Imagine this: you're at the airport, passport in hand, excitement bubbling as you anticipate your upcoming adventure abroad. But then a thought strikes – did you exchange enough local currency? Having the right currency in hand can make or break your travel experience, smoothing out transactions and opening doors to unique opportunities.

While airports and specialized currency exchange bureaus are often seen as the go-to spots for obtaining foreign currency, they aren't your only option. In fact, one of the most reliable and often cost-effective avenues is right in your neighborhood – your local bank.

Banks have long been facilitators of international travel and commerce. They provide a secure and trusted environment for exchanging currencies, offering a sense of familiarity that can be especially comforting when navigating a new and unfamiliar destination. Understanding how this service works can save you time, money, and potential travel hiccups.

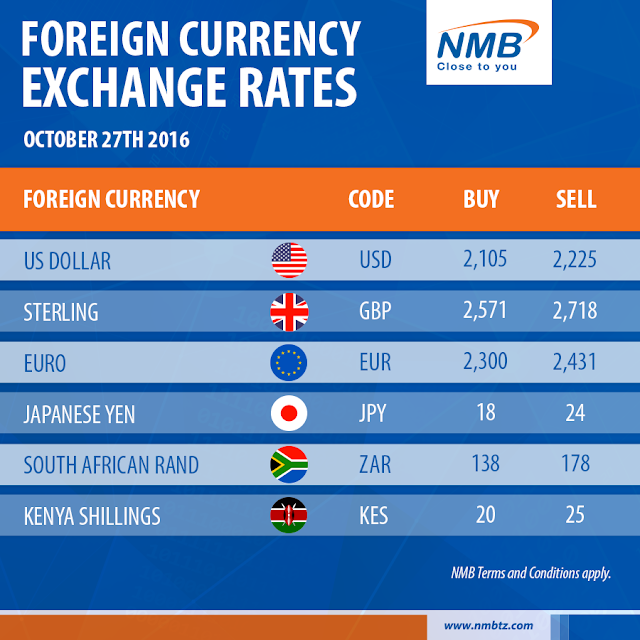

The world of foreign currency exchange can seem complex at first glance, filled with terminology like exchange rates, commissions, and transaction fees. However, the underlying principle is simple: you're essentially purchasing another country's currency using your own. This exchange rate fluctuates based on various economic factors, much like the ebb and flow of a global marketplace.

The process of obtaining foreign currency from a bank is surprisingly straightforward. Typically, you'll need to contact your bank in advance to inquire about their specific procedures and currency availability. Some banks might require you to place an order, especially if you need a larger amount or a less common currency. Once you've confirmed the details, you can visit your local branch to pick up your foreign currency, often with the added convenience of having it delivered.

Advantages and Disadvantages of Exchanging Currency at a Bank

| Advantages | Disadvantages |

|---|---|

| Security and Trust | Potential Fees |

| Convenience for Existing Customers | Limited Currency Availability |

| Competitive Exchange Rates | Advance Planning Required |

While using a bank for your foreign currency needs offers a range of advantages, it's essential to weigh them against potential drawbacks. Banks typically offer competitive exchange rates, but they may also charge transaction fees. The convenience of dealing with a familiar institution is undeniable, but you might need to plan ahead as not all banks keep every currency in stock. By carefully considering these factors, you can determine if exchanging currency at a bank aligns with your individual travel needs and financial preferences.

Navigating the world of foreign currency exchange might seem daunting, but with a little knowledge and preparation, you can ensure a smooth and financially savvy start to your next international journey. Remember, the key is to plan ahead, explore your options, and choose the method that best suits your travel style and budget.

Bank of Israel ready to sell $30B in foreign reserves to shore up - Trees By Bike

Foreign currency exchange rates. Bank Information board with different - Trees By Bike

Sell Your Foreign Currency for NZD - Trees By Bike

Transaction Sell Currency Transaction Vector, Sell, Currency - Trees By Bike

what banks sell foreign currency - Trees By Bike

Bank of tanzania foreign currency exchange rates and with it online - Trees By Bike

Where can I exchange foreign currency in South Africa safely? - Trees By Bike

The Cuban Government announces an 'exchange scheme' to sell foreign - Trees By Bike

How a Cal Poly study illustrates the need for strategic integrations - Trees By Bike

Urban exploration fashion photo with elizabeth banks vibe on Craiyon - Trees By Bike

what banks sell foreign currency - Trees By Bike

what banks sell foreign currency - Trees By Bike

SBV to sell foreign currency to stabilize exchange rate - Trees By Bike

Flat Bank Information Board with Different Flags and Currency for Buy - Trees By Bike

what banks sell foreign currency - Trees By Bike