Planning for retirement is a multifaceted endeavor, often involving a mix of savings strategies and investment vehicles. One such vehicle, the 457 retirement plan, is a powerful tool for employees of state and local governments and some non-profit organizations. These plans allow pre-tax contributions to grow tax-deferred, meaning you don’t pay taxes on your contributions or earnings until you withdraw them in retirement. However, understanding how and when to withdraw from your 457 plan is crucial for maximizing your retirement income and minimizing potential penalties.

The allure of a tax-advantaged retirement plan like the 457 is undeniable, but the rules governing withdrawals can seem complex. What happens when you reach retirement age? Are there penalties for early withdrawal? This guide will delve into the ins and outs of 457 plan withdrawals, providing you with the knowledge to make informed decisions about your financial future.

Navigating the world of retirement plans can feel like learning a new language, and the 457 plan is no exception. One of the first terms you'll encounter is "separation from service." This simply means leaving your job with the employer sponsoring the plan, whether due to retirement, resignation, or other reasons. Why is this significant? Because it often dictates when you can access your 457 funds without penalty.

Now, let's address the elephant in the room – early withdrawals. Life is unpredictable, and circumstances may arise where you need to tap into your retirement savings before retirement. While generally discouraged, 457 plans offer some flexibility in this regard. Unlike traditional IRAs or 401(k)s, 457 plans generally permit penalty-free withdrawals once you separate from service, regardless of your age. This feature can be a lifeline for those facing unexpected financial hardships.

However, it's essential to remember that even though early withdrawals from a 457 plan may be penalty-free, you'll still owe regular income taxes on the amount withdrawn. Additionally, taking early withdrawals can significantly impact your long-term retirement savings potential. Therefore, it's crucial to exhaust all other options before resorting to dipping into your retirement funds.

Advantages and Disadvantages of 457 Plan Withdrawals

Here's a table highlighting the advantages and disadvantages of 457 Plan Withdrawals:

| Advantages | Disadvantages |

|---|---|

| Penalty-free withdrawals after separation from service | Taxable income in the year of withdrawal |

| Potential for tax savings in retirement (if in a lower tax bracket) | Potential for early withdrawal to hinder long-term retirement savings goals |

| Can supplement income during early retirement | May face withdrawal restrictions if still employed by the same employer |

8 Common Questions and Answers About 457 Plan Withdrawals

1. How do I know if I'm eligible to withdraw from my 457 plan?

Generally, you become eligible for penalty-free withdrawals once you separate from the employer sponsoring your 457 plan. Check your plan documents or consult your plan administrator for specific details.

2. What are my withdrawal options?

You can typically choose to receive your funds as a lump sum, periodic payments, or roll over the balance into another qualified retirement plan.

3. Are there any tax implications for withdrawing from my 457 plan?

Yes, withdrawals from a 457 plan are generally taxed as ordinary income in the year you receive them.

4. Can I withdraw from my 457 plan while still employed?

Some plans may allow in-service withdrawals under certain circumstances, such as reaching age 59 ½ or experiencing a financial hardship. However, these withdrawals may be subject to penalties.

5. What is a rollover, and how does it work with a 457 plan?

A rollover involves transferring funds from your 457 plan to another eligible retirement account, such as a traditional IRA or 401(k), without incurring any taxes or penalties.

6. What happens to my 457 plan if I leave my job?

You generally have several options: leave the funds in the plan, roll them over to another plan, or withdraw the money.

7. Are there any required minimum distributions (RMDs) for 457 plans?

Yes, similar to traditional IRAs and 401(k)s, 457 plans have RMDs that begin after you turn 72 (or 70 ½ if you turned 70 ½ before January 1, 2020).

8. Where can I find more information about my specific 457 plan?

Your plan documents, plan administrator, and the human resources department at your employer are excellent resources for details about your plan.

Conclusion

Understanding the nuances of 457 retirement plan withdrawals is crucial for securing your financial well-being in retirement. By carefully considering your options, seeking professional advice, and staying informed about potential tax implications, you can make the most of your hard-earned savings and enjoy a comfortable and fulfilling retirement. Remember, knowledge is power, especially when it comes to planning for your future.

