In a world driven by financial pursuits, finding harmony between worldly wealth and spiritual well-being is paramount. For Muslims, Zakat, one of the five pillars of Islam, serves as this bridge, fostering a sense of social responsibility and financial equilibrium. While Zakat encompasses various forms of giving, 'Zakat Pendapatan,' focusing on income, holds significant weight, urging individuals to purify their earnings for the betterment of themselves and the community.

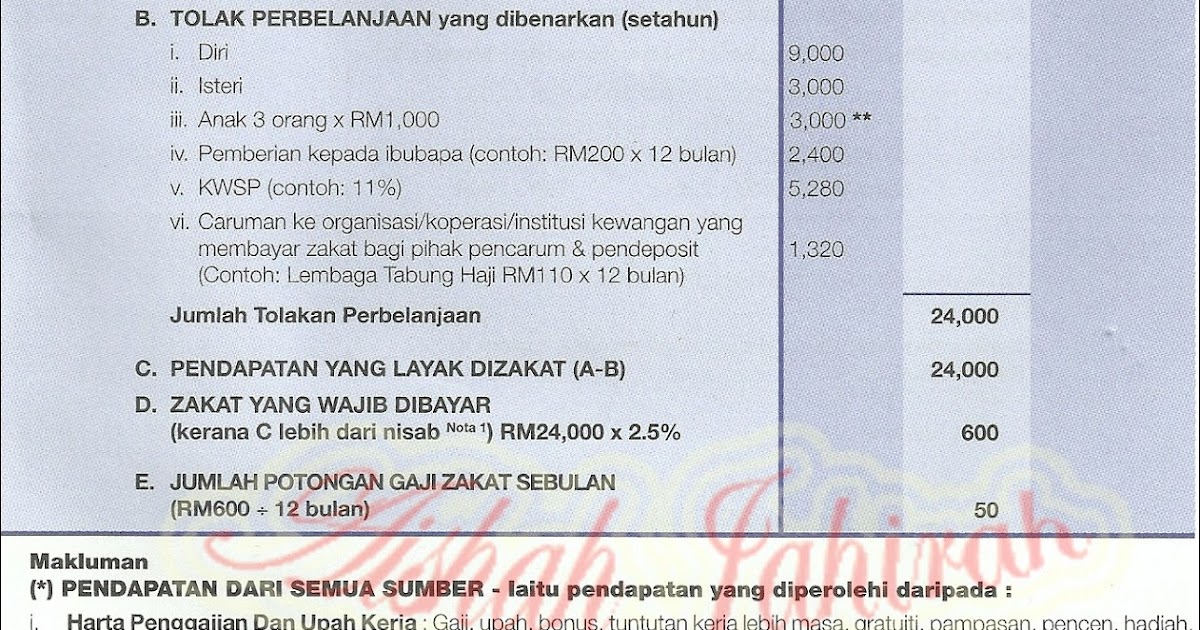

Navigating the intricacies of Zakat calculation can seem daunting, but understanding the core principles of "cara kira bayar zakat pendapatan" (how to calculate and pay Zakat on income) is an empowering step towards fulfilling this religious obligation. This guide serves to demystify the process, providing clarity and guidance for Muslims seeking to align their financial practices with their faith.

The concept of Zakat is deeply rooted in Islamic history, dating back to the time of Prophet Muhammad (peace be upon him). It was instituted as a mandatory act of worship, alongside prayer, fasting, and pilgrimage. The Quran, the holy book of Islam, explicitly mentions Zakat alongside prayer, emphasizing its paramount importance. This obligatory charity acts as a system of wealth circulation, ensuring the welfare of the less fortunate within the community.

Zakat is not merely a financial transaction; it carries profound spiritual and social significance. It instills a sense of gratitude within individuals, reminding them that their wealth is a blessing from a Higher Power. By sharing a portion of their income, Muslims purify their earnings and contribute towards building a just and equitable society.

However, the modern world presents unique challenges in understanding and calculating Zakat, particularly on income. The variety of income sources, investment opportunities, and evolving financial landscapes can lead to confusion and uncertainty. "Cara kira bayar zakat pendapatan" seeks to address these complexities, offering clear guidelines tailored to the contemporary financial landscape.

