Imagine finally owning your dream home in Malaysia. You've worked hard, saved diligently, and now you're ready to turn that dream into a reality. But what if you could leverage your existing savings to make the journey smoother? That's where the Employees Provident Fund (EPF), a social security institution in Malaysia, comes in. With a specific scheme, you can actually tap into your EPF savings to help finance your home purchase. Yes, you read that right – your retirement fund can contribute to building your future, literally!

This scheme, designed to empower Malaysians on their path to homeownership, has gained significant traction. It offers a lifeline, especially for first-time homebuyers who might find it challenging to gather a substantial down payment. It's not just about unlocking funds; it's about unlocking possibilities. But navigating the intricacies of this scheme requires a clear understanding of its mechanics, eligibility criteria, and potential implications.

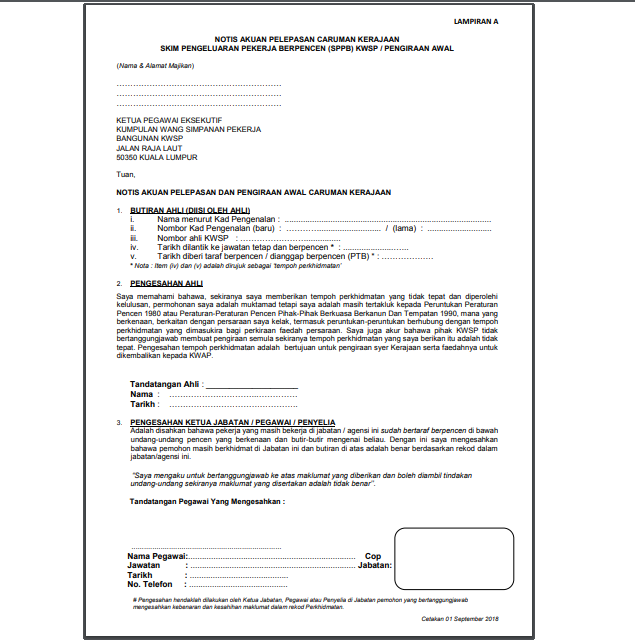

The process revolves around a specific form known as the "borang pengeluaran kwsp untuk beli rumah" (EPF withdrawal form for house purchase). This form is the key to unlocking your EPF funds for your housing dreams. But before you rush to fill out the form, it's crucial to arm yourself with the right information. Think of this article as your comprehensive guide to understanding everything about using your EPF savings for a house purchase – from eligibility requirements and potential benefits to the step-by-step application process and essential tips for a smooth experience.

Owning a home is often seen as a significant milestone, a symbol of security and achievement. However, the financial hurdles, especially in today's economic climate, can seem daunting. This EPF scheme provides a viable solution, easing the burden and making homeownership a more attainable goal for many Malaysians.

Let's delve deeper into this scheme, exploring its origins, benefits, and the crucial role that the "borang pengeluaran kwsp untuk beli rumah" plays in turning your homeownership aspirations into a tangible reality.

Advantages and Disadvantages of Using EPF to Buy a Home

| Advantages | Disadvantages |

|---|---|

| Reduced upfront payment | Lower retirement savings |

| Potentially smaller loan amount | Potential tax implications |

| Faster route to homeownership | Limited funds available |

Navigating the Malaysian housing market can be complex, and using your EPF savings to purchase a home is a significant financial decision. While the "borang pengeluaran kwsp untuk beli rumah" offers a pathway to homeownership, carefully weighing the pros and cons, seeking advice from financial advisors, and meticulously planning your finances is crucial. By making informed choices, you can leverage the benefits of this scheme while safeguarding your financial future.

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike

borang pengeluaran kwsp untuk beli rumah - Trees By Bike