Imagine a scenario where you're traveling for an extended period, or perhaps you're physically unable to manage your bills personally. What happens then? How do you ensure your financial obligations are met on time? This is where the often-overlooked but incredibly useful tool – the authorization letter for bill payments – comes into play.

In essence, this letter acts as your financial proxy, allowing a trusted individual to handle your bills in your absence. It's a simple yet powerful document that provides peace of mind and ensures financial continuity. Think of it as a temporary delegation of your bill-paying responsibilities, freeing you from potential late fees, service interruptions, or even damage to your credit score.

Now, you might be wondering, "Is this really necessary?" The answer, in many cases, is a resounding yes. Consider the modern individual's busy lifestyle, juggling work, family, and personal commitments. Add to that unexpected travel, illness, or even just the desire for a more streamlined financial management system, and the need for a reliable bill payment solution becomes clear.

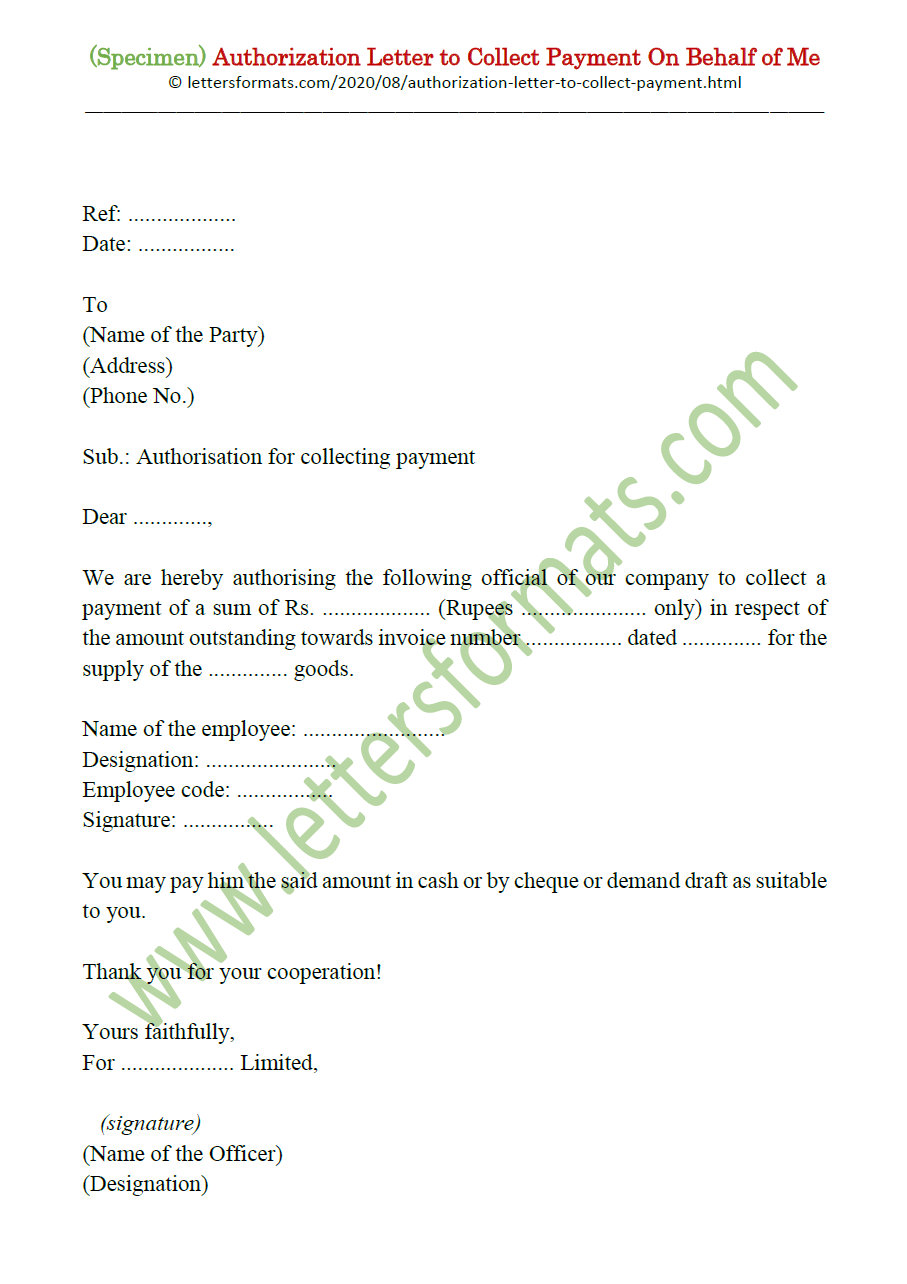

This is where the authorization letter shines. It formalizes the agreement between you and your designated payee, outlining exactly which bills they're authorized to pay, from what accounts, and for how long. This clarity not only safeguards your finances but also strengthens trust and transparency in your financial dealings.

While the concept itself is relatively straightforward, crafting an effective authorization letter involves understanding key elements and best practices. This ensures your letter is legally sound, comprehensive, and serves its intended purpose without any hiccups. In the following sections, we'll delve deeper into the intricacies of these letters, providing you with the knowledge and tools to navigate the world of authorized bill payments confidently.

Let's explore the power of authorization letters and how they can simplify your financial life.

Advantages and Disadvantages of Authorization Letters for Bill Payments

| Advantages | Disadvantages |

|---|---|

| Convenience and flexibility in managing bills | Potential risk of misuse if not handled carefully |

| Ensures timely bill payments, avoiding late fees and penalties | Limited control over individual transactions once authorized |

| Peace of mind knowing your finances are taken care of | Dependence on the authorized person's reliability and trustworthiness |

While authorization letters provide a practical solution, it's crucial to acknowledge both their strengths and limitations to make informed decisions about your financial well-being.

In conclusion, the authorization letter for bill payments, though seemingly simple, plays a vital role in today's fast-paced world. By understanding its nuances, benefits, and potential drawbacks, you can leverage this tool to streamline your financial management, ensuring your bills are paid on time, every time, regardless of your circumstances. This proactive approach not only safeguards your financial health but also provides invaluable peace of mind, allowing you to focus on what truly matters.

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike

authorization letter to pay bills - Trees By Bike