Imagine receiving an exclusive invitation, a chance to deepen your investment in a company you believe in, at a price often below market value. This is, in essence, the allure of a rights issue, a powerful tool companies use to raise capital while prioritizing existing shareholders. This offer, formalized in a rights issue letter of offer, presents a unique opportunity, but it also demands careful consideration.

A rights issuance, at its core, is a proactive measure by a company to generate funds. Unlike issuing new shares to the general public, a rights issue grants existing shareholders the preemptive right to purchase additional shares. This preemptive right maintains their proportional ownership in the company and shields them from dilution. The rights issue letter of offer acts as the formal communication, outlining the terms and conditions of this privileged offer.

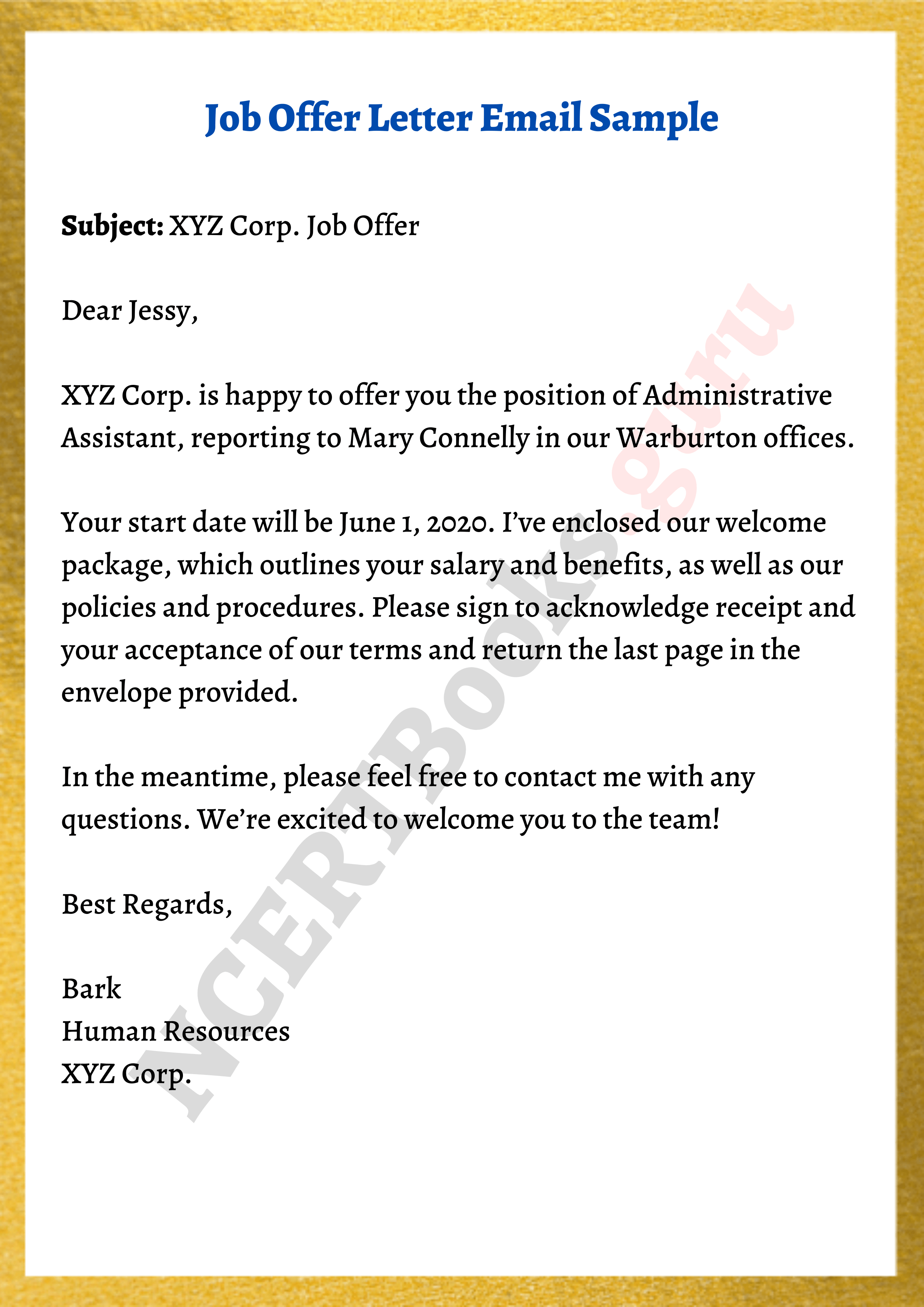

The process typically begins with the company announcing its intention to issue rights. This announcement triggers the preparation and distribution of the rights issue letter of offer to all eligible shareholders. This crucial document details the subscription price, the ratio at which shares can be purchased (e.g., 1 for 2, meaning one new share for every two shares held), the subscription period, and procedures for exercising the rights.

