In an increasingly interconnected world, financial transactions often require proof of income. Whether you're applying for a loan, renting an apartment, or even securing a visa, demonstrating your financial stability is crucial. This is where income verification letters, known as "contoh surat rasmi pengesahan pendapatan" in Malay, come into play. These official documents serve as a testament to your earnings and play a vital role in numerous financial endeavors.

Imagine this: you've found your dream apartment, but the landlord requests proof of income. Or perhaps you're eager to secure a loan to kickstart your business, and the bank requires income verification. In these scenarios, an official letter from your employer or a recognized entity stating your income details becomes indispensable. This letter, a "contoh surat rasmi pengesahan pendapatan," acts as a bridge of trust between you and the requesting party.

The significance of income verification letters extends beyond simple transactions. They are often required for legal and regulatory purposes, ensuring transparency and accountability in various financial dealings. These letters provide a standardized format for income reporting, making it easier for institutions to assess your financial standing.

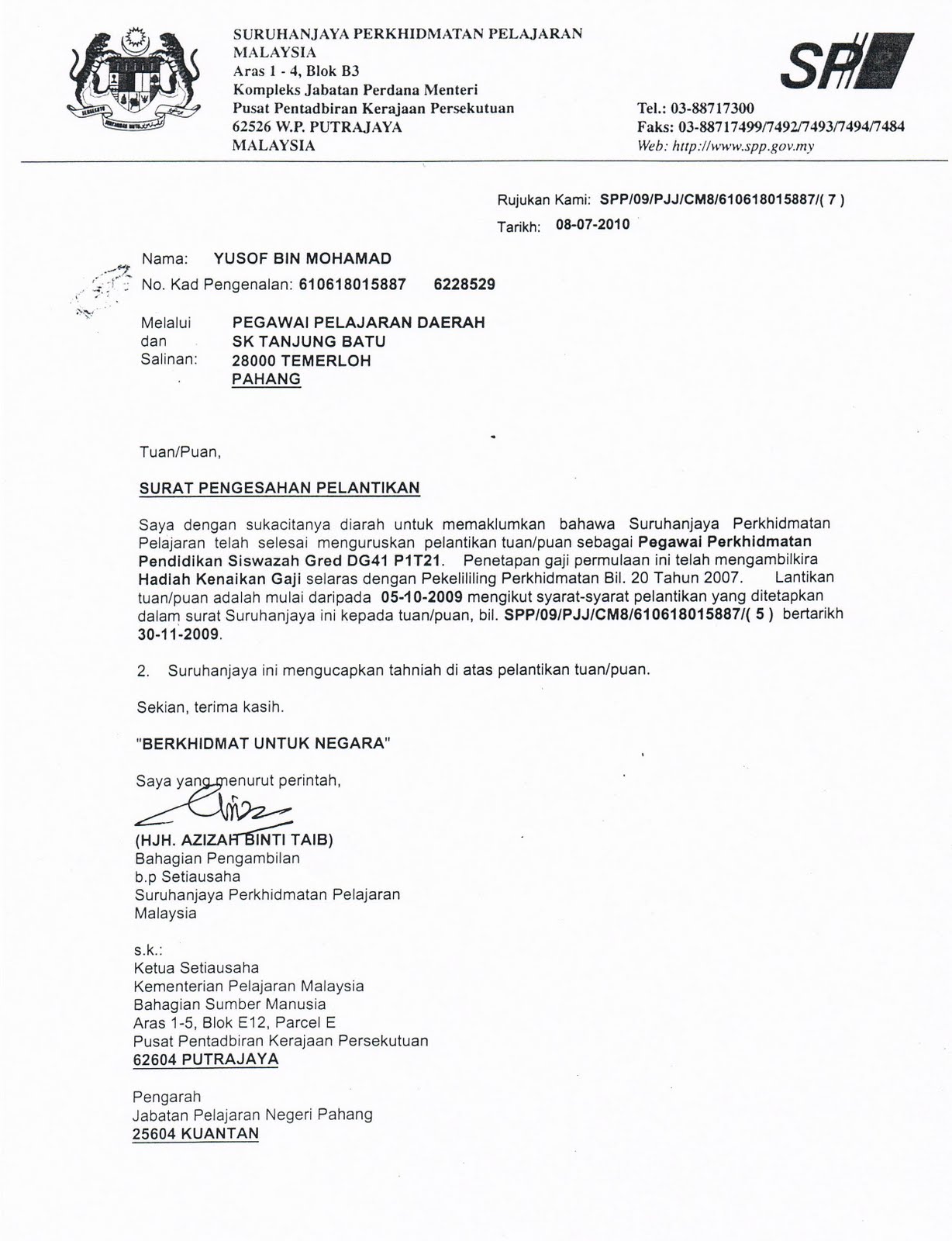

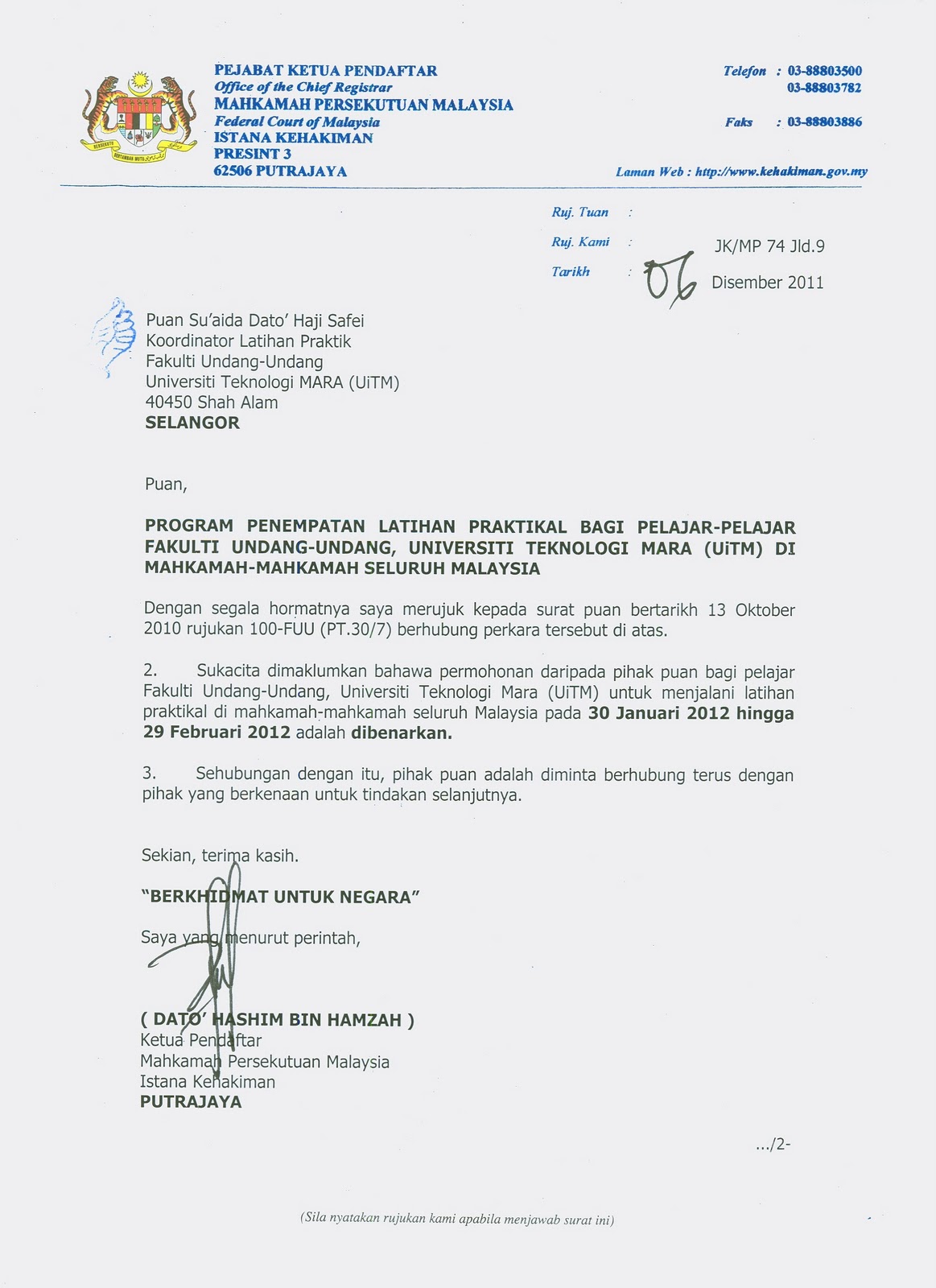

While the concept of income verification itself is fairly straightforward, the specific requirements for "contoh surat rasmi pengesahan pendapatan" can vary depending on the requesting organization and the purpose of the verification. Generally, these letters should include your full name, employment details, income information, and the date of issuance. They should be printed on official letterhead and signed by an authorized personnel.

