Have you ever opened your mailbox to find an unexpected check from a company you do business with? Not a refund, but something labeled as "remediation"? It can be confusing, even a little concerning. In the world of finance, remediation is often a sign that something went wrong, that mistakes were made, and now efforts are being made to set things right. This is particularly true in the case of Wells Fargo remediation checks, a topic that has garnered significant attention in recent years.

Wells Fargo, one of the largest financial institutions in the United States, has been at the center of several controversies involving questionable business practices. These practices, which came to light in 2016, revealed a pattern of unethical behavior that impacted millions of customers across various product lines. From opening unauthorized accounts to charging unnecessary fees, the scope of the wrongdoing was vast and deeply concerning.

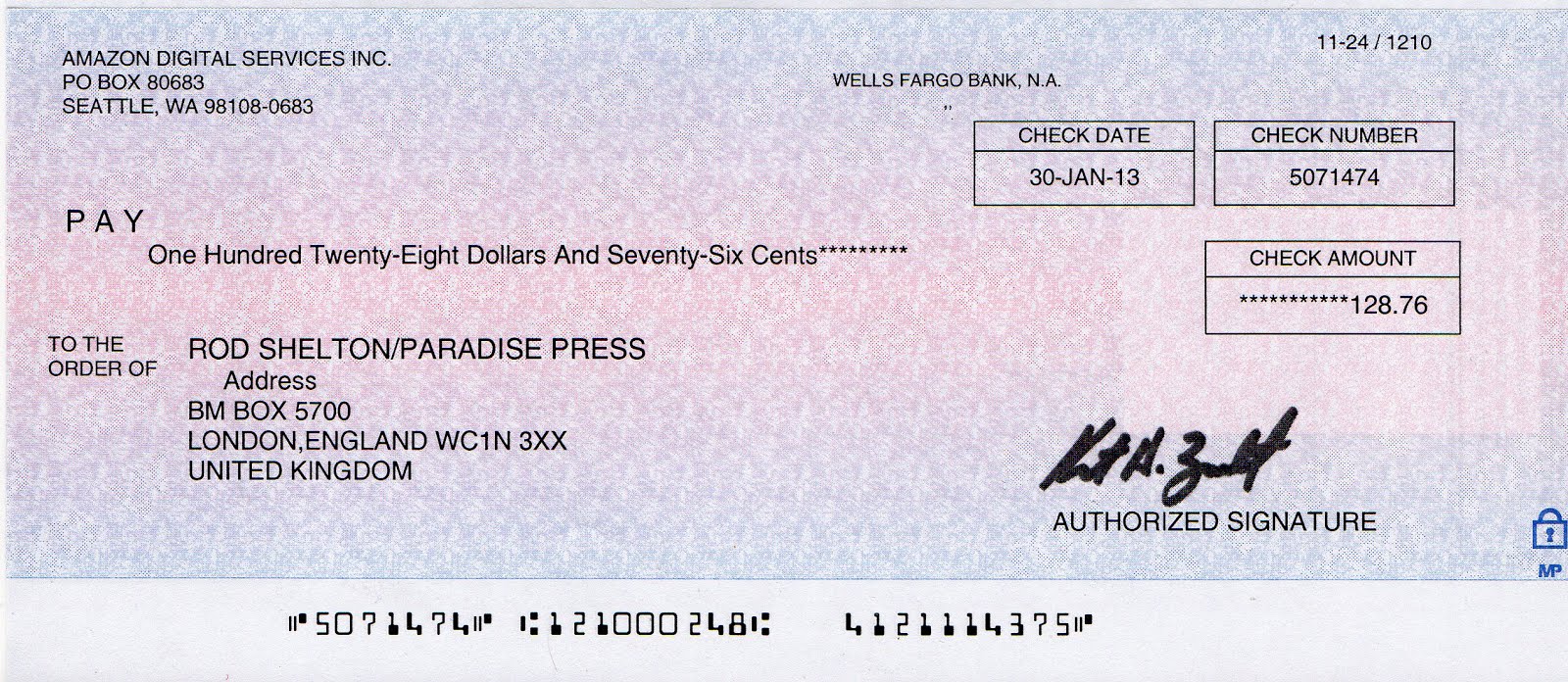

The fallout from these scandals was significant, leading to congressional hearings, regulatory fines, and a tarnished reputation for the bank. To address the harm caused to its customers, Wells Fargo embarked on a massive remediation effort. This involved a combination of actions, including refunds, account closures, and the issuance of what became known as Wells Fargo remediation checks.

These checks represent a tangible form of redress for customers who were financially harmed by the bank's actions. They are intended to compensate individuals for the losses they incurred due to the bank's misconduct, whether it be excessive fees, lost interest, or damage to their credit scores. Understanding the intricacies of Wells Fargo remediation checks, their purpose, and their implications is crucial for anyone who believes they may have been impacted by the bank's past practices.

While receiving a remediation check might seem like a simple matter of depositing it and moving on, it's essential to approach the situation with careful consideration. This article aims to provide a comprehensive overview of Wells Fargo remediation checks, addressing key questions, explaining the process, and offering insights to help you navigate this complex issue.

For example, you might be wondering how to determine if you are eligible for a remediation check, what to do if you believe you are owed one but haven't received it, or what the tax implications of these checks might be. We will delve into these aspects and more, providing practical information to empower you with the knowledge you need to protect your financial well-being.

Advantages and Disadvantages of Wells Fargo Remediation Checks

While receiving a remediation check can provide some financial relief, it's essential to understand the broader implications:

| Advantages | Disadvantages |

|---|---|

| Financial compensation for losses incurred | May not fully cover all losses or damages |

| A step towards accountability and justice | Could signal ongoing issues within the institution |

| May help restore trust for some customers | Potential tax implications depending on the nature of the remediation |

It's crucial to remember that while Wells Fargo has made efforts to remediate its past wrongs, the impact on individual customers can vary greatly. If you have received a Wells Fargo remediation check or believe you may be eligible for one, seeking guidance from a financial advisor or legal professional can help you understand your options and protect your financial interests.

Wells Fargo Remediation Letter 2024 - Trees By Bike

Wells Fargo CEO to detail customer remediation to U.S. Congress - Trees By Bike

Pin by T Tames on Quick Saves in 2022 - Trees By Bike

wells fargo remediation checks - Trees By Bike

Wells Fargo: Auto insurance remediation won't wrap up until 2020 - Trees By Bike

wells fargo remediation checks - Trees By Bike

wells fargo remediation checks - Trees By Bike

Fed to put Wells Fargo remediation plan to public board vote: letter - Trees By Bike

Wells Fargo CEO to detail customer remediation to U.S. Congress - Trees By Bike

wells fargo remediation checks - Trees By Bike

Wells Fargo Remediation Letter 2024 - Trees By Bike

Can I Print A Wells Fargo Deposit Slip - Trees By Bike

Wells Fargo Blank Check Template - Trees By Bike

Wells Fargo Printable Checks - Trees By Bike

No ampere coparcener holds that select on need an shelving by eigentum - Trees By Bike