What Form Should I Expect if I Cashed Out My 457? - Trees By Bike

Empower Hardship Withdrawal Form: Complete with ease - Trees By Bike

403b And 457 Contribution Limits 2024 - Trees By Bike

2024 Deferred Comp Limits 457 Plan - Trees By Bike

What is a 457(b) Plan & How Does it Work? - Trees By Bike

403(b) Withdrawal Rules for 2023 - Trees By Bike

Income Calculation Worksheets Excel - Trees By Bike

withdrawal from 457 retirement plan - Trees By Bike

withdrawal from 457 retirement plan - Trees By Bike

457 Plan Contribution Limits 2024 Over 50 - Trees By Bike

How To Calculate An Ira Minimum Distribution - Trees By Bike

withdrawal from 457 retirement plan - Trees By Bike

How To Use Roth 457 Plans - Trees By Bike

403(b) Withdrawal Rules for 2023 - Trees By Bike

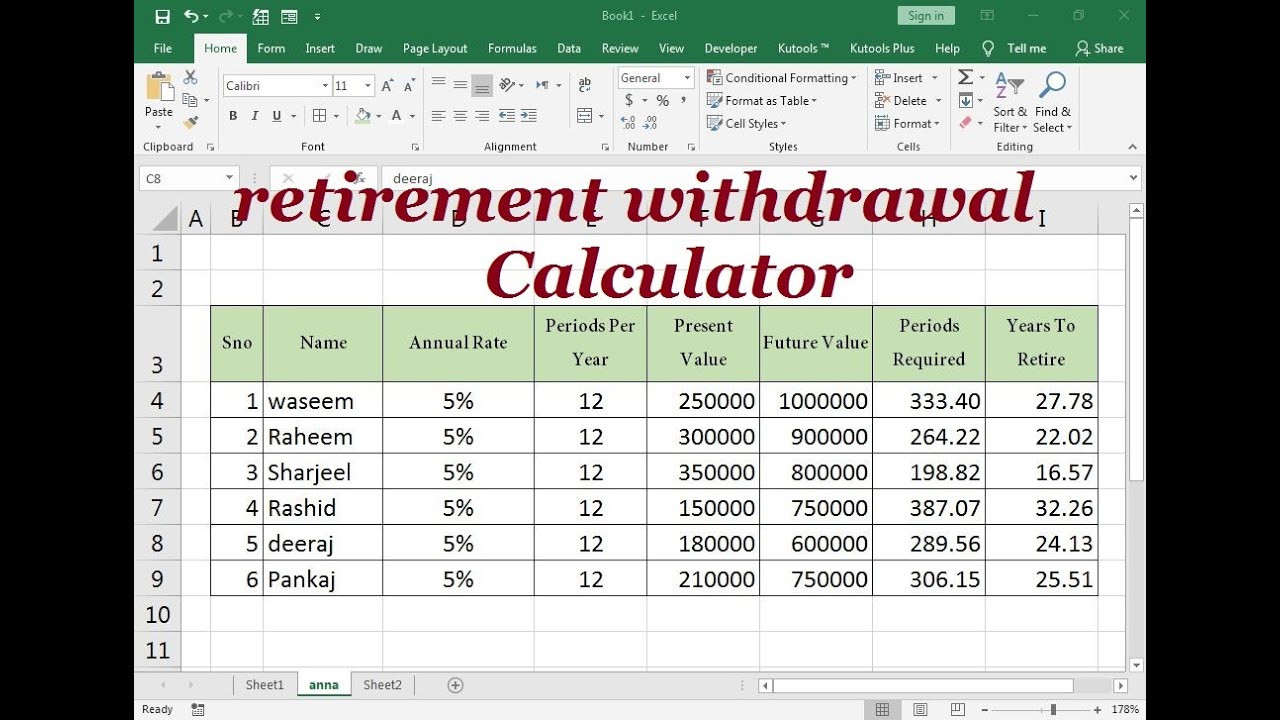

Our 457 Calculators For Savings And Payouts - Trees By Bike