual risk assessment. The specific limit for your account can be found within the Wells Fargo mobile banking app or by contacting customer service. Generally, new accounts may have lower limits, gradually increasing as the account history demonstrates consistent responsible usage.

Let's illustrate with an example. Imagine you receive a check for $3,000. If your Wells Fargo mobile deposit limit is $2,500, you would need to deposit the check in two separate transactions, or visit a physical branch or ATM. Understanding your limit beforehand prevents potential delays and allows you to plan accordingly.

One benefit of knowing your mobile deposit limit is enhanced financial planning. You can anticipate potential delays and adjust your deposit strategy. Another advantage is the avoidance of rejected deposits, streamlining your cash flow. Finally, understanding these limits contributes to a more secure banking experience, minimizing the risk of potential fraud.

To determine your specific Wells Fargo mobile deposit limit, log into the mobile banking app or contact customer service. This knowledge will empower you to make informed decisions about your deposits.

Advantages and Disadvantages of Mobile Deposit

| Advantages | Disadvantages |

|---|---|

| Convenience | Deposit Limits |

| Time-Saving | Potential for Technical Issues |

Best Practices for Mobile Deposit:

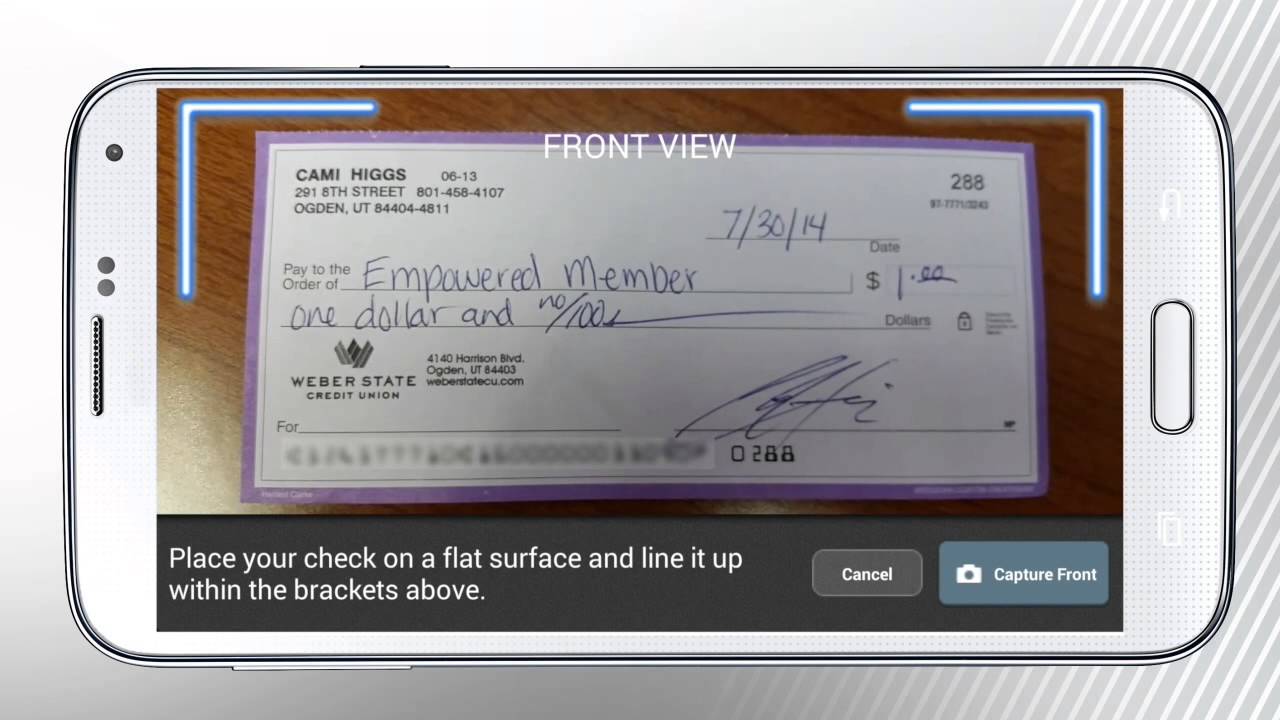

1. Endorse the check properly.

2. Take clear photos of the check.

3. Verify the deposit amount.

4. Keep the physical check until it clears.

5. Monitor your account for confirmation.

FAQ:

1. What is the Wells Fargo mobile deposit limit? - It varies depending on account and customer factors.

2. How can I find my specific limit? - Check the mobile app or contact customer service.

3. What happens if I exceed the limit? - The deposit may be rejected.

4. Can I increase my limit? - It may be possible depending on account history.

5. What types of checks can be deposited? - Most checks are accepted, with some exceptions.

6. Is mobile deposit secure? - Yes, Wells Fargo implements security measures.

7. How long does it take for a mobile deposit to clear? - Typically within a few business days.

8. What should I do with the check after depositing it? - Keep it until it clears, then shred it securely.

In conclusion, navigating the landscape of Wells Fargo mobile check deposit limits requires a mindful approach. Understanding these limits empowers you to optimize your financial flow and avoid potential frustrations. By embracing these best practices and staying informed about your specific deposit limits, you can harness the full potential of mobile banking, seamlessly integrating it into your modern lifestyle. Mobile deposit offers unparalleled convenience in our fast-paced world. Knowing your limits, adhering to best practices, and understanding the security measures in place allows you to leverage this technology confidently and efficiently. By embracing these insights, you can transform your banking experience, making it more seamless, efficient, and aligned with your evolving needs. Take advantage of the convenience while staying informed about your individual account limitations and security best practices.

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike

max mobile deposit wells fargo - Trees By Bike