Understanding the dynamics of a rights offering is crucial for shareholders. The subscription price is often set at a discount to the current market price, incentivizing participation. However, shareholders are not obligated to subscribe. They have the option to exercise their rights, let them expire, or even trade them on the stock exchange during the subscription period. Ignoring the rights issue letter of offer entirely can lead to dilution of ownership if other shareholders participate.

The history of rights issues dates back centuries, reflecting a long-standing mechanism for companies to strengthen their financial position while preserving shareholder value. Its importance stems from its ability to bridge funding gaps without resorting to debt, thus avoiding interest burdens. It also strengthens the bond with existing investors, reinforcing their stake in the company's future. However, a rights issue can also signal financial distress if perceived as a last resort for capital raising.

One of the key benefits of participating in a rights issue is the opportunity to acquire shares at a discounted price. This can enhance potential returns and reinforce one's position in a promising company. Another advantage is the avoidance of dilution, maintaining one's proportional ownership stake. Finally, the act of subscribing can be seen as a vote of confidence in the company's future prospects.

Navigating the rights issue process involves careful consideration. Begin by thoroughly reviewing the rights issue letter of offer. Assess the company's financial health, the rationale behind the capital raise, and the potential impact on your investment portfolio. Consult with a financial advisor if needed. Decide whether to exercise your rights, sell them, or let them expire, based on your investment goals and risk tolerance.

Before making a decision, consider: What is the company's financial position? What is the purpose of the capital raise? What are the potential risks and rewards? Can you afford to participate? Do you believe in the company's long-term prospects?

Advantages and Disadvantages of Rights Issue Letter of Offer

| Advantages | Disadvantages |

|---|---|

| Opportunity to buy shares at a discount. | Requires additional investment. |

| Avoids dilution of ownership. | Can signal financial distress in some cases. |

| Shows confidence in the company. | Complex decision-making process. |

Frequently Asked Questions:

1. What is a rights issue? - A rights issue is an offer to existing shareholders to purchase additional shares.

2. What is a rights issue letter of offer? - It's the formal document outlining the terms of the rights issue.

3. Am I obligated to participate? - No, participation is optional.

4. What happens if I don't participate? - Your ownership might be diluted.

5. Can I sell my rights? - In many cases, yes.

6. How is the subscription price determined? - It's typically set at a discount to the market price.

7. When do rights expire? - The rights issue letter of offer specifies the expiration date.

8. Where can I find more information? - Consult your financial advisor or the company's investor relations department.

In conclusion, the rights issue letter of offer represents a significant event for shareholders. It's an invitation to participate in the company's growth trajectory, offering the potential for enhanced returns while safeguarding ownership. While the decision requires careful analysis of the company's financial standing and the terms of the offer, understanding the nuances of rights issues empowers investors to make informed decisions, maximizing their investment potential and aligning their portfolio with their long-term financial goals. Take the time to understand the offer, assess your financial situation, and make the choice that best serves your investment strategy. By actively engaging with the rights issue process, you can navigate the complexities of the market and position yourself for long-term success.

rights issue letter of offer - Trees By Bike

Home Offer Letter Sample - Trees By Bike

Who benefits from a letter of credit Leia aqui Who guarantees payment - Trees By Bike

Record levels of children experiencing homelessness - Trees By Bike

rights issue letter of offer - Trees By Bike

Offer for mining cities - Trees By Bike

Robert F Kennedy Human Rights Announces Arely Westley as the 2024 - Trees By Bike

Formidable Tips About Formal Job Offer Letter Template Cover Page For - Trees By Bike

Cartoon pilot with letter c on Craiyon - Trees By Bike

rights issue letter of offer - Trees By Bike

Offer smooth text on Craiyon - Trees By Bike

rights issue letter of offer - Trees By Bike

Suzlon Energy founder and CMD Tulsi Tanti dead company to continue - Trees By Bike

Leet platform offer on Craiyon - Trees By Bike

Daycare Welcome Letter Sample with Examples Word Editable - Trees By Bike