Navigating the world of financial documentation might seem daunting, but understanding the importance of income verification letters is a crucial step towards achieving your financial goals. These letters, though seemingly simple, hold significant weight in numerous situations, enabling individuals to access opportunities and build a secure financial future.

Advantages and Disadvantages of Using Standardized Income Verification Letters

| Advantages | Disadvantages |

|---|---|

| Increased Efficiency and Transparency | Potential for Fraudulent Activities |

| Reduced Processing Time for Applications | Limited Flexibility in Information Provided |

| Enhanced Trust and Credibility | Dependence on Third-Party Verification |

Understanding and utilizing "contoh surat rasmi pengesahan pendapatan" effectively can be instrumental in navigating various financial processes. Whether you're an employee, an employer, or an individual seeking financial services, recognizing the importance of these letters is essential for a smooth and successful experience.

Contoh Surat Akuan Sumpah Pendapatan Surat Penerimaan Akuan Borang - Trees By Bike

Download Borang Pengesahan Pendapatan - Trees By Bike

Surat Pengesahan Pendapatan Majikan - Trees By Bike

Contoh Surat Akuan Pendapatan Bekerja Sendiri - Trees By Bike

Surat Akuan Sumpah Pendapatan Ptptn - Trees By Bike

Contoh Surat Pernyataan Pendapatan - Trees By Bike

Contoh Surat Pengesahan Kerja Sendiri - Trees By Bike

Contoh Surat Pengesahan Berhenti Kerja Daripada Majikan - Trees By Bike

Surat akuan pengesahan pendapatan - Trees By Bike

Contoh Surat Pengesahan Pekerja Dari Majikan Pembantu - Trees By Bike

Surat Pengesahan Majikan dengan Format & Contoh - Trees By Bike

Contoh dan Format Surat Pengesahan Pendapatan - Trees By Bike

Borang Pengesahan Pendapatan Lhdn - Trees By Bike

Surat Akuan Pendapatan Pdf - Trees By Bike