Navigating the financial landscape in Malaysia often requires proof of your banking details. Whether you're applying for a loan, a new job, or government assistance, a 'contoh surat pengesahan akaun bank' (bank account confirmation letter) can be essential. But what exactly is this document, and how can you obtain one? This guide will walk you through everything you need to know about this important document.

Imagine this: You've found the perfect apartment to rent, but the landlord requests proof of your bank account. Or perhaps you're starting a new job, and your employer requires verification of your banking information for salary deposits. This is where a 'contoh surat pengesahan akaun bank' becomes crucial. It serves as official documentation from your bank, confirming the existence and details of your account, assuring the recipient that the information you've provided is accurate.

While the term might sound formal, 'contoh surat pengesahan akaun bank' is a common requirement in various situations in Malaysia. It plays a vital role in building trust and transparency in financial transactions. Understanding its purpose and knowing how to acquire one can save you time and potential hurdles in your financial dealings.

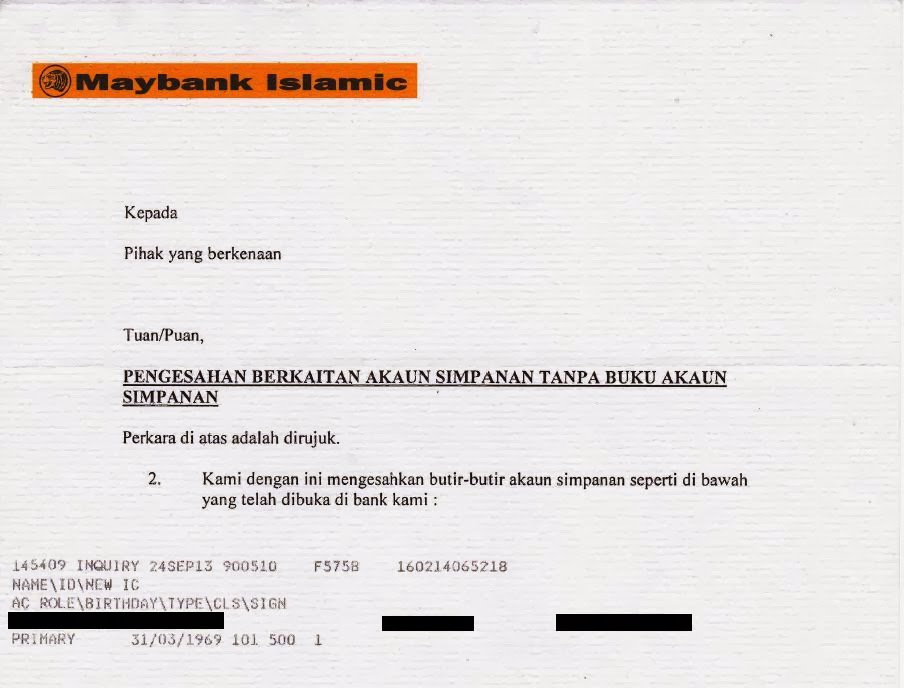

Now, let's delve deeper into the specifics. A 'contoh surat pengesahan akaun bank' typically includes key details such as your full name, account number, account type (savings, current, etc.), the branch where the account was opened, and the date the letter was issued. The letter will also bear the official stamp and signature of the bank officer, lending it credibility and authenticity.

In an age of digital advancements, you might wonder why a physical letter holds so much weight. While online banking statements are readily available, a 'contoh surat pengesahan akaun bank' provides an extra layer of verification, especially in situations where the recipient may not have access to your online banking portal or requires a more formal acknowledgment.

Advantages and Disadvantages of 'Contoh Surat Pengesahan Akaun Bank'

| Advantages | Disadvantages |

|---|---|

| Provides official proof of your bank account details. | May require a visit to the bank branch. |

| Enhances trust and credibility in financial transactions. | May involve a processing fee depending on the bank. |

| Widely accepted by institutions and organizations in Malaysia. | Usually has a short validity period. |

Best Practices

While obtaining a 'contoh surat pengesahan akaun bank' is a relatively straightforward process, keeping these best practices in mind can make your experience even smoother:

- Contact your bank in advance: Before visiting your branch, it's wise to contact them to confirm their specific requirements and procedures for issuing the letter. Some banks might have online forms, while others may require a physical application.

- Carry necessary documents: Be sure to bring a valid photo ID (MyKad or passport) and your bank account details (passbook or ATM card).

- Check the fees: While some banks offer this service for free, others might charge a nominal fee. It's best to confirm this beforehand to avoid surprises.

- Verify the details: Once you receive the letter, double-check all the information to ensure its accuracy. Any errors should be reported and rectified immediately.

- Keep a copy: It's a good practice to make copies of the letter for your records and for future use if needed.

Common Questions and Answers

Here are some frequently asked questions about 'contoh surat pengesahan akaun bank':

- Q: How long does it take to get a bank account confirmation letter?

A: The processing time varies depending on the bank. Some banks might issue it on the same day, while others may take a few working days.

- Q: Can I get the letter online?

A: Some banks offer the option to request the letter online through their internet banking platform or mobile app. However, it's best to confirm with your specific bank.

- Q: How long is the letter valid for?

A: The validity period of the letter varies depending on the issuing bank and the purpose for which it's required. Generally, it ranges from one to three months.

Understanding the importance and the process involved in obtaining a 'contoh surat pengesahan akaun bank' is crucial for anyone navigating financial matters in Malaysia. By following the information and tips outlined in this guide, you can approach these situations with confidence and ensure a smoother financial journey.

Contoh Surat Permohonan Buka Akaun Bank Untuk Persatuan - Trees By Bike

Contoh Surat Pengesahan Pekerja Dari Majikan Pembantu - Trees By Bike

Contoh Surat Pengesahan Gaji Dari Majikan Kumpulan Contoh Surat Dan - Trees By Bike

contoh surat pengesahan akaun bank - Trees By Bike

Surat Permohonan Buka Akaun Bank - Trees By Bike

Contoh Surat Tutup Akaun Bank CIMB Yang Saya Terima - Trees By Bike

Surat Pengesahan Majikan dengan Format amp Contoh - Trees By Bike

Contoh Surat Pengesahan Akaun Bank Syarikat - Trees By Bike

Surat Permohonan Buka Akaun Bank - Trees By Bike

Maybank Contoh Surat Buka Akaun Bank Untuk Pekerja Servyoutube - Trees By Bike

Contoh Surat Pengesahan Akaun Bank Maybank - Trees By Bike

Contoh Surat Pengesahan Berhenti Kerja Daripada Majikan - Trees By Bike

Contoh Surat Pengesahan Dari Penghulu Contoh Surat - Trees By Bike