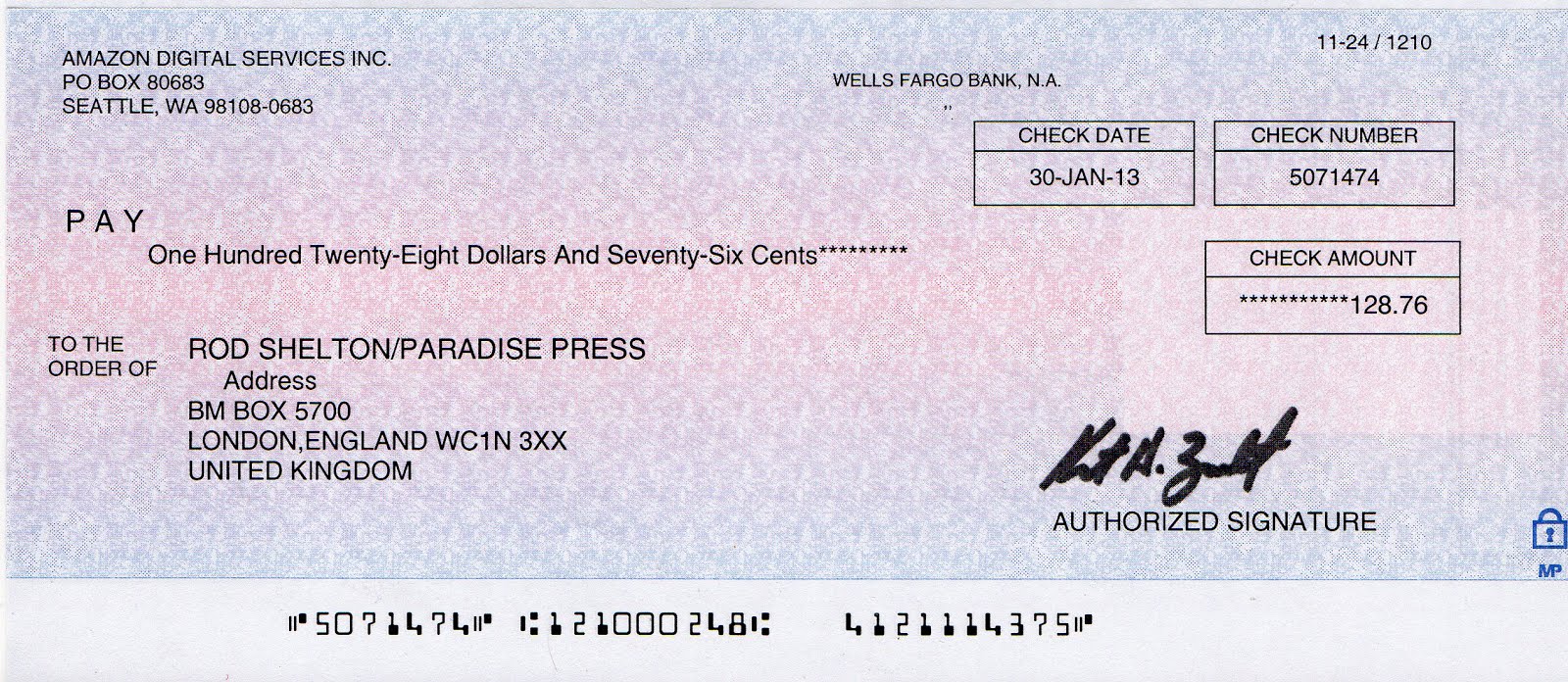

You check your mailbox one day and find an unexpected envelope from Wells Fargo. Inside, there's a check with your name on it! It's labeled as a "remediation check," but what does that even mean? If you're anything like me, a wave of curiosity (and maybe a little confusion) washes over you. Don't worry, you're not alone. In this article, we'll unravel the mystery of Wells Fargo remediation checks, exploring why they're issued, what to do if you receive one, and what it all means for your finances.

Let's face it, dealing with finances can be a bit like navigating a winding road – there are twists and turns, and sometimes you encounter unexpected detours. A Wells Fargo remediation check falls squarely into the "unexpected detour" category for many people. It might seem like a random act of kindness from the banking gods, but there's actually a specific reason behind these checks.

Essentially, a Wells Fargo remediation check represents the bank's way of making things right after identifying instances where they haven't met their own standards or have made mistakes that negatively impacted their customers. Think of it like this: you go to a restaurant and order a delicious meal. However, when the food arrives, it's cold and not what you ordered. The restaurant, realizing their error, offers you a complimentary dessert and a discount on your next visit. That's similar to what Wells Fargo is doing with these remediation checks – acknowledging past errors and trying to rebuild trust with their customers.

The reasons behind these remediation checks can vary. In some cases, it might involve overcharged fees, incorrect interest calculations, or even issues related to unauthorized account openings. Whatever the reason, the arrival of a Wells Fargo remediation check means the bank has identified you as someone who was potentially impacted by their past practices.

So, what should you do if you find yourself holding one of these checks? The first thing to do is take a deep breath – it's not every day you receive money out of the blue! Then, take some time to review the accompanying letter from Wells Fargo. This letter will typically provide details about why you're receiving the check, outlining the specific issue the bank has identified and the amount they've determined you're owed.

Advantages and Disadvantages of Wells Fargo Remediation Check Amount

| Advantages | Disadvantages |

|---|---|

| Receiving compensation for past errors | May not fully cover all losses or inconveniences |

| Indicates Wells Fargo is taking steps to rectify past issues | May raise concerns about the security and reliability of Wells Fargo's services |

Ultimately, receiving a Wells Fargo remediation check can be a positive thing. It reflects the bank's commitment to addressing past mistakes and compensating affected customers. However, it also serves as a reminder of the importance of staying informed about your financial accounts, carefully reviewing statements for any discrepancies, and taking steps to protect yourself from potential financial harm.

Can I Print A Wells Fargo Deposit Slip - Trees By Bike

Wells Fargo Remediation Letter 2024 - Trees By Bike

Settlement Letter With Wells Fargo Bank: Client Saved 60% - Trees By Bike

Wells Fargo Blank Check Template - Trees By Bike

Wells Fargo Blank Check Template - Trees By Bike

Exclusive: Wells Fargo says auto insurance remediation will not wrap up - Trees By Bike

Best Essay Writers Here - Trees By Bike

Wells Fargo Remediation Check 2024 - Trees By Bike

Wells Fargo Customer Care Remediation Check 2024 - Trees By Bike

First Time Credit Card Wells Fargo at Ora Garibay blog - Trees By Bike

Wells Fargo Customers Entitled To Billions In Settlement - Trees By Bike

Certificate of Completion Template - Trees By Bike

Wells Fargo Bank Statement Template Free - Trees By Bike

Wells Fargo Bank Routing Number: Full Info About ABA, ACH, and SWIFT - Trees By Bike

Can You Get Just One Check From The Bank at James Cearley blog - Trees By Bike