Advantages and Disadvantages of Zakat on Income (Cara Kira Bayar Zakat Pendapatan)

| Advantages | Disadvantages |

|---|---|

| Promotes financial discipline and awareness | Potential for miscalculation or misunderstanding of guidelines |

| Purifies wealth and fosters gratitude | May require seeking guidance from religious scholars or financial experts |

| Contributes to poverty alleviation and social welfare |

While the advantages of fulfilling this Islamic obligation are immense, some may find the calculation process daunting or encounter challenges in determining the correct amount. However, with the plethora of resources available online, through Islamic centers, and financial institutions, these obstacles can be easily overcome.

In conclusion, understanding "cara kira bayar zakat pendapatan" is not merely about fulfilling a religious duty; it is a journey of self-purification, social responsibility, and financial consciousness. By embracing the principles and seeking knowledge, Muslims can navigate the complexities of modern finance while upholding the spirit of Zakat, fostering a more just and equitable world for all.

Cara Pengiraan Zakat Pendapatan - Trees By Bike

Apa Itu Zakat Pelaburan Hartanah, Cara Kira & Bayar Di Malaysia - Trees By Bike

Cara Kira Zakat Keuntungan Saham - Trees By Bike

Bila Perlu Bayar Zakat Pendapatan & Kadar Kiraan Terperinci - Trees By Bike

Cara Mudah Kira Zakat Pendapatan - Trees By Bike

9 Jenis Zakat Harta & Cara Kira Zakat - Trees By Bike

Zakat Pendapatan Selangor Kalkulator & Cara Kira Bayar Online - Trees By Bike

Cara Kira Kadar Zakat Pendapatan 2020 Yang Perlu Dibayar. Jangan Lupa - Trees By Bike

cara kira bayar zakat pendapatan - Trees By Bike

Apa Itu Zakat Pelaburan Hartanah, Cara Kira & Bayar Di Malaysia - Trees By Bike

Apa Itu Zakat Pendapatan dan Cara Pengiraan Zakat Pendapatan - Trees By Bike

Cara Bayar Zakat Pendapatan Johor Secara Online - Trees By Bike

Zakat saham: Cara kira & bayar zakat online - Trees By Bike

Cara Kira Kadar Zakat Pendapatan 2022 Yang Perlu Dibayar. Jangan Lupa - Trees By Bike

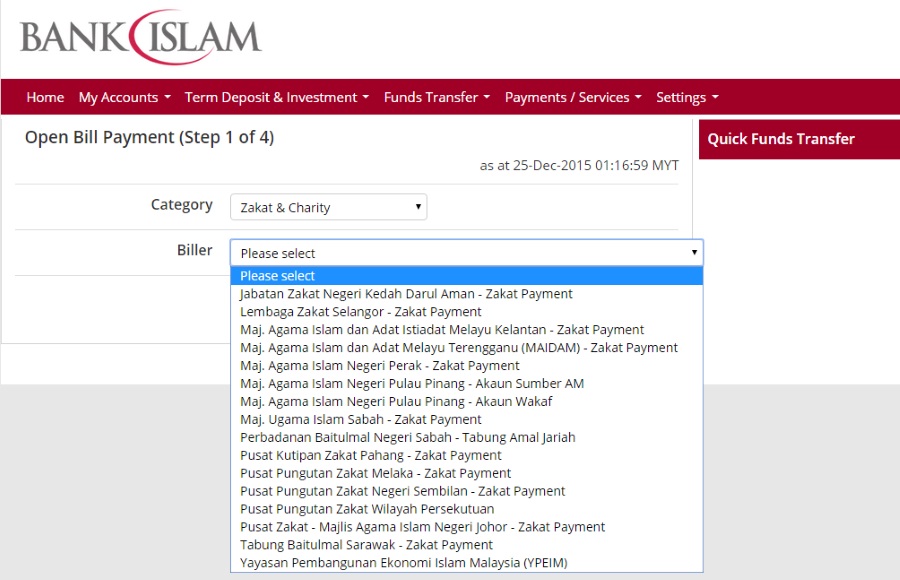

Cara Bayar Zakat Pendapatan Online dengan Bank Islam - Trees By Bike